SunTrust 2006 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We may not be able to hire or retain additional qualified personnel and recruiting and

compensation costs may increase as a result of turnover, both of which may increase costs and

reduce profitability and may adversely impact our ability to implement the business strategy.

Our success depends upon the ability to attract and retain highly motivated, well-qualified personnel.

We face significant competition in the recruitment of qualified employees. Our ability to execute the

business strategy and provide high quality service may suffer if we are unable to recruit or retain a

sufficient number of qualified employees or if the costs of employee compensation or benefits increase

substantially.

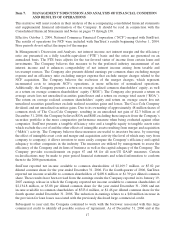

Our accounting policies and methods are key to how we report our financial condition and results

of operations. They may require management to make estimates about matters that are uncertain.

Accounting policies and methods are fundamental to how we record and report the financial condition

and results of operations. Management must exercise judgment in selecting and applying many of these

accounting policies and methods so they comply with Generally Accepted Accounting Principles in the

United States (“US GAAP”).

Management has identified certain accounting policies as being critical because they require

management’s judgment to ascertain the valuations of assets, liabilities, commitments and

contingencies. A variety of factors could affect the ultimate value that is obtained either when earning

income, recognizing an expense, recovering an asset, or reducing a liability. We have established

detailed policies and control procedures that are intended to ensure these critical accounting estimates

and judgments are well controlled and applied consistently. In addition, the policies and procedures are

intended to ensure that the process for changing methodologies occurs in an appropriate manner.

Because of the uncertainty of estimates about these matters, we cannot guarantee that we will not be

required to adjust accounting policies or restate prior period financial statements. See the “Critical

Accounting Policies” section beginning on page 63 and Note 1, “Accounting Policies,” to the

Consolidated Financial Statements in this report for more information.

Changes in our accounting policies or in accounting standards could materially affect how we

report our financial results and condition.

From time to time, the Financial Accounting Standards Board (“FASB”) changes the financial

accounting and reporting standards that govern the preparation of our financial statements. These

changes can be hard to predict and can materially impact how we record and report our financial

condition and results of operations. In some cases, we could be required to apply a new or revised

standard retroactively, resulting in us restating prior period financial statements.

Our stock price can be volatile.

Our stock price can fluctuate widely in response to a variety of factors including:

•variations in our quarterly operating results;

•changes in market valuations of companies in the financial services industry;

•fluctuations in stock market prices and volumes;

•issuances of shares of common stock or other securities in the future;

•the addition or departure of key personnel;

•seasonal fluctuations;

•changes in financial estimates or recommendations by securities analysts regarding SunTrust or

shares of our common stock; and

•announcements by us or our competitors of new services or technology, acquisitions, or joint

ventures.

General market fluctuations, industry factors, and general economic and political conditions and events,

such as terrorist attacks, economic slowdowns or recessions, interest rate changes, credit loss trends, or

currency fluctuations, also could cause our stock price to decrease regardless of operating results.

12