SunTrust 2006 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

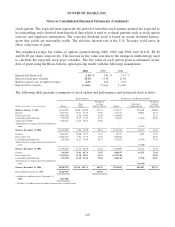

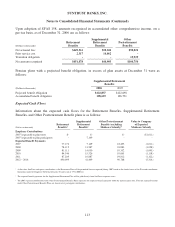

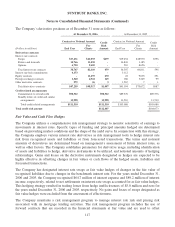

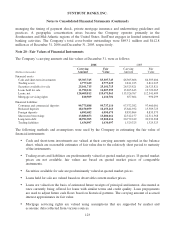

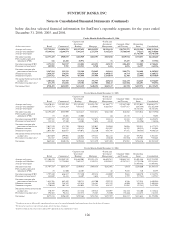

The Company’s derivative positions as of December 31 were as follows:

At December 31, 2006 At December 31, 2005

Contract or Notional Amount Credit

Risk

Amount

Contract or Notional Amount Credit

Risk

Amount(Dollars in millions)End User

For

Clients End User

For

Clients

Derivatives contracts

Interest rate contracts

Swaps $17,231 $61,055 $679 $19,454 $48,970 $596

Futures and forwards 14,766 11,450 - 16,843 3,185 -

Options 6,750 9,605 - 210 8,656 -

Total interest rate contracts 38,747 82,110 679 36,507 60,811 596

Interest rate lock commitments 6,173 - - 3,112 - -

Equity contracts - 11,459 270 22 9,605 291

Foreign exchange contracts 1,360 4,922 145 186 5,249 99

Other derivative contracts 979 26 3 1,567 7 1

Total derivatives contracts $47,259 $98,517 $1,097 $41,394 $75,672 $987

Credit-related arrangements

Commitments to extend credit $98,512 $98,512 $89,576 $89,576

Standby letters of credit and similar

arrangements 12,998 12,998 13,510 13,510

Total credit-related arrangements $111,510 $111,510 $103,086 $103,086

Total credit risk amount $112,607 $104,073

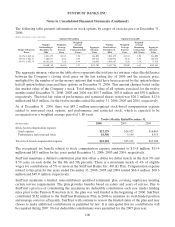

Fair Value and Cash Flow Hedges

The Company utilizes a comprehensive risk management strategy to monitor sensitivity of earnings to

movements in interest rates. Specific types of funding and principal amounts hedged are determined

based on prevailing market conditions and the shape of the yield curve. In conjunction with this strategy,

the Company employs various interest rate derivatives as risk management tools to hedge interest rate

risk from recognized assets and liabilities or from forecasted transactions. The terms and notional

amounts of derivatives are determined based on management’s assessment of future interest rates, as

well as other factors. The Company establishes parameters for derivative usage, including identification

of assets and liabilities to hedge, derivative instruments to be utilized, and notional amounts of hedging

relationships. Gains and losses on the derivative instruments designated as hedges are expected to be

highly effective in offsetting changes in fair values or cash flows of the hedged assets, liabilities and

forecasted transactions.

The Company has designated interest rate swaps as fair value hedges of changes in the fair value of

recognized liabilities due to changes in the benchmark interest rate. For the years ended December 31,

2006 and 2005, the Company recognized $64.7 million of interest expense and $89.2 million of interest

income, respectively, related to net settlements on interest rate swaps accounted for as fair value hedges.

This hedging strategy resulted in trading losses from hedge ineffectiveness of $5.0 million and zero for

the years ended December 31, 2006 and 2005, respectively. No gains and losses of swaps designated as

fair value hedges were excluded from the assessment of effectiveness.

The Company maintains a risk management program to manage interest rate risk and pricing risk

associated with its mortgage lending activities. The risk management program includes the use of

forward contracts that are recorded in the financial statements at fair value and are used to offset

117