SunTrust 2006 Annual Report Download - page 71

Download and view the complete annual report

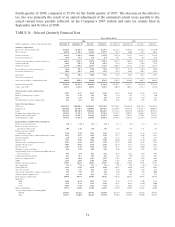

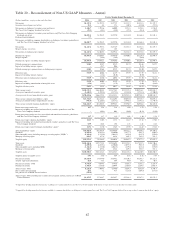

Please find page 71 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$80.0 million due to gains from the sale of mortgage servicing assets of $66.3 million and increased fees

from higher servicing balances. Higher mortgage servicing rights amortization partially offset these

increases. Other noninterest income was down $10.4 million due to higher secondary marketing

reserves, partially offset by higher insurance income. At December 31, 2006, total loans serviced were

$130.0 billion, up $24.4 billion, or 23.1% from $105.6 billion in the prior year.

Total noninterest expense increased $75.6 million, or 14.5%. Increased volume and investments in

production and servicing capabilities were the primary drivers of the higher expense level.

Wealth and Investment Management

Wealth and Investment Management’s net income for the twelve months ended December 31, 2006 was

$267.3 million, an increase of $80.1 million, or 42.8%. Excluding the net gain on the sale of the Bond

Trustee business, net income increased 5.5%. Increases in both net interest income and noninterest

income were partially offset by higher expenses.

Fully taxable-equivalent net interest income increased $24.3 million, or 7.1%, attributable to a

combination of increased loan volumes and wider deposit spreads. Average loans increased $0.3 billion,

or 4.2%, primarily due to growth in commercial real estate and commercial loans. Average deposits

decreased $0.1 billion, or 0.5%, due to declines in demand deposits and money market accounts,

partially offset by increases in consumer time deposits. Deposit spreads widened due to deposit rate

increases that have been slower relative to market rate increases as well as the increasing value of lower-

cost deposits in a higher rate environment.

Provision for loan losses, which represents net charge-offs for the lines of business, decreased $5.2

million, or 58.4%.

Total noninterest income increased $154.9 million, or 16.4%, primarily due to the $112.8 million

pre-tax gain on the sale of the Bond Trustee business. The remainder of the increase was largely driven

by growth in trust and retail investment services income. Trust income increased due to growth in assets

under management from improved sales and market conditions. Retail investment services income

increased due to growth in variable annuities, managed account and new business revenue.

Total noninterest expense increased $60.1 million, or 6.2%. Growth was primarily driven by higher

structural and staff expense.

Corporate Other and Treasury

Corporate Other and Treasury’s net loss for the twelve months ended December 31, 2006 was $2.7

million, mainly due to a decline in fully taxable-equivalent net interest income and increased securities

losses partially offset by a decrease in merger expense.

Fully taxable-equivalent net interest income decreased $136.3 million. The main drivers were a $1.9

billion decrease in average securities available for sale, a decrease in income on receive fixed/pay

floating interest rate swaps used to extend the duration of the commercial loan portfolio resulting from

narrower spreads between the receive fixed/pay floating rates, an increase in short-term borrowing costs

due to an increase in the size of these borrowings needed to fund earning asset growth, as well as a

significant rise in short-term interest rates over the past year.

Total average assets decreased $2.1 billion, or 6.5%, mainly due to a $1.9 billion reduction in the size of

the investment portfolio that resulted from the investment portfolio restructuring in the second half of

2006. Total average deposits increased $9.2 billion, or 52.6%, mainly due to growth in brokered and

foreign deposits of $9.3 billion.

58