SunTrust 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other Actuarial Assumptions

To estimate the projected benefit obligation, actuarial assumptions are required about factors such as

mortality rate, turnover rate, retirement rate, disability rate and the rate of compensation increases.

These factors don’t tend to change significantly over time, so the range of assumptions, and their impact

on pension cost, is generally limited. SunTrust periodically reviews the assumptions used based on

historical and expected future experience.

Due to the adoption of SFAS No. 158, to estimate the projected benefit obligation as of December 31,

2006, the Company projected forward the benefit obligations from January 1, 2006 to December 31,

2006, adjusting for benefit payments, expected growth in the benefit obligations, changes in key

assumptions and plan provisions, and any significant changes in the plan demographics that occurred

during the year, including (where appropriate) subsidized early retirements, salary changes different

from expectations, entrance of new participants, changes in per capita claims cost, Medicare Part D

subsidy, and retiree contributions.

Income Taxes

The Company is subject to the income tax laws of the various jurisdictions where it conducts business

and estimates income tax expense based on amounts expected to be owed to these various tax

jurisdictions. On a quarterly basis, management evaluates the reasonableness of the Company’s effective

tax rate based upon its current estimate of net income, tax credits, and the applicable statutory tax rates

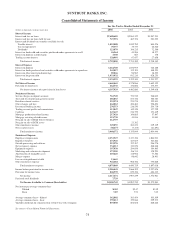

expected for the full year. The estimated income tax expense is reported in the Consolidated Statements

of Income.

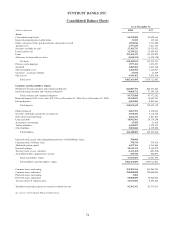

Accrued taxes represent the net estimated amount due or to be received from taxing jurisdictions either

currently or in the future and is reported in other liabilities on the Consolidated Balance Sheet. SunTrust

assesses the appropriate tax treatment of transactions and filing positions after considering statutes,

regulations, judicial precedent and other pertinent information and maintains tax accruals consistent

with its evaluation. Changes in the estimate of accrued taxes occur periodically due to changes in tax

rates, interpretations of tax laws, the status of examinations by the taxing authorities, and newly enacted

statutory, judicial, and regulatory guidance that could impact the relative merits of tax positions. These

changes, when they occur, impact accrued taxes and can materially affect the Company’s operating

results. For additional information, see Note 15, “Income Taxes” to the Consolidated Financial

Statements.

Accounting Policies Recently Adopted and Pending Accounting Pronouncements

Recently issued and pending accounting pronouncements are discussed in Note 1, “Accounting

Policies,” to the Consolidated Financial Statements.

66