SunTrust 2006 Annual Report Download - page 48

Download and view the complete annual report

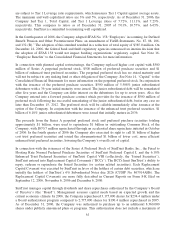

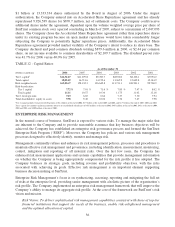

Please find page 48 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.are subject to Tier 1 Leverage ratio requirements, which measures Tier 1 Capital against average assets.

The minimum and well-capitalized ratios are 3% and 5%, respectively. As of December 31, 2006, the

Company had Tier 1, Total Capital, and Tier 1 Leverage ratios of 7.72%, 11.11%, and 7.23%,

respectively. This compares to ratios as of December 31, 2005 of 7.01%, 10.57%, and 6.65%,

respectively. SunTrust is committed to remaining well capitalized.

In the fourth quarter of 2006, the Company adopted SFAS No. 158 “Employers’ Accounting for Defined

Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements, No. 87, 88, 106,

and 132 (R).” The adoption of this standard resulted in a reduction of total equity of $385.0 million. On

December 14, 2006, the federal bank and thrift regulatory agencies announced an interim decision that

the adoption of SFAS 158 would not impact banking organizations’ regulatory capital. See Note 16,

“Employee Benefits” to the Consolidated Financial Statements for more information.

In connection with planned capital restructurings, the Company replaced higher cost capital with $500

million of Series A perpetual preferred stock, $500 million of preferred purchase securities and $1

billion of enhanced trust preferred securities. The perpetual preferred stock has no stated maturity and

will not be subject to any sinking fund or other obligation of the Company. See Note 14, “Capital” to the

Consolidated Financial Statements for more information on the perpetual preferred stock. In conjunction

with the issuance of the preferred purchase securities, $500 million of 5.588% junior subordinated

debentures with a 36 year initial maturity were issued. The junior subordinated debt will be remarketed

after five years and the Company can defer interest on the debentures for up to seven years. Also, the

Company entered into a forward purchase contract which provides for the issuance of $500 million of

preferred stock following the successful remarketing of the junior subordinated debt, but in any case no

later than December 15, 2012. The preferred stock will be callable immediately after issuance at the

option of the Company. In conjunction with the issuance of the enhanced trust preferred securities, $1

billion of 6.10% junior subordinated debentures were issued that initially mature in 2036.

The proceeds from the Series A perpetual preferred stock and preferred purchase securities totaling

approximately $1 billion, were used to repurchase $1 billion in outstanding Common Stock of the

Company, with $870.7 million repurchased through an accelerated share repurchase initiated in October

of 2006. In the fourth quarter of 2006 the Company also exercised its right to call $1 billion of higher

cost trust preferred securities and issued the aforementioned $1 billion of lower cost, more efficient

enhanced trust preferred securities, lowering the Company’s overall cost of capital.

In connection with the issuances of the Series A Preferred Stock of SunTrust Banks, Inc., the Fixed to

Floating Rate Normal Preferred Purchase Securities of SunTrust Preferred Capital I, and the 6.10%

Enhanced Trust Preferred Securities of SunTrust Capital VIII (collectively, the “Issued Securities”),

SunTrust entered into Replacement Capital Covenants (“RCCs”). The RCCs limit SunTrust’s ability to

repay, redeem or repurchase the Issued Securities (or certain related securities). Each Replacement

Capital Covenant was executed by SunTrust in favor of the holders of certain debt securities, which are

initially the holders of SunTrust’s 6% Subordinated Notes due 2026 (CUSIP No. 867914AH6). The

Replacement Capital Covenants are more fully described in Current Reports on Form 8-K filed on

September 12, 2006, November 6, 2006 and December 6, 2006.

SunTrust manages capital through dividends and share repurchases authorized by the Company’s Board

of Director’s (the “Board”). Management assesses capital needs based on expected growth and the

current economic climate. In 2006, the Company repurchased 3,175,000 shares for $234.4 million under

a Board authorization program compared to 2,775,000 shares for $196.4 million repurchased in 2005.

As of December 31, 2006, the Company was authorized to purchase up to an additional 8,360,000

shares under publicly announced plans or programs. This authorization does not include a maximum of

35