SunTrust 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

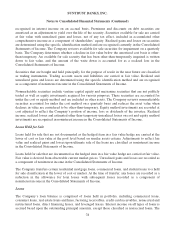

Notes to Consolidated Financial Statements (Continued)

recognized in interest income on an accrual basis. Premiums and discounts on debt securities are

amortized as an adjustment to yield over the life of the security. Securities available for sale are carried

at fair value with unrealized gains and losses, net of any tax effect, included in accumulated other

comprehensive income as a component of shareholders’ equity. Realized gains and losses on securities

are determined using the specific identification method and are recognized currently in the Consolidated

Statements of Income. The Company reviews available for sale securities for impairment on a quarterly

basis. The Company determines whether a decline in fair value below the amortized cost basis is other-

than-temporary. An available for sale security that has been other-than-temporarily impaired is written

down to fair value, and the amount of the write down is accounted for as a realized loss in the

Consolidated Statements of Income.

Securities that are bought and held principally for the purpose of resale in the near future are classified

as trading instruments. Trading account assets and liabilities are carried at fair value. Realized and

unrealized gains and losses are determined using the specific identification method and are recognized

as a component of noninterest income in the Consolidated Statements of Income.

Nonmarketable securities include venture capital equity and mezzanine securities that are not publicly

traded as well as equity investments acquired for various purposes. These securities are accounted for

under the cost or equity method and are included in other assets. The Company reviews nonmarketable

securities accounted for under the cost method on a quarterly basis and reduces the asset value when

declines in value are considered to be other-than-temporary. Equity method investments are recorded at

cost adjusted to reflect the Company’s portion of income, loss or dividends of the investee. Realized

income, realized losses and estimated other than-temporary unrealized losses on cost and equity method

investments are recognized in noninterest income in the Consolidated Statements of Income.

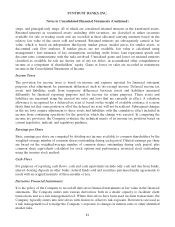

Loans Held for Sale

Loans held for sale that are not documented as the hedged item in a fair value hedge are carried at the

lower of cost or fair value at the pool level based on similar assets criteria. Adjustments to reflect fair

value and realized gains and losses upon ultimate sale of the loans are classified as noninterest income

in the Consolidated Statements of Income.

Loans held for sale that are documented as the hedged item in a fair value hedge are carried at fair value.

Fair value is derived from observable current market prices. Unrealized gains and losses are recorded as

a component of noninterest income in the Consolidated Statements of Income.

The Company transfers certain residential mortgage loans, commercial loans, and student loans to a held

for sale classification at the lower of cost or market. At the time of transfer, any losses are recorded as a

reduction in the allowance for loan losses with subsequent losses recorded as a component of

noninterest income in the Consolidated Statements of Income.

Loans

The Company’s loan balance is comprised of loans held in portfolio, including commercial loans,

consumer loans, real estate loans and lines, factoring receivables, credit card receivables, nonaccrual and

restructured loans, direct financing leases, and leveraged leases. Interest income on all types of loans is

accrued based upon the outstanding principal amounts, except those classified as nonaccrual loans. The

78