SunTrust 2006 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

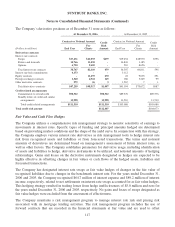

managing the timing of payment shock, private mortgage insurance and underwriting guidelines and

practices. A geographic concentration arises because the Company operates primarily in the

Southeastern and Mid-Atlantic regions of the United States. SunTrust engages in limited international

banking activities. The Company’s total cross-border outstandings were $693.1 million and $412.8

million as of December 31, 2006 and December 31, 2005, respectively.

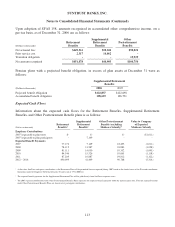

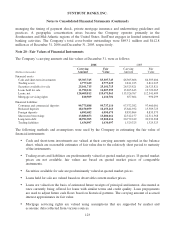

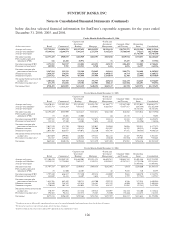

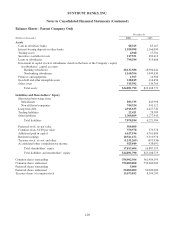

Note 20 - Fair Values of Financial Instruments

The Company’s carrying amounts and fair values at December 31, were as follows:

2006 2005

(Dollars in thousands)

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Financial assets

Cash and short-term investments $5,307,745 $5,307,745 $6,305,606 $6,305,606

Trading assets 2,777,629 2,777,629 2,811,225 2,811,225

Securities available for sale 25,101,715 25,101,715 26,525,821 26,525,821

Loans held for sale 11,790,122 11,807,395 13,695,613 13,729,065

Loans, net 120,409,812 119,673,963 113,526,767 112,341,489

Mortgage servicing rights 810,509 1,110,701 657,604 996,299

Financial liabilities

Consumer and commercial deposits 99,775,888 99,737,114 97,572,382 97,460,001

Brokered deposits 18,150,059 18,153,263 15,644,932 15,589,723

Foreign deposits 6,095,682 6,095,675 8,835,864 8,835,573

Short-term borrowings 13,880,653 13,880,661 12,312,157 12,311,568

Long-term debt 18,992,905 19,202,616 20,779,249 20,932,308

Trading liabilities 1,634,097 1,634,097 1,529,325 1,529,325

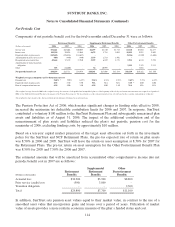

The following methods and assumptions were used by the Company in estimating the fair value of

financial instruments:

•Cash and short-term investments are valued at their carrying amounts reported in the balance

sheet, which are reasonable estimates of fair value due to the relatively short period to maturity

of the instruments.

•Trading assets and liabilities are predominantly valued at quoted market prices. If quoted market

prices are not available, fair values are based on quoted market prices of comparable

instruments.

•Securities available for sale are predominantly valued at quoted market prices.

•Loans held for sale are valued based on observable current market prices.

•Loans are valued on the basis of estimated future receipts of principal and interest, discounted at

rates currently being offered for loans with similar terms and credit quality. Loan prepayments

are used to adjust future cash flows based on historical patterns. The carrying amount of accrued

interest approximates its fair value.

•Mortgage servicing rights are valued using assumptions that are supported by market and

economic data collected from various sources.

123