SunTrust 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

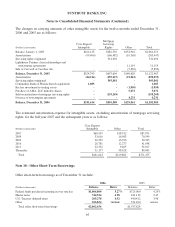

Notes to Consolidated Financial Statements (Continued)

resulting from adoption is expected to range from $25 million to $30 million related to an expected

change in the timing on its lease cash flows. An amount approximating this one-time charge will be

accreted into income on an effective yield basis over the remaining terms of the affected leases.

In September 2006, the EITF reached a consensus on EITF Issue No. 06-4, “Postretirement Benefits

Associated with Split-Dollar Life Insurance.” This Issue clarifies the accounting for endorsement split-

dollar life insurance arrangements that provide a benefit to an employee that is not limited to the

employee’s active service period. This Issue concluded that an employer should recognize a liability for

future benefits based on the substantive agreement with the employee since the postretirement benefit

obligation is not effectively settled through the purchase of the endorsement split-dollar life insurance

policy. This Issue is effective for SunTrust beginning January 1, 2008 and any resulting adjustment will

be recorded as a change in accounting principle through a cumulative effect adjustment to equity.

SunTrust does not expect this Issue to have a material impact on its financial position and results of

operations.

In September 2006, the Emerging Issues Task Force (“EITF”) reached a consensus on EITF Issue

No. 06-5, “Accounting for Purchases of Life Insurance – Determining the Amount That Could Be

Realized in Accordance with FASB Technical Bulletin No. 85-4, Accounting for Purchases of Life

Insurance.” This Issue clarifies how a company should determine “the amount that could be realized”

from a life insurance contract, which is the measurement amount for the asset in accordance with

Technical Bulletin 85-4; and requires policyholders to determine the amount that could be realized

under a life insurance contract assuming individual policies are surrendered, unless all policies are

required to be surrendered as a group. This EITF became effective for the Company on January 1, 2007

and the adoption did not have an impact on its financial position and results of operations.

Note 2 - Acquisitions/Dispositions

On September 29, 2006, SunTrust sold its Bond Trustee business unit to U.S. Bank, N.A. (“U.S. Bank”),

for $113.8 million in cash. This transaction resulted in a gain of $112.8 million, which was recorded in

the Consolidated Statements of Income as a component of noninterest income. This gain was partially

offset by $1.0 million of costs primarily related to employee retention, the write-off of fixed assets, and

system deconversion. The Company may realize an additional pre-tax gain of up to $16 million as a

result of future contingent payments from U.S. Bank linked to business retention levels in the twelve

month period following the completion of the sale. Approximately $21 billion in non-managed

corporate trust assets were transferred to U.S. Bank, which contributed approximately $17 million of

revenue for the nine month period ended September 30, 2006. The sale of the business, which was a part

of the Wealth and Investment Management line of business, was part of an effort by the Company to

modify its business mix to focus on its high-growth core business lines and market segments.

On July 28, 2006, AMA Holdings, Inc. (“AMA Holdings”), a 100%-owned subsidiary of SunTrust,

exercised its right to call 23 minority member owned interests in AMA, LLC. The transaction resulted in

$2.6 million of goodwill and $0.6 million of other intangibles related to client relationships which were

both deductible for tax purposes. On January 28, 2006, AMA Holdings exercised its right to call 98

minority member owned interests in AMA, LLC, resulting in $6.9 million of goodwill and $4.5 million

of other intangibles related to client relationships which were both deductible for tax purposes. During

the second quarter of 2005, AMA Holdings exercised its right to call 41 minority member owned

interests in AMA, LLC which resulted in $3.3 million of goodwill that was also deductible for tax

87