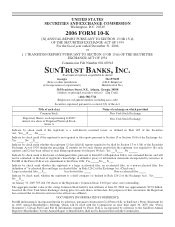

SunTrust 2006 Annual Report Download - page 15

Download and view the complete annual report

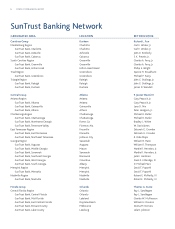

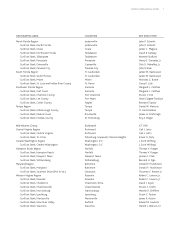

Please find page 15 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Virginia, West Virginia, Maryland, North Carolina, South Carolina, the District of Columbia,

Mississippi and Arkansas. SunTrust Bank is a member of the Federal Reserve System, and is regulated

by the Federal Reserve, the Federal Deposit Insurance Corporation (the “FDIC”) and the Georgia

Department of Banking and Finance. Until February 2, 2007 SunTrust Bank also operated certain

branches under the name “El Banco de Nuestra Comunidad, a division of SunTrust Bank” in Georgia.

The Company’s banking subsidiary is subject to various requirements and restrictions under federal and

state law, including requirements to maintain reserves against deposits, restrictions on the types and

amounts of loans that may be made and the interest that may be charged thereon, and limitations on the

types of investments that may be made and the types of services that may be offered. Various consumer

laws and regulations also affect the operations of the bank and its subsidiaries. In addition to the impact

of regulation, commercial banks are affected significantly by the actions of the Federal Reserve as it

attempts to control the money supply and credit availability in order to influence the economy.

Pursuant to the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994, bank holding

companies from any state may acquire banks located in any other state, subject to certain conditions,

including concentration limits. In addition, a bank may establish branches across state lines by merging

with a bank in another state, subject to certain restrictions. A bank holding company may not directly or

indirectly acquire ownership or control of more than 5% of the voting shares or substantially all of the

assets of any bank or merge or consolidate with another bank holding company without the prior

approval of the Federal Reserve.

There are a number of obligations and restrictions imposed on bank holding companies and their

depository institution subsidiaries by federal law and regulatory policy that are designed to reduce

potential loss exposure to the depositors of such depository institutions and to the FDIC insurance fund

in the event the depository institution becomes in danger of default or is in default. For example, under a

policy of the Federal Reserve with respect to bank holding company operations, a bank holding

company is required to serve as a source of financial strength to its subsidiary depository institutions and

commit resources to support such institutions in circumstances where it might not do so absent such

policy. In addition, the “cross-guarantee” provisions of federal law require insured depository

institutions under common control to reimburse the FDIC for any loss suffered or reasonably anticipated

as a result of the default of a commonly controlled insured depository institution or for any assistance

provided by the FDIC to a commonly controlled insured depository institution in danger of default. The

federal banking agencies have broad powers under current federal law to take prompt corrective action

to resolve problems of insured depository institutions. The extent of these powers depends upon whether

the institutions in question are “well capitalized,” “adequately capitalized,” “undercapitalized,”

“significantly undercapitalized” or “critically undercapitalized” as such terms are defined under

regulations issued by each of the federal banking agencies.

The Federal Reserve and the FDIC have issued substantially similar risk-based and leverage capital

guidelines applicable to United States banking organizations. In addition, these regulatory agencies may

from time to time require that a banking organization maintain capital above the minimum levels,

whether because of its financial condition or actual or anticipated growth. The Federal Reserve risk-

based guidelines define a tier-based capital framework. Tier 1 capital includes common shareholders’

equity, trust preferred securities, minority interests and qualifying preferred stock, less goodwill and

other adjustments. Tier 2 capital consists of preferred stock not qualifying as Tier 1 capital, mandatory

convertible debt, limited amounts of subordinated debt, other qualifying term debt, the allowance for

credit losses up to a certain amount and a portion of the unrealized gain on equity securities. The sum of

Tier 1 and Tier 2 capital less investments in unconsolidated subsidiaries represents the Company’s

qualifying total capital. Risk-based capital ratios are calculated by dividing Tier 1 and total capital by

2