SunTrust 2006 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

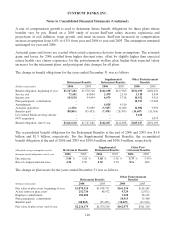

Notes to Consolidated Financial Statements (Continued)

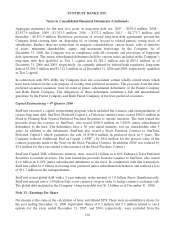

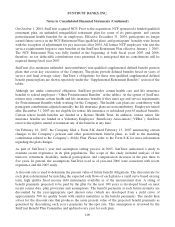

On October 1, 2004, SunTrust acquired NCF. Prior to the acquisition, NCF sponsored a funded qualified

retirement plan, an unfunded nonqualified retirement plan for some of its participants, and certain

postretirement health benefits for its employees. Effective December 31, 2004, participants no longer

earned future service in the NCF Retirement Plan (qualified plan), and participants’ benefits were frozen

with the exception of adjustments for pay increases after 2004. All former NCF employees who met the

service requirements began to earn benefits in the SunTrust Retirement Plan effective January 1, 2005.

The NCF Retirement Plan was fully funded at the beginning of both fiscal years 2005 and 2006;

therefore, no tax deductible contributions were permitted. It is anticipated that no contributions will be

required during fiscal year 2007.

SunTrust also maintains unfunded, noncontributory non-qualified supplemental defined benefit pension

plans that cover key executives of the Company. The plans provide defined benefits based on years of

service and final average salary. SunTrust’s obligations for these non-qualified supplemental defined

benefit pension plans are shown separately under the “Supplemental Retirement Benefits” section of the

tables.

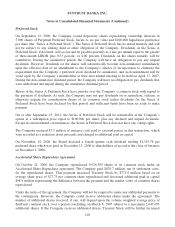

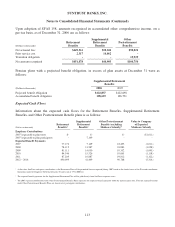

Although not under contractual obligation, SunTrust provides certain health care and life insurance

benefits to retired employees (“Other Postretirement Benefits” in the tables). At the option of SunTrust,

retirees may continue certain health and life insurance benefits if they meet age and service requirements

for Postretirement Benefits while working for the Company. The health care plans are contributory with

participant contributions adjusted annually; the life insurance plans are noncontributory. Employees retired

after December 31, 2003 are not eligible for retiree life insurance or subsidized post-65 medical benefits.

Certain retiree health benefits are funded in a Retiree Health Trust. In addition, certain retiree life

insurance benefits are funded in a Voluntary Employees’ Beneficiary Association (“VEBA”). SunTrust

reserves the right to amend or terminate any of the benefits at any time.

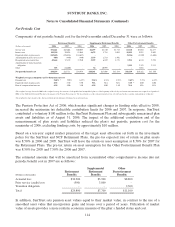

On February 16, 2007, the Company filed a Form 8-K dated February 13, 2007 announcing certain

changes to the Company’s pension and other postretirement benefit plans, as well as the matching

contribution related to the Company’s 401(k) Plan. Please refer to the Form 8-K for more information

regarding the plan changes.

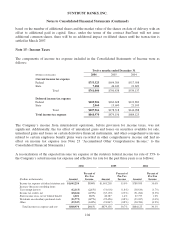

As part of SunTrust’s year end assumption setting process in 2005, SunTrust authorized a study to

examine recent experience in its plan populations. The scope of this study included analysis of the

turnover, retirement, disability, medical participation, and compensation increases in the past three to

five years. In general, the assumptions SunTrust used as of year-end 2006 were consistent with recent

experience and the 2005 study.

A discount rate is used to determine the present value of future benefit obligations. The discount rate for

each plan is determined by matching the expected cash flows of each plan to a yield curve based on long

term, high quality fixed income debt instruments available as of the measurement date. A string of

benefit payments projected to be paid by the plan for the next 100 years is developed based on most

recent census data, plan provisions and assumptions. The benefit payments at each future maturity are

discounted by the year-appropriate spot interest rates (which are developed from a yield curve of

approximately 500 Aa quality bonds with similar maturities as the benefit payments). The model then

solves for the discount rate that produces the same present value of the projected benefit payments as

generated by discounting each year’s payments by the spot rate. This assumption is reviewed by the

SunTrust Benefit Plan Committee and updated every year for each plan.

109