SunTrust 2006 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

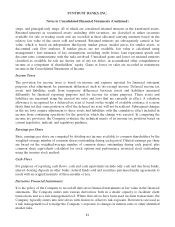

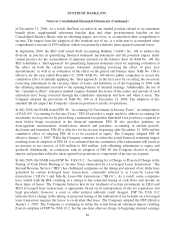

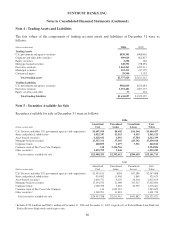

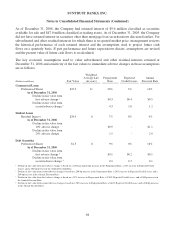

The amortized cost and fair value of investments in debt securities at December 31, 2006 by estimated

average life are shown below. Actual cash flows will differ from estimated average lives and contractual

maturities because borrowers may have the right to call or prepay obligations with or without call or

prepayment penalties.

(Dollars in thousands)

Amortized

Cost

Fair

Value

Due in one year or less $795,695 $794,526

Due in one year through five years 14,469,341 14,255,797

Due after five years through ten years 5,614,874 5,597,187

After ten years 694,534 700,134

Total $21,574,444 $21,347,644

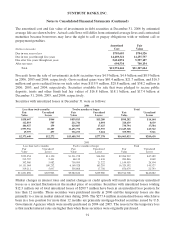

Proceeds from the sale of investments in debt securities were $4.9 billion, $4.4 billion and $8.9 billion

in 2006, 2005 and 2004, respectively. Gross realized gains were $69.4 million, $21.7 million, and $16.5

million and gross realized losses on such sales were $119.9 million, $28.8 million, and $58.2 million in

2006, 2005, and 2004, respectively. Securities available for sale that were pledged to secure public

deposits, trusts and other funds had fair values of $16.8 billion, $18.1 billion, and $17.4 billion at

December 31, 2006, 2005, and 2004, respectively.

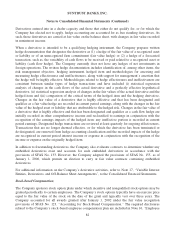

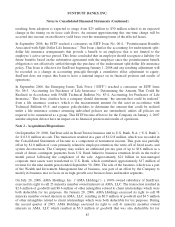

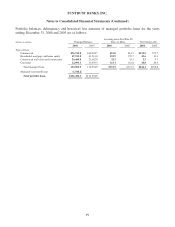

Securities with unrealized losses at December 31 were as follows:

2006

Less than twelve months Twelve months or longer Total

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

$138,467 $864 $859,815 $15,280 $998,282 $16,144

112,893 545 211,746 4,094 324,639 4,639

104,927 159 629,867 17,425 734,794 17,584

1,997,556 10,207 11,651,772 233,555 13,649,328 243,762

19,797 497 336,193 7,024 355,990 7,521

$2,373,640 $12,272 $13,689,393 $277,378 $16,063,033 $289,650

2005

Less than twelve months Twelve months or longer Total

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

$752,954 $11,120 $1,531,278 $36,269 $2,284,232 $47,389

215,707 2,431 68,139 1,438 283,846 3,869

392,960 5,082 756,999 21,222 1,149,959 26,304

10,151,064 180,232 6,169,528 163,295 16,320,592 343,527

319,211 5,037 556,868 17,756 876,079 22,793

$11,831,896 $203,902 $9,082,812 $239,980 $20,914,708 $443,882

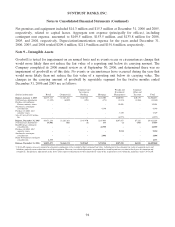

Market changes in interest rates and market changes in credit spreads will result in temporary unrealized

losses as a normal fluctuation in the market price of securities. Securities with unrealized losses totaling

$12.3 million out of total unrealized losses of $289.7 million have been in an unrealized loss position for

less than 12 months. These securities were purchased mostly in 2006 and the temporary losses are due

primarily to a rise in market interest rates during 2006. The $277.4 million in unrealized losses which have

been in a loss position for more than 12 months are primarily mortgage-backed securities issued by U.S.

Government Agencies which were mostly purchased in 2004 and 2005. The reason for the temporary loss

is that market interest rates are higher than when these securities were originally purchased.

91