SunTrust 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Pension Accounting

Several variables affect the annual pension cost and the annual variability of cost for the SunTrust

retirement programs. The main variables are: (1) size and characteristics of the employee population,

(2) discount rate, (3) expected long-term rate of return on plan assets, (4) recognition of actual asset

returns and (5) other actuarial assumptions. Below is a brief description of these variables and the effect

they have on SunTrust’s pension costs.

Size and Characteristics of the Employee Population

Pension cost is directly related to the number of employees covered by the plans, and other factors

including salary, age, and years of employment. The number of employees eligible for pension benefits

has increased over prior years, especially with the addition of NCF employees at the end of 2004.

Discount Rate

The discount rate is used to determine the present value of future benefit obligations. The discount rate

for each plan is determined by matching the expected cash flows of each plan to a yield curve based on

long term, high quality fixed income debt instruments available as of the measurement date,

December 31. This assumption is updated every year for each plan. The discount rate for each plan is

reset annually on the measurement date to reflect current market conditions.

If the Company were to assume a 0.25% increase/decrease in the discount rate for all retirement and

other postretirement plans, and keep all other assumptions constant, the benefit cost would decrease/

increase by approximately $14 million.

Expected Long-term Rate of Return on Plan Assets

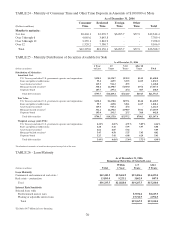

Based on historical experience and market projection of the target asset allocation set forth in the

investment policy for the SunTrust and NCF Retirement Plans, the pre-tax expected rate of return on

plan assets was 8.50% and 8.50% in 2006 and 2005, respectively. This expected rate of return is not

expected to change significantly each year.

Annual differences, if any, between expected and actual returns are included in the unrecognized net

actuarial gain or loss amount. The Company generally amortizes any unrecognized net actuarial gain or

loss in excess of a 10% corridor, as defined in SFAS No. 87, “Employers’ Accounting for Pensions,”

(“SFAS No. 87”) in net periodic pension expense over the average future service of active employees,

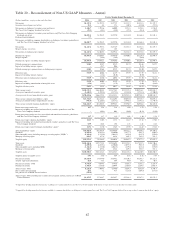

which is approximately eight years. See Note 16, “Employee Benefit Plans,” to the Consolidated

Financial Statements for details on changes in the pension benefit obligation and the fair value of plan

assets.

If the Company were to assume a 0.25% increase/decrease in the expected long-term rate of return for

the retirement and other postretirement plans, holding all other actuarial assumptions constant, the

benefit cost would decrease/increase by approximately $6 million.

Recognition of Actual Asset Returns

SFAS No. 87 allows for the use of an asset value that smoothes investment gains and losses over a

period up to five years. However, SunTrust has elected to use a preferable method in determining

pension expense. This method uses the actual market value of the plan assets, and therefore,

immediately recognizes prior gains and losses. Therefore, SunTrust will have more variability in the

annual pension cost, as the asset values will be more volatile than companies who elected to “smooth”

their investment experience.

65