SunTrust 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

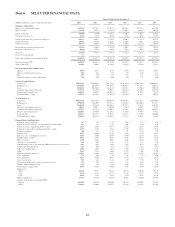

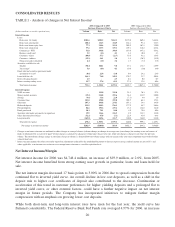

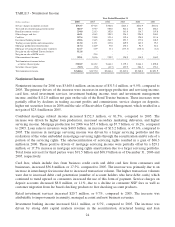

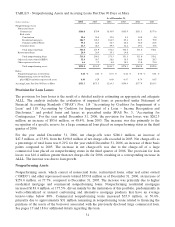

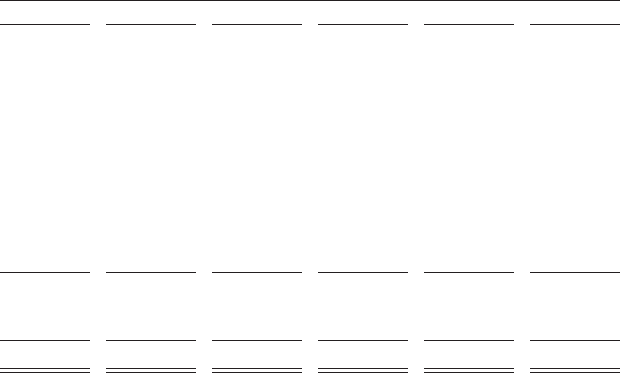

TABLE 3 - Noninterest Income

Year Ended December 31

(Dollars in millions) 2006 2005 2004 2003 2002 2001

Service charges on deposit accounts $763.7 $772.5 $700.0 $643.1 $612.9 $510.2

Trust and investment management income 686.9 673.7 586.8 502.4 504.5 486.1

Retail investment services 234.0 213.3 192.8 161.8 136.7 107.8

Other charges and fees 462.1 456.5 390.5 326.3 296.9 240.3

Card fees 247.6 210.8 153.4 119.6 120.0 113.6

Investment banking income 230.6 216.5 206.7 192.5 177.0 108.5

Trading account profits and commissions 113.0 145.1 127.8 109.9 103.2 95.7

Mortgage production related income 217.4 144.9 57.8 150.1 92.3 82.2

Mortgage servicing related income (expense) 121.7 41.9 11.1 (177.5) (110.1) (6.1)

Net gain on sale of Bond Trustee business 112.8 -----

Net gain on sale of RCM assets -23.4 ----

Other noninterest income 329.1 263.6 219.2 150.9 130.9 160.5

Total noninterest income before

securities (losses)/gains 3,518.9 3,162.2 2,646.1 2,179.1 2,064.3 1,898.8

Securities (losses)/gains (50.5) (7.2) (41.7) 123.9 204.5 153.1

Total noninterest income $3,468.4 $3,155.0 $2,604.4 $2,303.0 $2,268.8 $2,051.9

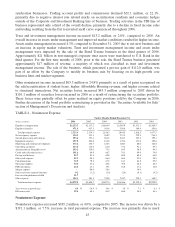

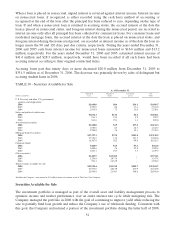

Noninterest Income

Noninterest income for 2006 was $3,468.4 million, an increase of $313.4 million, or 9.9%, compared to

2005. The primary drivers of the increase were increases in mortgage production and servicing income,

card fees, retail investment services, investment banking income, trust and investment management

income, and the $112.8 million net gain on the sale of the Bond Trustee business. These increases were

partially offset by declines in trading account profits and commissions, service charges on deposits,

higher net securities losses in 2006 and the sale of Receivables Capital Management, which resulted in a

net gain of $23.4 million in 2005.

Combined mortgage related income increased $152.3 million, or 81.5%, compared to 2005. The

increase was driven by higher loan production, increased secondary marketing deliveries, and higher

servicing income. Mortgage production for 2006 was $55.4 billion, up $7.7 billion, or 16.2%, compared

to 2005. Loan sales to investors were $40.9 billion, an increase of $13.2 billion, or 47.6%, compared to

2005. The increase in mortgage servicing income was driven by a larger servicing portfolio and the

realization of the value embedded in mortgage servicing rights through the securitization and/or sale of a

portion of the servicing rights. The sale/securitization of servicing rights resulted in a gain of $66.3

million in 2006. These positive drivers of mortgage servicing income were partially offset by a $29.1

million, or 17.5% increase in mortgage servicing rights amortization due to a larger servicing portfolio.

Total loans serviced for third parties were $91.5 billion and $68.9 billion as of December 31, 2006 and

2005, respectively.

Card fees, which include fees from business credit cards and debit card fees from consumers and

businesses, increased $36.8 million, or 17.5%, compared to 2005. The increase was primarily due to an

increase in interchange fee income due to increased transaction volume. The higher transaction volumes

were due to increased debit card penetration (number of account holders who have debit cards) which

continued to trend upward as consumers increased the use of this form of payment. Service charges on

deposit accounts decreased $8.8 million, or 1.1%, due to a decline in consumer NSF fees as well as

customer migration from fee based checking products to free checking account products.

Retail investment services increased $20.7 million, or 9.7%, compared to 2005. The increase was

attributable to improvements in annuity, managed account and new business revenues.

Investment banking income increased $14.1 million, or 6.5%, compared to 2005. The increase was

driven by strong debt capital markets revenue in the securitization, structured leasing and loan

24