SunTrust 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

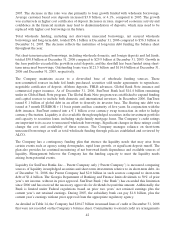

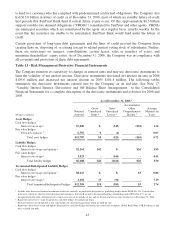

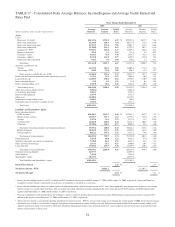

5Represents interest rate swaps designated as fair value hedges of subordinated notes, FHLB Advances, certificate and time deposits and other fixed rate

debt.

6Represents the fair value of derivative financial instruments less accrued interest receivable or payable.

7Represents interest rate swaps that have been terminated and/or dedesignated as derivatives that qualified for hedge accounting. The interest rate swaps

were designated as cash flow hedges of floating rate debt and tax exempt bonds. The $2.5 million of net gains, net of taxes, recorded in accumulated other

comprehensive income will be reclassified into earnings as interest expense over the life of the respective hedged items.

8Represents interest rate swaps that have been terminated and/or dedesignated as derivatives that qualified for hedge accounting. The interest rate swaps

were designated as fair value hedges of fixed rate debt. The $76.0 million of pre-tax net losses recorded in a valuation account in long-term debt will be

reclassified into earnings as a yield adjustment of the hedged item in the same period that the hedged cash flows impact earnings.

9At December 31, 2006, the net unrealized gain on derivatives included in accumulated other comprehensive income, which is a component of

shareholders’ equity, was $18.9 million, net of income taxes. Of this net-of-tax amount, a $16.4 million gain represents the effective portion of the net

gains on derivatives that currently qualify as cash flow hedges, and a $2.5 million gain relates to previous qualifying cash flow hedging relationships that

have been terminated or dedesignated. Gains or losses on hedges of interest rate risk will be classified into interest income or expense as a yield

adjustment of the hedged item in the same period that the hedged cash flows impact earnings. As of December 31, 2006, $14.2 million of net gains, net of

taxes, recorded in accumulated other comprehensive income are expected to be reclassified as interest income or interest expense during the next twelve

months.

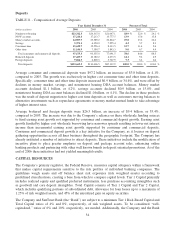

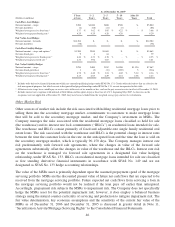

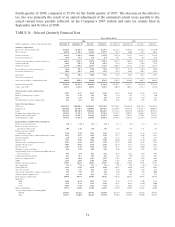

As of December 31, 2005 1

(Dollars in millions)

Notional

Amount

Gross

Unrealized

Gains 6

Gross

Unrealized

Losses 6Equity 9

Average

Maturity in

Years

Asset Hedges

Cash flow hedges

Interest rate swaps 2$5,800 $- ($88) ($54) 1.48

Fair value hedges

Forward contracts 314,384 - (78) - 0.08

Total asset hedges $20,184 $- ($166) ($54) 0.47

Liability Hedges

Cash flow hedges

Interest rate swaps and options 4$5,065 $79 $- $49 1.97

Fair value hedges

Interest rate swaps 57,467 10 (226) - 6.28

Total liability hedges $12,532 $89 ($226) $49 4.54

Terminated/Dedesignated Liability Hedges

Cash flow hedges

Interest rate swaps 7$1,942 $- $- ($12) 2.42

Fair value hedges

Interest rate swaps 8300 16 - - 14.26

Total terminated/dedesignated hedges $2,242 $16 $- ($12) 4.01

1Includes only derivative financial instruments which are currently, or previously designated as, qualifying hedges under SFAS No. 133. Certain other

derivatives which are effective for risk management purposes, but which are not in designated hedging relationships under SFAS No. 133, are not included

in this table. These instruments are classified as free standing derivatives. All interest rate swaps have resets of six months or less and are the pay and

receive rates in effect at December 31, 2005.

2Represents interest rate swaps designated as cash flow hedges of commercial loans.

3Forward contracts are designated as fair value hedges of closed mortgage loans, which are held for sale. Certain other forward contracts which are

effective for risk management purposes, but which are not in designated hedging relationships under SFAS No. 133, are not incorporated in this table.

4Represents interest rate swaps and options designated as cash flow hedges of floating rate certificates of deposit, Global Bank Notes, FHLB Advances and

other variable rate debt.

5Represents interest rate swaps designated as fair value hedges of subordinated notes, FHLB Advances, certificate and time deposits and other fixed rate

debt.

6Represents the fair value of derivative financial instruments less accrued interest receivable or payable.

7Represents interest rate swaps that have been terminated and/or dedesignated as derivatives that qualified for hedge accounting. The interest rate swaps

were designated as cash flow hedges of floating rate debt and tax exempt bonds. The $11.9 million of net losses, net of taxes, recorded in accumulated

other comprehensive income will be reclassified into earnings as interest expense over the life of the respective hedged items.

8Represents interest rate swaps that have been terminated and/or dedesignated as derivatives that qualified for hedge accounting. The interest rate swaps

were designated as fair value hedges of fixed rate debt. The $15.9 million of pre-tax net gains recorded in a valuation account in long-term debt will be

reclassified into earnings as a yield adjustment of the hedged item in the same period that the hedged cash flows impact earnings.

9As of December 31, 2005, the net unrealized loss on derivatives included in accumulated other comprehensive income, which is a component of

shareholders’ equity, was $17.3 million, net of income taxes. Of this net-of-tax amount, a $5.4 million loss represents the effective portion of the net losses

on derivatives that currently qualify as cash flow hedges, and an $11.9 million loss relates to previous qualifying cash flow hedging relationships that have

been terminated or dedesignated. Gains or losses on hedges of interest rate risk will be classified into interest income or expense as a yield adjustment of

the hedged item in the same period that the hedged cash flows impact earnings. As of December 31, 2005, $16.8 million of net losses, net of taxes,

recorded in accumulated other comprehensive income are expected to be reclassified as interest income or interest expense during the next twelve months.

44