SunTrust 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC. 2006 ANNUAL REPORT

2006

Table of contents

-

Page 1

2006 SUNTRUST BANKS, INC. 2006 ANNUAL REPORT -

Page 2

... ATMs are located primarily in Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia and the District of Columbia. In addition, SunTrust provides clients with a selection of technology-based banking channels including Online, PC, and Telephone Banking. Our internet address... -

Page 3

...glossy, paper-based annual report when so many people prefer electronically delivered information simply is not in our shareholders' financial interest. If you would like to know more about SunTrust strategies, performance, products or services, please visit our Web site (suntrust.com) or contact us... -

Page 4

..., posted meaningful growth in asset securitization, structured real estate, derivatives, and primary bonds, as we delivered solutions to our Corporate Banking, Commercial Banking, Wealth and Investment Management and institutional investor clients. Cross-selling capital markets products to SunTrust... -

Page 5

...and Tennessee. Our business line, product and sales capabilities were significantly enhanced. And SunTrust moved from its historically decentralized operating structure to a unified "one-bank" platform. This long-planned transition reflects the priority SunTrust places on executive talent management... -

Page 6

4 SUNTRUST 2006 ANNUAL REPORT Delivering Growth - Our entire range of client experience-related initiatives, most visibly our company-wide "S3" sales and retention program and our "Thinking 360°" cross-sell efforts, are focused squarely on adding new clients and expanding our relationships with ... -

Page 7

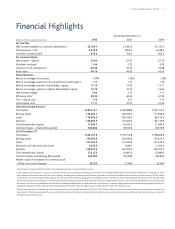

...' equity Common shares outstanding (thousands) Market value of investment in common stock of The Coca-Cola Company 1 Total revenue is comprised of net interest income (taxable-equivalent) and noninterest income. report, SunTrust presents a return on average assets less net unrealized securities... -

Page 8

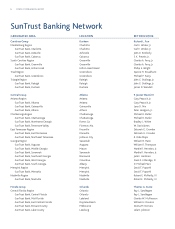

... Central Florida · SunTrust Bank, Brevard County · SunTrust Bank, Lake County LOCATION Durham Charlotte Charlotte Asheville Cabarrus Greenville Greenville Hilton Head Island Greensboro Greensboro Raleigh Raleigh Durham Atlanta Atlanta Atlanta Gainesville Athens Chattanooga Chattanooga Rome, Ga... -

Page 9

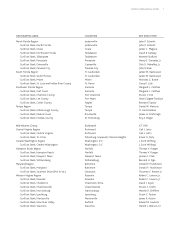

... SunTrust Bank, Central Virginia · SunTrust Bank, Tri-Cities Greater Washington Region · SunTrust Bank, Greater Washington Hampton Roads Region · SunTrust Bank, Hampton Roads · SunTrust Bank, Newport News · SunTrust Bank, Williamsburg Maryland Region · SunTrust Bank, Maryland · SunTrust Bank... -

Page 10

8 SUNTRUST 2006 ANNUAL REPORT Key Subsidiaries CHIEF EXECUTIVE Asset Management Advisors, L.L.C. Provides comprehensive family office services. Premium Assignment Corporation Provides insurance premium financing to businesses. SunTrust Capital Markets, Inc. SunTrust's investment banking subsidiary... -

Page 11

SUNTRUST 2006 ANNUAL REPORT 9 Management Committee James M. Wells III President and Chief Executive Officer 39 years of service William R. Reed, Jr. Vice Chairman Geographic Banking and Sales Administration 37 years of service Gay O. Abbott Corporate Executive Vice President Commercial Line of ... -

Page 12

... Parts Company Atlanta, Georgia Frank S. Royal, M.D. 2 President Frank S. Royal, M.D., P.C. Richmond, Virginia Karen Hastie Williams 2, 4 Retired Partner Crowell & Moring, L.L.P. Washington, D.C. Dr. Phail Wynn, Jr. 4, 5 President Durham Technical Community College Durham, North Carolina. J. Hyatt... -

Page 13

...303 Peachtree Street, N.E., Atlanta, Georgia 30308 (Address of principal executive offices) (Zip Code) (404) 588-7711 (Registrant's telephone number, including area code) Securities registered pursuant to section 12(b) of the Act: Title of each class Common Stock Depositary Shares, each representing... -

Page 14

...mortgage banking, credit-related insurance, asset management, securities' brokerage and capital market services. SunTrust enjoys strong market positions in some of the highest-growth markets in the United States and operates primarily within Florida, Georgia, Maryland, North Carolina, South Carolina... -

Page 15

... West Virginia, Maryland, North Carolina, South Carolina, the District of Columbia, Mississippi and Arkansas. SunTrust Bank is a member of the Federal Reserve System, and is regulated by the Federal Reserve, the Federal Deposit Insurance Corporation (the "FDIC") and the Georgia Department of Banking... -

Page 16

.... In addition, FDICIA requires the various regulatory agencies to prescribe certain non-capital standards for safety and soundness relating generally to operations and management, asset quality and executive compensation and permits regulatory action against a financial institution that does not... -

Page 17

... through diversified financial services companies and conveyed to outside vendors. The FDIC merged the Bank Insurance Fund ("BIF") and the Savings Association Insurance Fund ("SAIF") to form the Deposit Insurance Fund ("DIF") on March 31, 2006 in accordance with the Federal Deposit Insurance Reform... -

Page 18

...'s competitors have greater financial resources and/or face fewer regulatory constraints. As a result of these various sources of competition, the Company could lose business to competitors or be forced to price products and services on less advantageous terms to retain or attract clients, either of... -

Page 19

...writing to: SunTrust Banks, Inc., Attention: Investor Relations Department, P.O. Box 4418, Center 645, Atlanta, Georgia 30302-4418. The Company's Annual Report on Form 10-K is being distributed to shareholders in lieu of a separate annual report containing financial statements of the Company and its... -

Page 20

... of assets for which we provide processing services; or • To the extent we access capital markets to raise funds to support the business, such changes could affect the cost of such funds or the ability to raise such funds. The fiscal and monetary policies of the federal government and its agencies... -

Page 21

... net income. Technology and other changes now allow parties to complete financial transactions without banks. For example, consumers can pay bills and transfer funds directly without banks. This process could result in the loss of fee income, as well as the loss of client deposits and the income... -

Page 22

... This regulation is to protect depositors, the federal deposit insurance fund and the banking system as a whole. Congress and state legislatures and federal and state regulatory agencies continually review banking laws, regulations, and policies for possible changes. Changes to statutes, regulations... -

Page 23

..., or those new products may not achieve market acceptance. As a result, we could lose business, be forced to price products and services on less advantageous terms to retain or attract clients, or be subject to cost increases. The Parent Company's ability to receive dividends from its subsidiaries... -

Page 24

... who have extensive experience in the industry. We do not carry key person life insurance on any of the executive officers or other key personnel. If we lose the services of any of these integral personnel and fail to manage a smooth transition to new personnel, the business could be impacted. 11 -

Page 25

... to execute the business strategy and provide high quality service may suffer if we are unable to recruit or retain a sufficient number of qualified employees or if the costs of employee compensation or benefits increase substantially. Our accounting policies and methods are key to how we report our... -

Page 26

...'s fiscal year relating to the Company's periodic or current reports filed under the Securities Exchange Act of 1934. Item 2. PROPERTIES The Company's headquarters is located in Atlanta, Georgia. As of December 31, 2006, SunTrust Bank owned 995 of its 1,701 full-service banking offices and leased... -

Page 27

... SECURITIES REGISTRANT'S COMMON EQUITY AND RELATED MATTERS AND ISSUER PURCHASES OF EQUITY The principal market on which the Common Stock of the Company is traded is the New York Stock Exchange ("NYSE"). See Item 6 and Table 16 in the MD&A for information on the high and the low closing sales... -

Page 28

...return on the S&P 500 Commercial Bank Industry Index this year in advance of retiring the comparison to the S&P 500 Diversified Banks Index in 2008 and replacing it with this index. The reason for this transition is that the Company believes the S&P 500 Commercial Bank Industry Index provides a more... -

Page 29

... Efficiency ratio, excluding merger expense Tangible efficiency ratio Effective tax rate Allowance to year-end loans Nonperforming assets to total loans plus OREO and other repossessed assets Common dividend payout ratio Full-service banking offices ATMs Full-time equivalent employees Tier 1 capital... -

Page 30

...business as well as the capital adequacy of the Company. The Company provides reconcilements on pages 67 and 68 for all non-US GAAP measures. Certain reclassifications may be made to prior period financial statements and related information to conform them to the 2006 presentation. SunTrust reported... -

Page 31

... the financial information included in the Company's 2006 Annual Report on Form 10-K has been updated to reflect these revisions. INTRODUCTION SunTrust is headquartered in Atlanta, Georgia, and operates primarily within Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia... -

Page 32

... other deposit products, specifically DDA, money market, and savings, declined. • Noninterest income improved $313.3 million, or 9.9%, compared to 2005. The increase was driven by strong mortgage production and servicing income and gain on the sale of the Bond Trustee business. • Noninterest... -

Page 33

... trading assets Total interest income Interest Expense NOW accounts Money market accounts Savings Consumer time Other time Brokered deposits Foreign deposits Funds purchased Securities sold under agreements to repurchase Other short-term borrowings Long-term debt Total interest expense Net change in... -

Page 34

... increased 60 basis points over the same time period to an average rate of 5.33%. As a result, incremental asset growth, in particular mortgage loans and mortgage loans held for sale, were funded at tighter spreads due to higher short-term borrowing costs. The 2006 earning asset yield increased 92... -

Page 35

... NOW accounts Money market accounts Savings Consumer time Other time Total interest-bearing consumer and commercial deposits Brokered deposits Foreign deposits Total interest-bearing deposits Federal funds purchased Securities sold under agreements to repurchase Other short-term borrowings Long-term... -

Page 36

... accounts Money market accounts Savings Consumer time Other time Total interest-bearing consumer and commercial deposits Brokered deposits Foreign deposits Total interest - bearing deposits Federal funds purchased Securities sold under agreements to repurchase Other short-term borrowings Long-term... -

Page 37

... management income Retail investment services Other charges and fees Card fees Investment banking income Trading account profits and commissions Mortgage production related income Mortgage servicing related income (expense) Net gain on sale of Bond Trustee business Net gain on sale of RCM assets... -

Page 38

... Employee compensation Employee benefits Total personnel expense Net occupancy expense Outside processing and software Equipment expense Marketing and customer development Consulting and legal Amortization of intangible assets Credit and collection services Postage and delivery Other staff expense... -

Page 39

... with higher transaction volumes and higher software maintenance costs. Marketing and customer development expense increased $16.5 million, or 10.5%, primarily due to the Company's marketing campaigns focused on customer acquisition and deposit promotion. Amortization of intangible assets decreased... -

Page 40

... 0.9 (Dollars in millions) Construction Real estate Business services & nonprofits Retail trade Manufacturing Wholesale trade Health & social assistance Finance & insurance Professional, scientific & technical services Public administration Information Accomodation & food services Transportation... -

Page 41

... level of allowance. At year-end 2006, the Company's total allowance was $1.0 billion, which represented 0.86% of period-end loans. In addition to the review of credit quality through ongoing credit review processes, the Company employs a variety of modeling and estimation tools for measuring credit... -

Page 42

...debt in-full and the loan is in the legal process of collection. Accordingly, secured loans may be chargeddown to the estimated value of the collateral with previously accrued unpaid interest reversed. Subsequent charge-offs may be required as a result of changes in the market value of collateral or... -

Page 43

... from acquisitions and other activity - net Provision for loan losses Charge-offs Commercial Real estate: Home equity lines Construction Residential mortgages Commercial real estate Consumer loans: Direct Indirect Total charge-offs Recoveries Commercial Real estate: Home equity lines Construction... -

Page 44

... or insured conforming and alternative mortgage products that have an average loan-to-value below 80%. Commercial nonperforming loans increased $35.9 million, or 50.6%, primarily due to approximately $31 million remaining in nonperforming loans related to financing the purchase of the assets of... -

Page 45

... for Sale As of December 31 (Dollars in millions) Amortized Cost Unrealized Gains Unrealized Losses Fair Value U.S. Treasury and other U.S. government agencies and corporations 2006 2005 2004 States and political subdivisions 2006 2005 2004 Asset-backed securities 2006 2005 2004 Mortgage-backed... -

Page 46

...cost, improved $152.1 million compared to December 31, 2005. These changes in market value did not affect the net income of SunTrust, but were included in other comprehensive income. The Company reviews all of its securities with unrealized losses for impairment at least quarterly. As of December 31... -

Page 47

... The decline in these products was the result of deposit migration to higher cost time deposits as well as customers moving balances to alternative investments such as repurchase agreements or money market mutual funds to take advantage of higher interest rates. Average brokered and foreign deposits... -

Page 48

... are more fully described in Current Reports on Form 8-K filed on September 12, 2006, November 6, 2006 and December 6, 2006. SunTrust manages capital through dividends and share repurchases authorized by the Company's Board of Director's (the "Board"). Management assesses capital needs based on... -

Page 49

... reasonable assurance that key business objectives will be achieved, the Company has established an enterprise risk governance process and formed the SunTrust Enterprise Risk Program ("SERP"). Moreover, the Company has policies and various risk management processes designed to effectively identify... -

Page 50

... and support staff. These Risk Managers, while reporting directly to their respective line of business or function, facilitate communications with the Company's risk functions and execute the requirements of the enterprise risk management framework and policies. Enterprise Risk Management works in... -

Page 51

...provide leadership, expertise, and direction to each line of business and functional area in the development and maintenance of an effective, comprehensive program for the management of operational risk. These efforts support SunTrust's goals to achieve performance targets, prevent loss of resources... -

Page 52

...). SunTrust is also exposed to market risk in its trading activities, mortgage servicing rights, mortgage warehouse and pipeline, and equity holdings of The Coca-Cola Company common stock. The Asset/Liability Management Committee meets regularly and is responsible for reviewing the interest-rate... -

Page 53

... at a point in time, is defined as the discounted present value of asset cash flows and derivative cash flows minus the discounted value of liability cash flows, the net of which is referred to as "EVE." The sensitivity of EVE to changes in the level of interest rates is a measure of the longer-term... -

Page 54

...policies. The Company's sources of funds include a large, stable deposit base, secured advances from the Federal Home Loan Bank ("FHLB") and access to the capital markets. The Company structures its balance sheet so that illiquid assets, such as loans, are funded through customer deposits, long-term... -

Page 55

... Company maintains access to a diversified base of wholesale funding sources. These non-committed sources include fed funds purchased, securities sold under agreements to repurchase, negotiable certificates of deposit, offshore deposits, FHLB advances, Global Bank Note issuance and commercial paper... -

Page 56

..., SunTrust Bank would fund under the letters of credit. Certain provisions of long-term debt agreements and the lines of credit prevent the Company from creating liens on, disposing of, or issuing (except to related parties) voting stock of subsidiaries. Further, there are restrictions on mergers... -

Page 57

... rate swaps have resets of six months or less and are the pay and receive rates in effect at December 31, 2005. Represents interest rate swaps designated as cash flow hedges of commercial loans. Forward contracts are designated as fair value hedges of closed mortgage loans, which are held for sale... -

Page 58

...'s mortgage loans held for sale. As of December 31, 2006 and 2005, the notional amount of mortgage derivative contracts totaled $6.8 billion and $14.4 billion, respectively. The following table presents the expected maturities of derivative financial instruments: As of December 31, 2006 1 (Dollars... -

Page 59

...the time the customer locks in the rate on the anticipated loan and the time the loan is sold on the secondary mortgage market, which is typically 90-150 days. The Company manages interest rate risk predominately with forward sale agreements, where the changes in value of the forward sale agreements... -

Page 60

... FIN 45. In the normal course of business, the Company utilizes various derivative and credit-related financial instruments to meet the needs of clients and to manage the Company's exposure to interest rate and other market risks. These financial instruments involve, to varying degrees, elements of... -

Page 61

...a multi-seller commercial paper conduit, Three Pillars Funding LLC ("Three Pillars"). Three Pillars provides financing for direct purchases of financial assets originated and serviced by SunTrust's corporate clients. Three Pillars finances this activity by issuing A-1/P-1 rated commercial paper. The... -

Page 62

...real estate Commercial paper conduit Commercial credit card Total unused lines of credit Letters of credit Financial standby Performance standby Commercial Total letters of credit 1Includes $6.2 billion and $3.1 billion in interest rate locks accounted for as derivatives as of December 31, 2006 and... -

Page 63

... the bond portfolio. Additionally, growth in retail investment services income, other charges and fees, investment banking income, card fees and mortgage production related income was offset by declines in service charges on deposits, trust and investment management income, trading account profits... -

Page 64

... ratio, excluding merger expense Tangible efficiency ratio Effective tax rate Allowance to period-end loans Nonperforming assets to total loans plus OREO and other repossessed assets Common dividend payout ratio Full-service banking offices ATMs Full-time equivalent employees Tier 1 capital... -

Page 65

...: NOW accounts Money market accounts Savings Consumer time Other time Total interest-bearing consumer and commercial deposits Brokered deposits Foreign deposits Total interest-bearing deposits Funds purchased Securities sold under agreements to repurchase Other short-term borrowings Long-term debt... -

Page 66

...telephone (1-800-SUNTRUST). In addition to serving the retail market, the Retail line of business serves as an entry point for other lines of business. When client needs change and expand, Retail refers clients to SunTrust's Wealth and Investment Management, Mortgage and Commercial lines of business... -

Page 67

... group; the Corporate Real Estate group, which manages the Company's facilities; Marketing, which handles advertising, product management, customer information functions, and internet banking; BankCard, which handles credit card issuance and merchant discount relationships; SunTrust Online, which... -

Page 68

... Retail Commercial Corporate and Investment Banking Mortgage Wealth and Investment Management Corporate Other and Treasury Reconciling Items The following table for SunTrust's reportable business segments compares average loans and average deposits for the twelve months ended December 31, 2006 to... -

Page 69

... relative to market rate increases, as well as the increasing value of lower cost deposits in a higher rate environment. Provision for loan losses, which represents net charge-offs for the lines of business, decreased $32.3 million, or 23.4%, primarily due to a decline in consumer indirect auto net... -

Page 70

... as increased expense related to merchant banking activities. Mortgage Mortgage's net income for the twelve months ended December 31, 2006 was $248.4 million, an increase of $76.5 million, or 44.5%. Income from sales of servicing assets, higher income from loans and deposits, better net secondary... -

Page 71

... time deposits. Deposit spreads widened due to deposit rate increases that have been slower relative to market rate increases as well as the increasing value of lowercost deposits in a higher rate environment. Provision for loan losses, which represents net charge-offs for the lines of business... -

Page 72

...middle market commercial loan volumes. The average earning asset yield increased 85 basis points compared to 2004 while the average interest bearing liability cost increased 101 basis points. This reduction in interest rate spread was primarily due to increases in short term funding rates throughout... -

Page 73

... capital markets activities, loan fees, and deposit sweep income. Partially offsetting these increases, was a decrease in service charges on deposits due to higher compensating balances and increased client earnings credit rates. Noninterest expense increased $121.2 million, or 24.0%. NCF accounted... -

Page 74

... increased $24.3 million, or 0.7%. Core commercial loan and lease growth was due to increased corporate demand and increased merger and acquisition activity. Provision for loan losses, which represents net charge-offs for the lines of business, decreased $1.6 million, or 9.7% when compared to... -

Page 75

...-directed retirement accounts. SunTrust's total assets under advisement were approximately $242.5 billion, which include the aforementioned assets under management, $45.5 billion in non-managed trust assets, $33.4 billion in retail brokerage assets, and $28.3 billion in non-managed corporate... -

Page 76

... in merger expense representing costs to integrate the operations of NCF. Additionally, increases in corporate overhead expenses of $98.1 million were partially offset by increased expense recovery from the lines of business in the amount of $256.6 million. CRITICAL ACCOUNTING POLICIES The Company... -

Page 77

... be sold in a transaction between willing parties, that is, other than in a forced or liquidation sale, in a normal business transaction. The estimation of fair value is significant to a number of SunTrust's assets and liabilities, including loans held for sale, financial instruments, MSRs, other... -

Page 78

Pension Accounting Several variables affect the annual pension cost and the annual variability of cost for the SunTrust retirement programs. The main variables are: (1) size and characteristics of the employee population, (2) discount rate, (3) expected long-term rate of return on plan assets, (4) ... -

Page 79

... as mortality rate, turnover rate, retirement rate, disability rate and the rate of compensation increases. These factors don't tend to change significantly over time, so the range of assumptions, and their impact on pension cost, is generally limited. SunTrust periodically reviews the assumptions... -

Page 80

... including MSRs Mortgage servicing rights Tangible assets Tangible equity to tangible assets Net interest income Taxable equivalent adjustment Net interest income - FTE Noninterest income Total revenue - FTE Net securities losses/(gains) Net gain on sale of Bond Trustee business Total revenue - FTE... -

Page 81

... Mortgage servicing rights Tangible assets Tangible equity to tangible assets Net interest income Taxable - equivalent adjustment Net interest income - FTE Noninterest income Total revenue - FTE Net securities (gains)/losses Net gain on sale of RCM assets Net gain on sale of Bond Trustee business... -

Page 82

... Company's Common Stock, of which authority the Company has repurchased 9,926,589 shares. TABLE 23 - Funds Purchased and Securities Sold Under Agreements to Repurchase1 As of December 31 Balance Rate Daily Average Balance Rate Maximum Outstanding at Any Month-end (Dollars in millions) 2006 2005... -

Page 83

... Asset-backed securities1 Mortgage-backed securities1 Corporate bonds Total debt securities Fair Value U.S. Treasury and other U.S. government agencies and corporations States and political subdivisions Asset-backed securities1 Mortgage-backed securities1 Corporate bonds Total debt securities... -

Page 84

... Report of Independent Registered Public Accounting Firm To the Board of Directors and Shareholders of SunTrust Banks, Inc.: We have completed integrated audits of SunTrust Banks, Inc.'s consolidated financial statements and of its internal control over financial reporting as of December 31, 2006... -

Page 85

... accepted accounting principles. A company's internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii... -

Page 86

... fees Mortgage production related income Mortgage servicing related income Net gain on sale of Bond Trustee business Net gain on sale of RCM assets Other noninterest income Net securities losses Total noninterest income Noninterest Expense Employee compensation Employee benefits Outside processing... -

Page 87

... from banks Interest-bearing deposits in other banks Funds sold and securities purchased under agreements to resell Trading assets Securities available for sale1 Loans held for sale Loans Allowance for loan and lease losses Net loans Premises and equipment Goodwill Other intangible assets Customers... -

Page 88

... taxes Change in accumulated other comprehensive income related to employee benefit plans Total comprehensive income Common stock dividends, $2.00 per share Exercise of stock options and stock compensation element expense Acquisition of treasury stock Acquisition of National Commerce Financial, Inc... -

Page 89

... servicing rights Provisions for loan losses and foreclosed property Deferred income tax provision Amortization of compensation element of performance and restricted stock Stock option compensation Excess tax benefits from stock-based compensation Net securities losses Net gain on sale of assets... -

Page 90

... company with its headquarters in Atlanta, Georgia. SunTrust's principal banking subsidiary, SunTrust Bank, offers a full line of financial services for consumers and businesses through its branches located primarily in Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia... -

Page 91

... equity method investments are recognized in noninterest income in the Consolidated Statements of Income. Loans Held for Sale Loans held for sale that are not documented as the hedged item in a fair value hedge are carried at the lower of cost or fair value at the pool level based on similar assets... -

Page 92

... derived from the Company's internal risk rating process. These factors are developed and applied to the portfolio in terms of line of business and loan type. Adjustments are also made to the allowance for the pools after an assessment of internal and external influences on credit quality that have... -

Page 93

... assets for financial reporting purposes. Such capitalized assets are amortized, using the straight-line method, over the terms of the leases. Construction in process primarily includes in process branch expansion, branch renovation, and software development projects. Upon completion, branch related... -

Page 94

..., interest-bearing deposits in other banks, federal funds sold and securities purchased under agreements to resell with an original maturity of three months or less. Derivative Financial Instruments It is the policy of the Company to record all derivative financial instruments at fair value in the... -

Page 95

... over three years. The Company accounted for all awards granted after January 1, 2002 under the fair value recognition provisions of SFAS No. 123, "Accounting for Stock-Based Compensation." The required disclosures related to the Company's stock-based employee compensation plan are included in Note... -

Page 96

... 1, 2006, the Company began estimating the number of awards for which it is probable that service will be rendered and adjusted compensation cost accordingly. Estimated forfeitures are subsequently adjusted to reflect actual forfeitures. Foreign Currency Transactions Foreign denominated assets and... -

Page 97

...the Company's financial position or results of operations. In March 2006, the FASB issued SFAS No. 156, "Accounting for Servicing of Financial Assets - an amendment of FASB Statement No. 140." This Statement requires that all separately recognized servicing rights be initially measured at fair value... -

Page 98

... status of their benefit plans in the statement of financial position. SFAS No. 158 also requires that previously disclosed but unrecognized actuarial gains and losses, unrecognized prior service costs and credits, and any transition assets or obligations remaining from the initial application... -

Page 99

... tax expense. In July 2006, the FASB issued FSP No. FAS 13-2, "Accounting for a Change or Projected Change in the Timing of Cash Flows Relating to Income Taxes Generated by a Leveraged Lease Transaction." The Internal Revenue Service ("IRS") has challenged companies on the timing and amount of tax... -

Page 100

... corporate trust assets were transferred to U.S. Bank, which contributed approximately $17 million of revenue for the nine month period ended September 30, 2006. The sale of the business, which was a part of the Wealth and Investment Management line of business, was part of an effort by the Company... -

Page 101

.... On March 17, 2006, SunTrust acquired 11 Florida Wal-Mart banking branches from Community Bank of Florida ("CBF"), based in Homestead, Florida. The Company acquired approximately $5.1 million in assets and $56.4 million in deposits and related liabilities. The transaction resulted in $1.1 million... -

Page 102

... other intangibles related to client relationships and noncompete agreements which were both deductible for tax purposes. On October 1, 2004, SunTrust acquired National Commerce Financial Corporation and subsidiaries, a Memphis-based financial services organization. NCF's parent company merged into... -

Page 103

...Asset-backed securities Mortgage-backed securities Corporate bonds Common stock of The Coca-Cola Company Other securities1 Total securities available for sale 1 Includes $729.4 million and $860.1 million at December 31, 2006 and December 31, 2005, respectively, of Federal Home Loan Bank and Federal... -

Page 104

... sale that were pledged to secure public deposits, trusts and other funds had fair values of $16.8 billion, $18.1 billion, and $17.4 billion at December 31, 2006, 2005, and 2004, respectively. Securities with unrealized losses at December 31 were as follows: Less than twelve months Fair Unrealized... -

Page 105

... portfolio at December 31 is shown in the following table: (Dollars in thousands) 2006 2005 Commercial Real estate: Home equity lines Construction Residential mortgages Commercial real estate Consumer: Direct Indirect Business credit card Total loans $34,613,882 14,102,655 13,892,988 33,830,101... -

Page 106

SUNTRUST BANKS, INC. Notes to Consolidated Financial Statements (Continued) Note 7 - Allowance for Loan and Lease Losses Activity in the allowance for loan and lease losses for the twelve months ended December 31 is summarized in the table below: (Dollars in thousands) 2006 $1,028,128 262,536 (356,... -

Page 107

... respectively. Note 9 - Intangible Assets Goodwill is tested for impairment on an annual basis and as events occur or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount. The Company completed its 2006 annual review as of September... -

Page 108

... Lighthouse Partners client relationships and noncompete agreements Sale of Carswell of Carolina, Inc. Balance, December 31, 2005 Amortization Servicing rights originated Community Bank of Florida branch acquisition Reclass investment to trading assets Purchase of AMA, LLC minority shares Sale... -

Page 109

... the underlying mortgage loans. Servicing assets of approximately $9 million were recorded as a result of the transaction. A pre-tax gain of $1.1 million was also recognized as a result of the transaction. The key assumptions used in measuring the fair value of the retained interests at the time of... -

Page 110

..., including credit losses, loan repayment speeds and discount rates commensurate with the risks involved. Gains or losses upon securitization as well as servicing fees and collateral management fees are recorded in noninterest income. In 2006, the Company recognized net gains and fees related to the... -

Page 111

... 11 Prepayment Rate 20% Expected Credit Losses 2% Annual Discount Rate 14% (Dollars in millions) Fair Value $22.9 Commercial Loans Preferenced Shares As of December 31, 2006 Decline in fair value from first adverse change 1 Decline in fair value from second adverse change 2 Student Loans Residual... -

Page 112

SUNTRUST BANKS, INC. Notes to Consolidated Financial Statements (Continued) Portfolio balances, delinquency and historical loss amounts of managed portfolio loans for the years ending December 31, 2006 and 2005 are as follows: (Dollars in millions) Principal Balance 2006 2005 $36,512.8 47,932.8 26,... -

Page 113

SUNTRUST BANKS, INC. Notes to Consolidated Financial Statements (Continued) Note 12 - Long-Term Debt Long term debt at December 31 consisted of the following: (Dollars in thousands) 2006 2005 Parent Company Only Senior Floating rate notes due 2007 based on three month LIBOR + .08% 5.05% notes due... -

Page 114

...several long-term debt agreements prevent the Company from creating liens on, disposing of, or issuing (except to related parties) voting stock of subsidiaries. Further, there are restrictions on mergers, consolidations, certain leases, sales or transfers of assets, minimum shareholders' equity, and... -

Page 115

... to various regulatory capital requirements which involve quantitative measures of the Company's assets. 2006 (Dollars in millions) 2005 Ratio 7.72% 11.11 7.23 7.97 10.85 7.35 Amount $11,080 16,714 Ratio 7.01% 10.57 6.65 7.49 10.54 7.04 Amount $12,525 18,025 SunTrust Banks, Inc. Tier 1 capital... -

Page 116

SUNTRUST BANKS, INC. Notes to Consolidated Financial Statements (Continued) Preferred Stock On September 12, 2006, the Company issued depositary shares representing ownership interests in 5,000 shares of Perpetual Preferred Stock, Series A, no par value and $100,000 liquidation preference per share ... -

Page 117

..., the tax effect of unrealized gains and losses on securities available for sale, unrealized gains and losses on certain derivative financial instruments, and other comprehensive income related to certain employee benefit plans were recorded in other comprehensive income and had no effect... -

Page 118

... Financial Statements. Note 16 - Employee Benefit Plans SunTrust sponsors various incentive plans for eligible employees. The Management Incentive Plan for key employees provides for potential annual cash awards based on the attainment of the Company's earnings and/or the achievement of business... -

Page 119

... the Company's Board of Directors. Compensation expense related to the Management Incentive Plan and PUP for the years ended December 31, 2006, 2005 and 2004 totaled $72.6 million, $57.3 million and $55.0 million, respectively. The Company provides stock-based awards through the SunTrust Banks, Inc... -

Page 120

SUNTRUST BANKS, INC. Notes to Consolidated Financial Statements (Continued) stock options. The expected term represents the period of time that stock options granted are expected to be outstanding and is derived from historical data which is used to evaluate patterns such as stock option exercise ... -

Page 121

... to the Pension Protection Act), the plan was well funded at the beginning of 2006. SunTrust contributed $182 million to the SunTrust Retirement Plan in 2006 to maintain its well-funded position and manage costs tax-efficiently. SunTrust will continue to review the funded status of the plan and may... -

Page 122

... time. On February 16, 2007, the Company filed a Form 8-K dated February 13, 2007 announcing certain changes to the Company's pension and other postretirement benefit plans, as well as the matching contribution related to the Company's 401(k) Plan. Please refer to the Form 8-K for more information... -

Page 123

...68 % 4.50 Supplemental Retirement Benefits 2006 2005 5.68 % 4.50 5.56 % 4.50 Other Postretirement Benefits 2006 2005 5.75 % N/A 5.45% N/A Discount rate Rate of compensation increase The change in plan assets for the years ended December 31 was as follows: Retirement Benefits 2006 2005 $1,870,310... -

Page 124

...Benefit Plans is maintained separately from the strategy for the Retirement Plan. The Company's investment strategy is to create a stream of investment return sufficient to provide for current and future liabilities at a reasonable level of risk. The expected long-term rate of return on these assets... -

Page 125

SUNTRUST BANKS, INC. Notes to Consolidated Financial Statements (Continued) A contribution of $7.0 million was made on December 29, 2006 and invested in a short-term fund. Equity securities do not include SunTrust common stock for the Other Postretirement Benefit Plans. Funded Status The funded ... -

Page 126

... the Employee Retirement Income Security Act of 1974 (ERISA). The expected benefit payments for the Supplemental Retirement Plan will be paid directly from SunTrust corporate assets. The 2007 expected contribution for the Other Postretirement Benefits Plans represents the expected benefit payments... -

Page 127

...) $29,800 Supplemental Retirement Benefits $3,900 3,800 $7,700 Other Postretirement Benefits $8,800 2,300 $11,100 (Dollars in thousands) Actuarial loss Prior service (credit)/cost Transition obligation Total In addition, SunTrust sets pension asset values equal to their market value, in contrast... -

Page 128

... 25 basis point decrease in the discount rate or expected long-term return on plan assets would increase the Retirement Benefits net periodic benefit cost approximately $14 million and $6 million, respectively. Assumed healthcare cost trend rates have a significant effect on the amounts reported for... -

Page 129

...with changes in fair value recorded in noninterest income. Derivatives designated in hedging transactions are accounted for in accordance with the provisions of SFAS No. 133. The Company's derivatives are based on underlying risks primarily related to interest rates, equities, foreign exchange rates... -

Page 130

... of effectiveness. The Company maintains a risk management program to manage interest rate risk and pricing risk associated with its mortgage lending activities. The risk management program includes the use of forward contracts that are recorded in the financial statements at fair value and are used... -

Page 131

SUNTRUST BANKS, INC. Notes to Consolidated Financial Statements (Continued) changes in value of the mortgage inventory due to changes in market interest rates. A portion of the forward contracts have been documented as fair value hedges of specific pools of loans that meet the similar assets test, ... -

Page 132

...a multi-seller commercial paper conduit, Three Pillars Funding LLC ("Three Pillars"). Three Pillars provides financing for direct purchases of financial assets originated and serviced by SunTrust's corporate clients. Three Pillars finances this activity by issuing A-1/P-1 rated commercial paper. The... -

Page 133

...perform under an obligating agreement; (iii) indemnification agreements that contingently require the indemnifying party to make payments to an indemnified party based on changes in an underlying factor that is related to an asset, a liability, or an equity security of the indemnified party; and (iv... -

Page 134

...'s line of credit is also in default, the Company may take possession of the collateral securing the line of credit. Contingent Consideration The Company has contingent payment obligations related to certain business combination transactions. Payments are calculated using certain post-acquisition... -

Page 135

... Stock. SunTrust Investment Services, Inc. ("STIS") and SunTrust Capital Markets, Inc. ("STCM"), brokerdealer affiliates of SunTrust, use a common third party clearing broker to clear and execute their clients' securities transactions and to hold clients' accounts. Under their respective agreements... -

Page 136

...905 1,634,097 Financial assets Cash and short-term investments Trading assets Securities available for sale Loans held for sale Loans, net Mortgage servicing rights Financial liabilities Consumer and commercial deposits Brokered deposits Foreign deposits Short-term borrowings Long-term debt Trading... -

Page 137

... sales in larger metropolitan markets). Clients are serviced through an extensive network of traditional and in store branches, ATMs, the Internet and the telephone. The Commercial line of business provides enterprises with a full array of financial products and services including commercial lending... -

Page 138

... Management line of business. The sale was part of an effort by the Company to modify its business mix to focus on its high-growth core business lines and market segments. See Note 2, "Acquisitions/Dispositions," to the Consolidated Financial Statements for additional details. The Mortgage line... -

Page 139

..., INC. Notes to Consolidated Financial Statements (Continued) below disclose selected financial information for SunTrust's reportable segments for the years ended December 31, 2006, 2005, and 2004. Twelve Months Ended December 31, 2006 Corporate and Investment Banking $23,967,653 7,901,335 $202,909... -

Page 140

... for sale securities Unrealized gain/(loss) on derivative financial instruments Employee benefit plans Total accumulated other comprehensive income Note 24 - Other Noninterest Expense Other noninterest expense in the Consolidated Statements of Income includes: (Dollars in thousands) Twelve Months... -

Page 141

... Only Twelve Months Ended December 31 (Dollars in thousands) Income From subsidiaries: Dividends - substantially all from SunTrust Bank Interest on loans Other income Total income Expense Interest on short-term borrowings Interest on long-term debt Employee compensation and benefits Service fees to... -

Page 142

SUNTRUST BANKS, INC. Notes to Consolidated Financial Statements (Continued) Balance Sheets - Parent Company Only December 31 (Dollars in thousands) 2006 2005 Assets Cash in subsidiary banks Interest-bearing deposits in other banks Trading assets Securities available for sale Loans to subsidiaries ... -

Page 143

... of long-term debt Repayment of long-term debt Proceeds from the exercise of stock options Proceeds from the issuance of preferred stock Acquisition of treasury stock Excess tax benefits from stock option compensation Common and preferred dividends paid Net cash (used in)/provided by financing... -

Page 144

... and forms, and such information is accumulated and communicated to management to allow timely decisions regarding required disclosures. Changes in Internal Control over Financial Reporting Management of the Company has evaluated, with the participation of the Company's Chief Executive Officer and... -

Page 145

... financial reporting. CEO and CFO Certifications The Company's Chief Executive Officer and Chief Financial Officer have filed with the Securities and Exchange Commission the certifications required by Section 302 of the Sarbanes-Oxley Act of 2002 as Exhibits 31.1 and 31.2 to the Company's 2006 Form... -

Page 146

...April 17, 2007 and to be filed with the Commission is incorporated by reference into this Item 13. Item 14. Principal Accountant Fees and Services The information at the captions "Audit Fees and Related Matters" - "Audit and Non-Audit Fees" and "Audit Committee Policy for Pre-approval of Independent... -

Page 147

... 4.2 to the Registration Statement on Form S-4 of National Commerce Bancorporation (File No. 333-29251). Form of Guarantee Agreement entered into by National Commerce Financial Corporation and The Bank of New York, as Guarantee Trustee, and registered under the Securities Act of 1933, as amended... -

Page 148

... to Exhibit 9 to the Registrant's Registration Statement on Form 8-A filed on October 1, 2004. Assignment and Assumption Agreement dated September 22, 2004 between National Commerce Financial Corporation and SunTrust Banks, Inc. (Trust Agreement dated December 14, 2001), incorporated by reference to... -

Page 149

... by reference to Exhibit 10.2 to Registrant's Current Report on Form 8-K/A filed January 12, 2006. SunTrust Banks, Inc. Executive Stock Plan, incorporated by reference to Exhibit 10.16 to Registrant's 1998 Annual Report on Form 10-K (File No. 001-08918). * 10.2 * 10.3 * 10.4 * 10.5 * 10... -

Page 150

... to Performance Stock Agreement effective February 10, 1998, incorporated by reference to Exhibit 10.10 to Registrant's 2003 Annual Report on Form 10-K. SunTrust Banks, Inc. 1995 Executive Stock Plan, incorporated by reference to Exhibit 10.16 to Registrant's 1999 Annual Report on Form 10-K (File No... -

Page 151

... Deferred Compensation Program Under Incentive Compensation Plan of Crestar Financial Corporation and Affiliated Corporations, incorporated by reference to Exhibit 10.34 to Registrant's 1998 Annual Report on Form 10-K (File No. 00108918). Crestar Financial Corporation Deferred Compensation Plan for... -

Page 152

...effective October 23, 1998) to Crestar Financial Corporation Directors' Equity Program, incorporated by reference to Exhibit 10.44 to Registrant's 1999 Annual Report on Form 10-K (File No. 001-08918). Lighthouse Mortgage Corporation 1994 Stock Option Plan, incorporated by reference to Exhibit 4.1 to... -

Page 153

... Deferred Compensation Agreement as of December 1, 1983, with Thomas M. Garrott, III, incorporated by reference to Exhibit 10c(2) to CCB Corporation's Form 10-K for the year ended December 31, 1984 (File No. 06094). 2003 Stock Incentive Plan of National Commerce Financial Corporation, and amendments... -

Page 154

... 2007. Amendment, dated December 31, 2004, to National Commerce Financial Corporation Supplemental Executive Retirement Plan, incorporated by reference to Exhibit 10.2 of Registrant's Current Report on Form 8-K filed February 11, 2005. National Commerce Financial Corporation Director's Fees Deferral... -

Page 155

... subsidiaries and any of its unconsolidated subsidiaries for which financial statements are required to be filed under which the total amount of debt securities authorized does not exceed ten percent of the total assets of Registrant and its subsidiaries on a consolidated basis. * incorporated... -

Page 156

... Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. SUNTRUST BANKS, INC. By: /s/ James M. Wells III James M. Wells III President and Chief Executive Officer Dated: March 1, 2007 POWER OF ATTORNEY... -

Page 157

... Williams /s/ Dr. Phail Wynn, Jr. Dr. Phail Wynn, Jr. 3/01/2007 Date 3/01/2007 Date 3/01/2007 Date 3/01/2007 Date 3/01/2007 Date 3/01/2007 Date 3/01/2007 Date 3/01/2007 Date 3/01/2007 Date 2/13/2007 Date Title Director Director Director Director Director Director Director Director Director Director... -

Page 158

..., contact: Greg Ketron Director of Investor Relations 404.827.6714 For information online, visit suntrust.com: • 2006 Annual Report (including select information translated in Spanish) • Quarterly earnings releases • Press releases WEB SITE ACCESS TO UNITED STATES SECURITIES AND EXCHANGE... -

Page 159

SUNTRUST BANKS, INC. 303 PEACHTREE STREET, ATLANTA, GA 30308