Chrysler 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REPORT ON

OPERATIONS

94

SHARE-BASED

INCENTIVE PLANS

On 3 November 2006, the Fiat S.p.A. Board of Directors approved (subject to the final approval of Shareholders at the General Meeting of 5 April 2007)

an eight-year stock option plan, which provided certain managers of the Group and the Fiat S.p.A. Chief Executive Officer with the right to purchase a set

number of Fiat S.p.A. ordinary shares at the fixed price of €13.37 per share. In particular, the 10,000,000 options granted to employees and the 5,000,000

options granted to the Chief Executive Officer had a vesting period of four years, with a quarter of the number vesting each year, were subject to achieving

certain pre-determined profitability targets (Non-Market Conditions or “NMC”) in the reference period and were exercisable from the date on which the

2010 Financial statements are approved. The remaining 5,000,000 options granted to the Chief Executive Officer of Fiat S.p.A. also had a vesting period

of four years with a quarter of the number vesting each year and are exercisable from November 2010. Exercise of the options was also subject to specific

restrictions regarding the duration of the employment relationship or the continuation of the position held. The Board also exercised its powers under Article

2443 of the Civil Code to issue new shares, in service of the incentive plan, to employees of the Company and/or its subsidiaries up to 1% of share capital or

a maximum of €50,000,000 (€35,000,000 following the Demerger) in the form of 10,000,000 ordinary shares having a par value of €5.00 (€3.50 following

the Demerger) each, representing 0.78% of total share capital or 0.92% of ordinary share capital, at a price of €13.37 each. Execution of the capital increase

is subject to the conditions of the Plan being satisfied.

On the basis of amendments to the stock option plans introduced in relation to the Demerger, the vesting conditions of each stock plan, whether they

consisted in the continuation of a professional relationship with the Fiat Group or the achievement of specific performance targets, expired on 31 December

2010. With specific reference to options granted under the 2006 Stock Option Plan, for which vesting was subject to the achievement of pre-established

profitability targets, only the first tranche (i.e., 25%) of those rights vested as the profitability targets established in 2006 for the 3-year period 2008-2010

were not met. As a result, the remaining 75% did not vest.

On 26 February 2008, the Board of Directors of Fiat S.p.A. approved an incentive plan, authorized by Shareholders on 31 March 2008, which allowed for

the periodic granting of a maximum 4 million stock options and/or stock appreciation rights until the end of 2010. This plan was intended for managers

hired or promoted subsequent to the stock option plan established on 3 November 2006, or who, in any event, warranted additional recognition, and it was

structured similar to the 2006 plan in terms of profitability targets, vesting and exercise. On 23 July 2008, the Board of Directors, in execution of that plan,

voted to grant 1,418,500 stock options at an exercise price of €10.24. The plan did not vest as the profitability targets established for the 3-year period

2008-2010 were not met.

On 23 February 2009, the Board of Directors of Fiat S.p.A. approved an incentive plan, which was subsequently approved by Shareholders at the Annual

General Meeting of 27 March 2009, based on the granting of rights that, subject to achievement of pre-determined performance targets (Non-Market

Conditions or “NMC”) for 2009 and 2010 and continuation of a professional relationship with the Group, entitled the CEO of Fiat S.p.A. to receive a total of

2 million ordinary shares. Vesting was in a single tranche upon approval of the 2010 consolidated financial statements by the Board and the number of shares

granted equivalent to 25% of the rights allocated for achievement of the 2009 targets and 100% of the rights allocated for achievement of the 2010 targets.

The Group profitability targets for 2009 were reached. At the proposal of the Board, on 26 March 2010 Shareholders introduced a loyalty only component for

an additional 2 million rights, the vesting of which was subject solely to continuation of a professional relationship with the Group at the date of approval of the

2011 financial statements. In addition, the original duration of the Plan was extended to the date of approval of the 2011 financial statements and the targets

for 2010 and 2011 were reset. On 18 February 2011, the Board of Directors, having consulted the Compensation Committee, verified the vesting of 375,000

rights based on the achievement of the predetermined operating targets and, in light of the extraordinary transactions occurring during the year, also voted to

make vesting of the remaining rights, which was dependent on the achievement of 2011 operating targets, subject only to the continuation of a professional

relationship with the Group until the end of 2011. As stated previously, following the Demerger, the stock grant plan will entitle beneficiaries to receive one

Fiat ordinary share and one Fiat Industrial ordinary share for every stock grant right held, with all other conditions of the plan remaining unchanged.

The stock grant plan is to be serviced through shares bought on the market rather than through the issue of new shares.

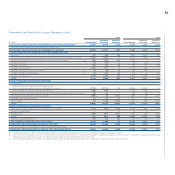

Detailed information on all Plans is also available in the notes to both the consolidated and parent company financial statements.