Chrysler 2010 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2010 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

225

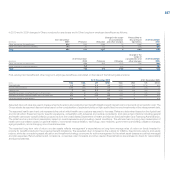

Stock option plan linked to Ferrari S.p.A. ordinary shares

Under this scheme, certain employees of Ferrari S.p.A. on the one hand and the Chairman and the Chief Executive Officer of the company at the time on the

other had the option to acquire respectively 207,200 and 184,000 Ferrari S.p.A. ordinary shares at a price of €175 per share. Under the scheme the options

could be exercised until 31 December 2010, wholly or partially, and in part were subject to the listing of the company. As the conditions for the plans to vest

were not met, the stock option rights granted did not vest.

Cash-settled share-based payments

Various entities belonging to the former joint venture with General Motors reached agreements with certain employees in 2001, 2002, 2003 and 2004 over

four cash-settled share-based payment schemes entitled Stock Appreciation Rights (SAR) plans. Under these plans, certain of the employees involved

had the right to receive a payment corresponding to the increase in price between the grant date and the exercise date of Fiat S.p.A. ordinary shares.

The 2001 and 2002 plans have already expired. In accordance with IFRS 2, the Group measures the liability arising from cash-settled share-based payment

transactions at fair value at each reporting date and each settlement date; the changes in the fair value of these liabilities are recognised in the income

statement for the period. With reference to the 70,644 rights outstanding at that date, the liability arising at 31 December 2010 was €0.7million (€0.5 million

at 31 December 2009). Moreover, 30,192 rights that were still outstanding at 31 December 2010 were no longer so at the date of these financial statements

following the expiry of the 2003 plan. Finally, as a consequence of the Demerger, the residual Stock Appreciation Rights were converted to the right to

receive a payment corresponding to the increase in price between the grant date and the exercise date of the sum of the prices of the Fiat S.p.A. and Fiat

Industrial S.p.A. ordinary shares.

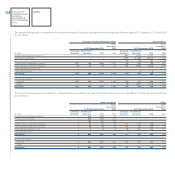

24. Provisions for employee benefits

Group companies provide post-employment benefits for their active employees and for retirees, either directly or by contributing to independently

administered funds. The way these benefits are provided varies according to the legal, fiscal and economic conditions of each country in which the Group

operates, the benefits generally being based on the employees’ remuneration and years of service.

Group companies provide post-employment benefits under defined contribution and/or defined benefit plans.

In the case of defined contribution plans, the Group pays contributions to publicly or privately administered pension insurance plans on a mandatory,

contractual, or voluntary basis. Once the contributions have been paid, the Group has no further payment obligations. The entity recognise the contribution

cost when the employee has rendered his service and includes this cost by function in Cost of sales, Selling, general and administrative costs and Research

and development costs. In 2010 expenses of this nature included in Profit/(loss) from Continuing Operations totalled €937 million (€984 million in 2009),

while those included in Profit/(loss) from Discontinued Operations totalled €443 million (€396 million in 2009).

Defined benefit plans may be unfunded, or they may be wholly or partly funded by contributions made by an entity, and sometimes by its employees, into an

entity, or fund, that is legally separate from the employer and from which the employee benefits are paid. Benefits are generally payable under these plans

after the completion of employment. The plans are classified by the Group on the basis of the type of benefit provided as follows: Reserve for Employee

leaving entitlements in Italy (TFR), Pension plans, Health care plans and Other.

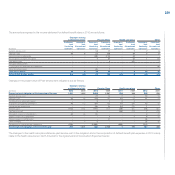

Reserve for Employee leaving entitlements in Italy (“TFR”)

The TFR consists of the residual obligation for employee leaving entitlement which was required until 31 December 2006 under Italian legislation to be

paid to employees of Italian companies with more than 50 employees when leaving the company, and accrued over the employee’s working life for other

companies. This provision is settled to retiree employees and may be partially paid in advance if certain conditions are met. This is an unfunded defined

benefit post-employment plan.

Pension plans

The item Pension plans consists principally of the obligations of Group companies operating in the United States (mainly to those in the CNH – Case New

Holland sector) and in the United Kingdom towards certain employees and former employees of the Group.

Under these plans, a contribution is generally made to a separate fund (trust) which independently administers the plan assets. The Group’s funding policy

is to contribute amounts to the plan equal to the amounts required to satisfy the minimum funding requirements prescribed by the laws and regulations of

each individual country. Prudently, the Group makes discretionary contributions in addition to the funding requirements. If these funds are overfunded, that

is if they present a surplus compared to the requirements of law, the Group companies concerned could not be required to contribute to the plan in respect

of a minimum performance requirement as long as the fund is in surplus.