Chrysler 2010 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2010 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LETTER FROM

THE CHAIRMAN

AND THE CHIEF

EXECUTIVE

OFFICER

6

LETTER FROM THE CHAIRMAN

AND THE CHIEF EXECUTIVE OFFICER

Dear Shareholders,

2010 got off to a difficult start, with the previous year’s problems and uncertainties still in evidence and many of our markets not showing signs of significant recovery from the crisis.

The prospects became progressively more positive as the year unfolded and several of our trading regions exhibited a significant recovery, although most of them performed well

below pre-crisis levels.

Trading conditions improved for all of our businesses with the exception of Automobiles, where performance was impacted by the phasing out in many European countries of the

eco-incentives that had underpinned demand in 2009, particularly in the smaller car segments.

In this very uneven market environment, Fiat responded effectively and decisively.

We continued to hold the line on costs with rigorous measures, while taking advantage of the economic recovery from the very early stages.

This was made possible by the international reach of our industrial and commercial operations, which enabled us to minimize inefficiencies in some areas while delivering optimal

performance in others. This, in essence, is the real strength of our Group today.

A global and open attitude that doesn’t shrink away from adversity, but rather responds to challenges with determination and leverages the opportunities that present themselves.

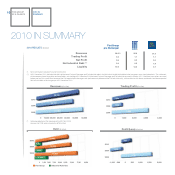

As a result, we closed 2010 significantly ahead of the targets we had set for ourselves at the beginning of the year.

Revenues were up more than 12% to €56 billion, trading profit doubled to €2.2 billion and the bottom line was once again positive at €600 million.

Cash generation was strong, with net industrial debt totaling €2.4 billion, a reduction of €2.0 billion from the previous year driven by strong performance for all businesses and

continued disciplined working capital management. Liquidity was strengthened to nearly €16 billion.

These achievements were only made possible by the energy, commitment and dedication of the people at Fiat, who actively engaged in containing the impact of the crisis and seized

every opportunity presented by the subsequent recovery.

We thank all the men and women at Fiat around the world for what they contribute professionally and personally to the Group’s growth and resilience.

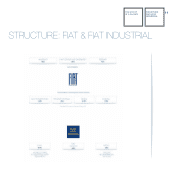

These results were achieved in a year which also saw the execution of a historic decision that has changed the shape of Fiat forever: the demerger of the Group, with effect from the

1st of January 2011, into two distinct entities – Fiat and Fiat Industrial.

Keeping together businesses that have common historical roots, but which, as a result of market developments over time, ended up having few economic or industrial characteristics

in common is an outdated concept. Preserving it ran the risk of restricting the growth potential of these businesses.

Given the enormity and speed of changes taking place in the market, we could no longer afford to look at these businesses in purely historic terms.

Today’s challenges are far greater and more complex, and a pattern-shifting, liberating strategic solution was necessary.

From a financial and industrial perspective, this is the solution that guarantees each business the greatest potential for development.

This decision responds to the imperative for growth, autonomy and efficiency.

Fiat and Fiat Industrial now have significant freedom of movement, including the potential for pursuing opportunities to form alliances, unhindered by the burden of an unrelated

business’ strategic limitations.

Each group can now focus on its core business, with well-defined objectives that are not only clearly understandable to the market, but also allow these organizations to view

themselves and develop their strategies in pure competitive terms against a well-defined cluster of competitors.

Each has a well-defined operating profile, enabling it to fully demonstrate an intrinsic value that risked being only partially realized in their conglomerate form.

This was a complex and ambitious transaction that has opened the door to a new future, a different and better future for our respective businesses.

Before committing to this transaction, we also considered one of its most sensitive aspects, the notion that Fiat would lose its identity as a Group – a group that has existed and

operated as a single entity for more than a century.

The truth of the matter is that an organization’s identity is not in its name.

Its identity comes from those who are part of it at a precise moment in time and for a precise objective.

The better way to understand the value of this demerger is to consider the opportunities for personal growth that it offers our people.

Throughout its history, Fiat has developed people of the highest calibre, not just in terms of their professional and technical abilities, but most importantly their competitive spirit and

leadership abilities.

These qualities are invaluable to the development of a company and have been fully preserved in the demerger process: they are the best guarantee for the future of Fiat and Fiat

Industrial.

The demerger also relied on a significant program that, although started in 2009, began taking visible form during 2010. We took several significant steps forward in our partnership

with Chrysler which has brought Fiat the opportunity to become a full-line automaker, expand its geographic footprint and reach the critical mass necessary to achieve the required

economies of scale to make it a long-term viable global carmaker.

On the industrial side, the process to share platforms and engine technologies is moving ahead rapidly. On the commercial side, we have begun the reorganization and integration of

commercial networks. As a first step, the Chrysler and Lancia distribution networks in Europe are being merged. And we unveiled the Fiat 500 at the Los Angeles Auto Show, marking

the brand’s return to North America after an absence of 27 years.