Chrysler 2010 Annual Report Download - page 244

Download and view the complete annual report

Please find page 244 of the 2010 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

243

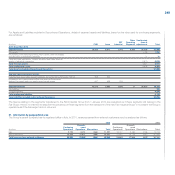

During 2010, the Group has recorded costs for lease payments of €48 million in Profit/(loss) from Continuing Operations, and of €45 million in Profit/(loss)

from Discontinued Operations. During 2009, the Group recorded costs for lease payments of €107 million.

Contingent liabilities

As a global company with a diverse business portfolio, the Group is exposed to numerous legal risks, particularly in the areas of product liability, competition

and antitrust law, environmental risks and tax matters. The outcome of any current or future proceedings cannot be predicted with certainty. It is therefore

possible that legal judgments could give rise to expenses that are not covered, or not fully covered, by insurers’ compensation payments and could affect

the Group’s financial position and results. At 31 December 2010, contingent liabilities estimated by the Group in connection with Continuing Operations

amount to approximately €131 million (approximately €111 million at 31 December 2009), for which no provisions have been recognised since an outflow

of resources is not considered to be probable. Furthermore, contingent assets and expected reimbursement in connection with these contingent liabilities

for approximately €17 million (€20 million at 31 December 2009) have been estimated but not recognised. With respect to Discontinued Operations,

at 31 December 2010 contingent liabilities estimated by the Group amount to approximately €36 million for which no provisions have been recognised since

an outflow of resources is not considered to be probable.

Instead, when it is probable that an outflow of resources embodying economic benefits will be required to settle obligations and this amount can be reliably

estimated, the Group recognises specific provisions for this purpose.

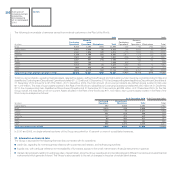

Furthermore, in connection with significant asset divestitures carried out in prior years, the Group provided indemnities to purchasers with the maximum

amount of potential liability under these contracts generally capped at a percentage of the purchase price. These liabilities, all relating to Continuing

Operations, refer principally to potential liabilities arising from possible breaches of representations and warranties provided in the contracts and, in certain

instances, environmental or tax matters, generally for a limited period of time. At 31 December 2010, potential obligations with respect to these indemnities

were approximately €859 million (approximately €879 million at 31 December 2009). Against these obligations, provisions of €60 million (€52 million

31 December 2009) have been made which are classified as Other provisions. The Group has provided certain other indemnifications that do not limit

potential payment; it is not possible to estimate a maximum amount of potential future payments that could result from claims made under these indemnities.

The question relating to the participation of certain Fiat Group companies, belonging to the CNH and Iveco sectors, in the Oil-for-Food program was

concluded in 2008 through two settlement agreements signed with the SEC and US Department of Justice (DOJ). The Fiat Group closed the matter with

these authorities by executing a settlement agreement in 2008. This settlement agreement with the DOJ requires the Fiat Group (and, after the Demerger,

the Fiat Industrial Group) to satisfy certain obligations such as continuing its cooperating with the DOJ and maintaining an adequate Foreign Corrupt

Practices Act prevention program.

Since January 2011, Iveco is subject to an investigation being conducted by the European Commission into certain business practices of the leading

manufacturers of commercial vehicles in the European Union in relation to possible anti-competitive behaviour. The investigation covers several Member

States of the European Union. The Group is cooperating fully with the European Commission and, since the investigation is at a very preliminary stage, it is

not possible to assess the effects that the investigation may have on the Group, if any.

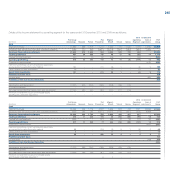

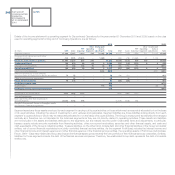

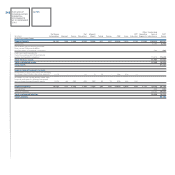

30. Segment reporting

The operating segments through which the Group carries out its activities are based on the internal reporting used by the Group’s Chief Executive Officer

to make strategic decisions.

As a result of the Demerger, described earlier, segment reporting disclosures are set out for Continuing Operations and then separately for Discontinued

Operations in order to reflect the Group’s new organisational structure. In addition, following the inclusion of the Industrial & Marine operations of the

FPT Powertrain Technologies sector in Discontinued Operations, starting from these financial statements this sector is no longer reported as a whole,

in accordance with IFRS 8 - Operating Segments, while the Fiat Powertrain sector, which includes the Passengers & Commercial Vehicles line of business,

and the FPT Industrial sector, which includes the Industrial & Marine line of business, are presented separately in Continuing Operations and Discontinued

Operations, respectively.

The reporting used in the preparation of this Note, which reflects the Group’s current organisational structure, is broken down by the various products and

services offered by the Group and prepared in accordance with the accounting policies described under Significant Accounting Policies above.