Travelers 2004 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In July 2002, concurrent with the issuance of 17.8 million of SPC common shares in a public offering, SPC

issued 8.9 million equity units, each having a stated amount of $50, for gross consideration of $443 million. Each

equity unit initially consists of a forward purchase contract for the Company’s common stock (maturing in

August 2005), and an unsecured $50 senior note of the Company (maturing in 2007). Total annual distributions

on the equity units are at the rate of 9.00%, consisting of interest on the note at a rate of 5.25% and fee payments

under the forward contract of 3.75%. The forward contract requires the investor to purchase, for $50, a variable

number of shares of the Company’s common stock on the settlement date of August 16, 2005. The number of

shares to be purchased will be determined based on a formula that considers the average closing price of the

Company’s stock on each of 20 consecutive trading days ending on the third trading day immediately preceding

the settlement date, in relation to the $24.20 per share price of common stock at the time of the offering. Had the

settlement date been December 31, 2004, the Company would have issued approximately 15 million common

shares based on the average closing price of the Company’s common stock immediately prior to that date.

Holders of the equity units have the opportunity to participate in a required remarketing of the senior note

component. The initial remarketing date is May 11, 2005. The interest rate on the senior notes will be reset on the

date of the remarketing and they will bear interest from the date of the settlement of the successful remarketing at

the reset rate.

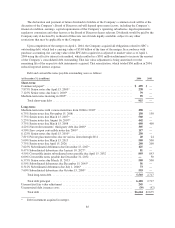

The Company currently intends to refinance certain maturing debt in 2005, including the $238 million of

7.875% senior notes due April 15, 2005, the $79 million of 7.125% senior notes due June 1, 2005, and a portion

of the medium term notes with maturities in 2005.

Line of Credit Agreements. Effective April 17, 2003, TPC entered into the following line of credit

agreements with Citibank, a subsidiary of Citigroup, TPC’s former parent: (i) a $250 million 45-month revolving

line of credit (the 45-Month Line of Credit), and (ii) a $250 million 364-day revolving line of credit (the TPC

364-Day Line of Credit and, together with the 45-Month Line of Credit, the TPC Lines of Credit). TPC may,

with Citibank’s consent, extend the commitment of the 364-day Line of Credit for additional 364-day periods

under the same terms and conditions. TPC has the option, provided there is no default or event of default, to

convert outstanding advances under the 364-Day Line of Credit at the commitment termination date to a term

loan maturing no later than one year from the commitment termination date.

Prior to the merger, SPC was party to the following line of credit agreements with a syndicate of banks: (i) a

$330 million 364-day revolving line of credit (the SPC 364-Day Line of Credit), and (ii) a $270 million 5-year

revolving line of credit (the 5-Year Line of Credit and, together with the SPC 364-Day Line of Credit, the SPC

Lines of Credit). SPC may, with bank syndicate consent, extend the commitment of the SPC 364-day Line of

Credit for additional 364-day periods under the same terms and conditions.

As a result of the expiration of the SPC 364-Day Line of Credit and the TPC 364-Day Line of Credit, the

Company entered into a new $480 million 364-day revolving line of credit agreement (the STA 364-Day Line of

Credit) with a syndicate of banks. As of December 31, 2004, the Company has access to the following bank

credit lines: (i) the $250 million 45-Month Line of Credit, (ii) the $270 million 5-Year Line of Credit, and (iii)

the $480 million STA 364-Day Line of Credit (collectively, the Company Line of Credit).

Borrowings under the Company Line of Credit may be made, at the Company’s option, at a variable interest

rate equal to either the lender’s base rate plus an applicable margin or at LIBOR plus an applicable margin. The

Company Line of Credit includes a commitment fee and, for any date on which advances exceed 50% of the total

commitment for each line of credit, a utilization fee. The applicable margin and the rates on which the

commitment fee and utilization fee are based vary based upon the Company’s long-term senior unsecured non-

credit-enhanced debt ratings.

87