Travelers 2004 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

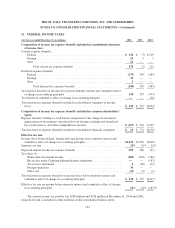

11. FEDERAL INCOME TAXES, Continued

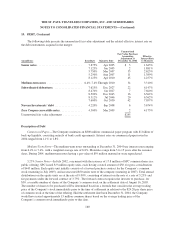

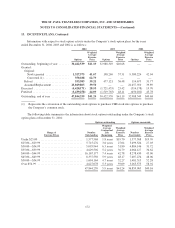

The net deferred tax asset comprises the tax effects of temporary differences related to the following assets

and liabilities:

(at December 31, in millions) 2004 2003

Deferred tax assets

Claims and claim adjustment expense reserves ...................................... $1,751 $ 947

Net operating loss carryforward .................................................. 731 —

Unearned premium reserves ..................................................... 651 432

Other ....................................................................... 842 204

Total gross deferred tax asset ............................................ 3,975 1,583

Less valuation allowance ................................................... 128 —

Net deferred tax asset .................................................. 3,847 1,583

Deferred tax liabilities

Deferred acquisition costs ....................................................... 493 337

Investments .................................................................. 635 522

Intangible assets .............................................................. 381 —

Other ....................................................................... 327 46

Total gross deferred tax liabilities ......................................... 1,836 905

Total deferred income taxes ............................................. $2,011 $ 678

If the Company determines that any of its deferred tax assets will not result in future tax benefits, a

valuation allowance must be established for the portion of these assets that are not expected to be realized. The

net change in the valuation allowance for deferred tax assets was an increase of $128 million in 2004 relating to

foreign operations. Based predominantly upon a review of the Company’s anticipated future taxable income, but

also including all other available evidence, both positive and negative, the Company’s management concluded

that it is “more likely than not” that the net deferred tax assets will be realized.

At December 31, 2002, the Company had a net operating loss (NOL) carryforward of $1.39 billion. Under

the terms of the tax sharing agreement with Citigroup, the Company is entitled to carry operating losses back to

prior years upon receiving Citigroup’s consent. During the first quarter of 2003, the Company received

Citigroup’s consent and, as a result, the Company’s deferred tax asset was reduced by $487 million with a

corresponding reduction to the current federal income tax payable (included in other cash flows from operating

activities in the consolidated statement of cash flows). On June 9, 2003, the Company received a federal income

tax refund of $531 million, which included the utilization of the NOL carryforward.

For the period ending March 27, 2002, the Company was included in the consolidated federal income tax

return filed by Citigroup. Citigroup allocated federal income taxes to its subsidiaries on a separate return basis

adjusted for credits and other amounts required by the consolidation process. Any resulting liability was paid

currently to Citigroup. Any credit for losses was paid by Citigroup currently to the extent that such credits were

for tax benefits that have been utilized in the consolidated federal income tax return.

As of March 28, 2002, as a result of the IPO, the Company is no longer included in the Citigroup

consolidated federal income tax return. As of that date, the Company began filing its own consolidated federal

income tax return. The Company’s intercompany tax sharing agreement was amended to include the SPC

companies effective with their acquisition on April 1, 2004.

165