Travelers 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

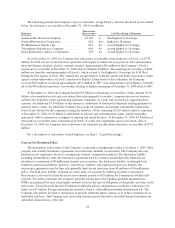

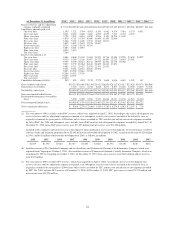

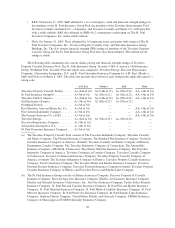

The following presents the Company’s top five reinsurers, except Lloyd’s, which is discussed in more detail

below, by reinsurance recoverables at December 31, 2004 (in millions):

Reinsurer

Reinsurance

Recoverables A.M. Best Rating of Reinsurer

American Re-Insurance Company ............ $1,198 A third highest of 16 ratings

General Reinsurance Corporation ............. 826 A++ highest of 16 ratings

XL Reinsurance America Inc. ................ 613 A+ second highest of 16 ratings

Transatlantic Reinsurance Company .......... 604 A+ second highest of 16 ratings

Swiss Reinsurance America Corporation ....... 493 A+ second highest of 16 ratings

As of December 31, 2004, the Company had reinsurance recoverables from syndicates at Lloyd’s of $738

million. In 1996, Lloyd’s restructured its operations with respect to claims for years prior to 1993 and reinsured

these into Equitas Limited, which is currently unrated. Approximately $90 million of the Company’s Lloyd’s

reinsurance recoverables at December 31, 2004 relates to Equitas liabilities. The remaining recoverables of $648

million are from the continuing market of Lloyd’s, which is rated A (3rd highest of 16 ratings) by A.M. Best.

During the first quarter of 2004, TPC entered into an agreement to settle all current and future reinsurance claims

against certain underwriters at Lloyd’s reinsured by Equitas. Under terms of this settlement, the Company

received $245 million, resolving approximately $255 million of TPC’s net claim balances from Equitas. Virtually

all of the $90 million reinsurance recoverables relating to Equitas remaining at December 31, 2004 relate to SPC.

At December 31, 2004, the Company had $19.05 billion in reinsurance recoverables. Of this amount, $2.50

billion is for mandatory pools and associations that relate primarily to workers’ compensation service business

and have the obligation of the participating insurance companies on a joint and several basis supporting these

cessions. An additional $3.94 billion of this amount is attributable to structured settlements relating primarily to

personal injury claims, for which the Company has purchased annuities and remains contingently liable in the

event of any defaults by the companies issuing the annuities. Of the remaining $12.61 billion ceded to reinsurers

at December 31, 2004, $1.50 billion is attributable to asbestos and environmental claims, and the remainder

principally reflects reinsurance in support of ongoing and runoff business. At December 31, 2004, $2.8 billion of

reinsurance recoverables were collateralized by letters of credit, trust agreements and escrow funds. Also at

December 31, 2004, the Company had an allowance for estimated uncollectible reinsurance recoverables of $751

million.

For a description of reinsurance related litigation, see Item 3, “Legal Proceedings.”

Current Net Retention Policy

The descriptions below relate to the Company’s reinsurance arrangements in effect at January 1, 2005. Most

property and casualty reinsurance agreements have terrorism sublimits or exclusions. The Company does not

purchase treaty reinsurance for losses arising from workers’ compensation policies. For third party liability,

including automobile no-fault, the reinsurance agreement used by Commercial and Specialty limits the net

retention to a maximum of $8 million per insured, per occurrence. For third party liability, including but not

limited to professional liability, directors’ and officers’ liability, and employment practices liability, the

reinsurance agreements used by Specialty generally limit the net retentions from $4 million to $16 million per

policy. For third party liability, National Accounts limits its exposure by utilizing facultative reinsurance.

Reinsurance is also used to limit the net retained amount per risk to $15 million for Commercial and Specialty

property. For surety protection, the Company generally retains up to $24.5 million probable maximum loss

(PML) per principal but may retain higher amounts based on the type of obligation, credit quality and other credit

risk factors. Personal retains the first $5 million of umbrella policies and purchases facultative reinsurance for

limits over $5 million. For personal property insurance, there is a $6 million maximum retention per risk. The

Company also utilizes facultative reinsurance to provide additional limits capacity or to reduce retentions on an

individual risk basis. The Company may also retain amounts greater than those described herein based upon the

individual characteristics of the risk.

18