Travelers 2004 Annual Report Download - page 149

Download and view the complete annual report

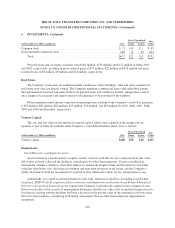

Please find page 149 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

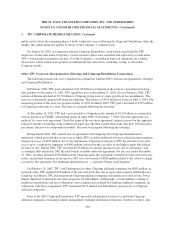

3. TPC CORPORATE REORGANIZATION

In 2002, TPC effected a corporate reorganization under which it transferred substantially all of its assets to

affiliates of its then parent company, Citigroup Inc. (together with its consolidated subsidiaries, Citigroup), other

than the capital stock of Travelers Insurance Group Holdings Inc. (TIGHI). Citigroup also assumed all of TPC’s

third-party liabilities, other than liabilities relating to TIGHI and TIGHI’s active employee. TPC then effected a

recapitalization whereby the previously outstanding shares of its common stock (1,500 shares), all of which were

owned by Citigroup, were changed into 269 million shares of class A common stock and 500 million shares of

class B common stock. Finally, TPC amended and restated its certificate of incorporation and bylaws.

As a result of these transactions, TIGHI and its property and casualty insurance subsidiaries became TPC’s

principal asset.

On March 21, 2002, TPC issued 231 million shares of its class A common stock in an initial public offering

(IPO), representing approximately 23% of TPC’s common equity. After the IPO, Citigroup beneficially owned

all of the 500 million shares of TPC’s outstanding class B common stock, each share of which is entitled to seven

votes, and 269 million shares of TPC’s class A common stock, each share of which is entitled to one vote,

representing at the time 94% of the combined voting power of all classes of TPC’s voting securities and 77% of

the equity interest in TPC. (All class A and class B share amounts presented are unadjusted for the merger of

TPC and SPC). Concurrent with the IPO, TPC issued $893 million aggregate principal amount of 4.5%

convertible junior subordinated notes which mature on April 15, 2032. The IPO and the offering of the

convertible notes are collectively referred to as the offerings.

Pursuant to TPC’s corporate reorganization, which was completed on March 19, 2002, TPC’s consolidated

financial statements were adjusted to exclude the accounts of certain formerly wholly-owned TPC subsidiaries,

principally The Travelers Insurance Company (TIC) and its subsidiaries, certain other wholly-owned

noninsurance subsidiaries of TPC and substantially all of TPC’s assets and certain liabilities not related to the

property casualty business.

Pursuant to TPC’s corporate reorganization, TPC’s consolidated financial statements included the accounts

of its primary subsidiary, TIGHI, a property casualty insurance holding company. Also included were the

accounts of CitiInsurance International Holdings Inc. and its subsidiaries (CitiInsurance), the principal assets of

which are investments in the property casualty and life operations of Fubon Insurance Co., Ltd. and Fubon

Assurance Co., Ltd., with respect to results prior to March 1, 2002.

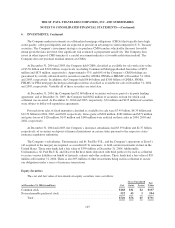

Citigroup Distribution of Ownership Interest in TPC

On August 20, 2002, Citigroup made a tax-free distribution to its stockholders (the Citigroup Distribution),

of a portion of its ownership interest in TPC, which, together with the shares issued in the IPO, represented more

than 90% of TPC’s common equity and more than 90% of the combined voting power of TPC’s outstanding

voting securities. For each 100 shares of Citigroup outstanding common stock, approximately 4.32 shares of TPC

class A common stock and 8.88 shares of TPC class B common stock were distributed. At December 31, 2004,

Citigroup held for its own account approximately 6.50% of the Company’s outstanding common stock. At

December 31, 2003 and 2002, Citigroup held for its own account 9.87% and 9.95%, respectively, of TPC’s

common equity and 9.87% and 9.98%, respectively, of the combined voting power of TPC’s outstanding voting

securities. Citigroup received a private letter ruling from the Internal Revenue Service that the Citigroup

Distribution was tax-free to Citigroup, its stockholders and TPC. As part of the ruling process, Citigroup agreed

to vote the shares it continued to hold following the Citigroup Distribution pro rata with the shares held by the

137