Travelers 2004 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

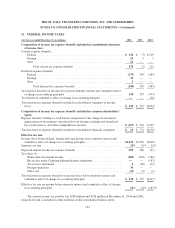

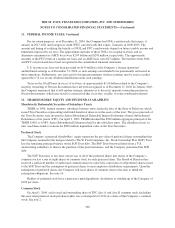

11. FEDERAL INCOME TAXES

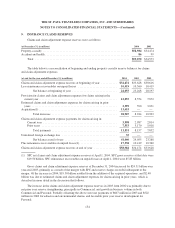

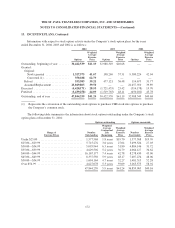

(for the year ended December 31, in millions) 2004 2003 2002

Composition of income tax expense (benefit) included in consolidated statement

of income (loss)

Current expense (benefit):

Federal ........................................................... $ 338 $ (7) $ 109

Foreign ........................................................... 26 53

State ............................................................. 14 ——

Total current tax expense (benefit) ................................. 378 (2) 112

Deferred expense (benefit):

Federal ........................................................... (275) 539 (589)

Foreign ........................................................... 34 ——

State ............................................................. 1——

Total deferred tax expense (benefit) ................................ (240) 539 (589)

Tax expense (benefit) on income (loss) before minority interest and cumulative effect

of change in accounting principles ....................................... 138 537 (477)

Tax benefit on cumulative effect of change in accounting principles ............... —— (26)

Total income tax expense (benefit) included in consolidated statement of income

(loss) ............................................................... $ 138 $ 537 $(503)

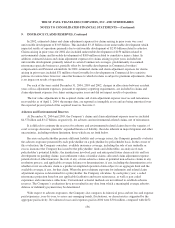

Composition of income tax expense (benefit) included in common shareholders’

equity

Expense (benefit) relating to stock-based compensation, the change in unrealized

appreciation on investments, unrealized loss on foreign exchange and unrealized

loss on derivatives, and other comprehensive income ......................... $ (117) $ 234 $ 225

Total income tax expense (benefit) included in consolidated financial statements ..... $21$ 771 $(278)

Effective tax rate

Income (loss) before federal, foreign and state income taxes, minority interest and

cumulative effect of change in accounting principles ......................... $1,128 $2,229 $(260)

Statutory tax rate ....................................................... 35% 35% 35%

Expected federal income tax expense (benefit) ................................ 395 780 (91)

Tax effect of:

Nontaxable investment income ........................................ (284) (201) (180)

Recoveries under Citigroup Indemnification Agreement .................... —— (182)

Tax reserve adjustment .............................................. 6(40) (23)

Foreign operations .................................................. 34 ——

Other, net ......................................................... (13) (2) (1)

Total income tax expense (benefit) on income (loss) before minority interest and

cumulative effect of change in accounting principles ......................... $ 138 $ 537 $(477)

Effective tax rate on income before minority interest and cumulative effect of change

in accounting principles ................................................ 12% 24% (183)%

The current income tax payable was $188 million and $226 million at December 31, 2004 and 2003,

respectively and is included in other liabilities in the consolidated balance sheet.

164