Travelers 2004 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.handling procedures, economic inflation, legal trends and legislative changes, among others. The impact of many

of these items on ultimate costs for loss and loss adjustment expenses is difficult to estimate. Loss reserve

estimation difficulties also differ significantly by product line due to differences in claim complexity, the volume

of claims, the potential severity of individual claims, the determination of occurrence date for a claim and

reporting lags (the time between the occurrence of the policyholder event and when it is actually reported to the

insurer). Informed judgment is applied throughout the process. The Company continually refines its loss reserve

estimates in a regular ongoing process as historical loss experience develops and additional claims are reported

and settled. The Company rigorously attempts to consider all significant facts and circumstances known at the

time loss reserves are established. Due to the inherent uncertainty underlying loss reserve estimates including but

not limited to the future settlement environment, final resolution of the estimated liability will be different from

that anticipated at the reporting date. Therefore, actual paid losses in the future may yield a materially different

amount than currently reserved—favorable or unfavorable.

Because establishment of loss reserves is an inherently uncertain process involving estimates, currently

established reserves may change. The Company reflects adjustments to reserves in the results of operations in the

period the estimates are changed.

A portion of the Company’s loss reserves are for asbestos and environmental claims and related litigation

which aggregated $4.57 billion at December 31, 2004. While the ongoing study of asbestos claims and associated

liabilities and of environmental claims considers the inconsistencies of court decisions as to coverage, plaintiffs’

expanded theories of liability and the risks inherent in major litigation and other uncertainties, in the opinion of

the Company’s management, it is possible that the outcome of the continued uncertainties regarding these claims

could result in liability in future periods that differs from current reserves by an amount that could be material to

the Company’s future operating results and financial condition. See the preceding discussion of Asbestos Claims

and Litigation and Environmental Claims and Litigation.

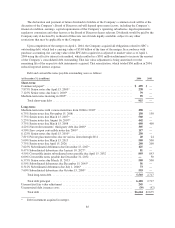

As described earlier, the Company acquired SPC’s runoff health care reserves in the merger, which are

included in the General Liability product line in the table below. SPC decided to exit this market at the end of

2001 and ceased underwriting new business as quickly as regulatory considerations allowed. SPC had

experienced significant adverse loss development on its health care loss reserves both prior to and since its

decision to exit this market. The Company continues to utilize specific tools and metrics to explicitly monitor and

validate its key assumptions supporting its conclusions with regard to these reserves. These tools and metrics

were established to more explicitly monitor and validate key assumptions supporting the Company’s reserve

conclusions since management believed that its traditional statistics and reserving methods needed to be

supplemented in order to provide a more meaningful analysis. The tools developed track three primary indicators

which influence those conclusions and include: newly reported claims; reserve development on known claims;

and the “redundancy ratio,” which compares the cost of resolving claims to the reserve established for that

individual claim. These three indicators are related such that if one deteriorates, additional improvement on

another is necessary for the Company to conclude that further reserve strengthening is not necessary. The results

of these indicators in 2004 support the Company’s current view that it has recorded a reasonable provision for its

medical malpractice exposures as of December 31, 2004. However, the Company will take reserve actions in the

future if these indicators no longer support this view.

92