Travelers 2004 Annual Report Download - page 70

Download and view the complete annual report

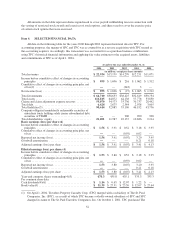

Please find page 70 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During the second quarter of 2004, the company recorded $500 million and $300 million of net unfavorable

prior year reserve development related to Specialty’s construction and surety reserves, respectively, acquired in

the merger. Upon having access to each company’s detailed policyholder information, including underwriting,

claim, and actuarial files on April 1, 2004, in connection with the closing of the merger, the Company was able to

begin the detailed process of developing a uniform and consistent approach to estimating the combined

company’s loss reserves. As part of that process, a team of actuaries representing the historical actuarial

perspectives, judgments and methods applied by each legacy company, discussed their views, methodologies,

and analysis of available data.

In addition to the discussion in the Critical Accounting Estimates section of this report, other items

specifically considered in the process of developing a uniform and consistent approach to estimating the

combined company’s loss reserves include interpreting the actuarial and claim data in a uniform manner and

determining an appropriate level of data segmentation for estimation purposes. This type of analysis involves a

high degree of judgment and can, and often does, lead to reserve estimates that differ materially from those of

prior periods, particularly in low frequency, high severity and complex exposures. In addition, since the reserving

process also considers the expectations of future outcomes, the actuaries involved had to analyze their differing

views on key assumptions, such as predicting inflation, estimating claim development patterns and determining

expectations related to judicial rulings and interpretations, among others. This “informed judgment” is brought

into the process by individuals such as actuaries, underwriters, claim adjusters, and company management.

Ultimately, this process required an analysis of the varying actuarial judgments and forward-looking

assessments. The result was similar to a single, ongoing insurance enterprise obtaining more information in a

reporting period than it had previously and identifying a change in estimate in its insurance reserves in that

period. Accordingly, the Company recorded a $500 million and $300 million charge for construction and surety,

respectively, in the second quarter of 2004.

Additional information on the analysis performed is included in the Specialty segment discussion below.

In June of 2004, the Company decided to commute certain reinsurance agreements with a major reinsurer

resulting in a $113 million prior year reserve charge (in addition to a current year loss of $40 million).

Commutations are a complete and final settlement with a reinsurer that results in a discharge of all obligations of

the parties to the terminated reinsurance agreement. The Company also recorded a charge of $252 million related

to a specific construction contractor as described in the Specialty segment discussion.

Other items increasing the 2004 claims and expenses compared to 2003 include $296 million of charges to

increase the allowances for estimated amounts due from reinsurance recoverables, policyholders receivables, and

co-surety participations on a specific construction contractor claim. The increase in the allowance for

uncollectible reinsurance recoverables recognized a change in estimated disputes with reinsurers and is based

upon the Company’s reinsurance strategy of reduced reinsurance utilization, including the cessation of ongoing

business relationships with certain of SPC’s reinsurers, and aggressive collection of reinsurance recoverables. A

provision was also made to increase the estimated uncollectible amounts due from policyholders for loss

sensitive business (primarily high deductible business). This increase recognized a change in estimated

uncollectible amounts due and resulted from applying the Company’s credit based methodology for determining

uncollectible amounts to the recoverables acquired in the merger. Because reinsurance recoverables and amounts

due from policyholders for loss sensitive business are insurance contract-related assets, these assets are subject to

the same types of estimation variables as loss reserves. Also during the second quarter of 2004, a participating

co-surety on a contract surety exposure announced that insurance regulators had approved its submitted run-off

plan. Based upon industry knowledge of the co-surety’s run-off plan and an analysis of the co-surety’s financial

condition, the Company concluded that it was unlikely to collect the full amount projected to be owed by the co-

surety and established an appropriate level of reserves.

Other 2004 claims and expenses related to the merger include $29 million of restructuring charges, $92

million of amortization expense related to finite-lived intangible assets acquired in the merger, and a benefit of

$58 million associated with the accretion of the fair value adjustment to claims and claim adjustment expenses

and reinsurance recoverables. Interest expense in 2004 included $100 million of additional interest expense on

SPC debt assumed in the merger.

58