Travelers 2004 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

losses and expenses paid in 2004 were $301 million, compared with $452 million in 2003. Approximately 22%

in 2004 and 57% in 2003 of total net paid losses relate to policyholders with whom the Company previously

entered into settlement agreements that would limit the Company’s liability. The decrease in the percentage of

net paid settlements to total paid losses in 2004 primarily reflected an increase in reinsurance billings in 2004,

which related to gross payments made in prior periods. In 2004, gross payments associated with policyholders

with settlement agreements totaled $199 million, compared with $289 million in 2003.

At December 31, 2004, net asbestos reserves totaled $3.93 billion, compared with $2.98 billion at December

31, 2003. The Company acquired $311 million of net asbestos reserves in the merger with SPC. Net incurred

asbestos losses and loss adjustment expenses totaled $928 million in 2004, driven by a $922 million provision to

strengthen reserves in the fourth quarter following completion of the Company’s annual ground-up review of

asbestos exposures. That review included an analysis of exposure and claim payment patterns by policyholder

category, as well as recent settlements, policyholder bankruptcies, state judicial rulings and legislative actions.

The $922 million provision primarily resulted from an increase in litigation costs and activity surrounding

peripheral defendants.

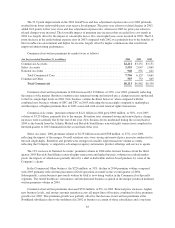

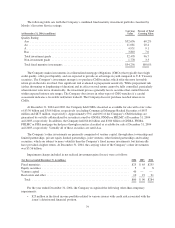

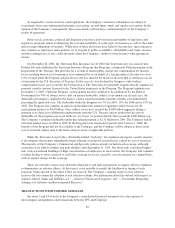

The Company categorizes its asbestos reserves as follows (the increase in policyholders in 2004 reflected

the acquisition of SPC):

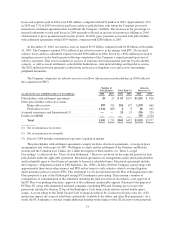

Number of

Policyholders Total Paid (1)

Asbestos

Reserves (2)

(at and for the year ended December 31, $ in millions) 2004 2003 2004 2003 2004 2003

Policyholders with settlement agreements ................. 29 23 $67 $257 $1,431 $ 826

Other policyholders with active claims:

Home office review ............................... 597 312 202 172 1,339 669

Field office review ............................... 1,324 880 8881 102

Assumed reinsurance and International (3) ................. ——24 15 526 230

Unallocated IBNR .................................... ————555 1,150

Total .......................................... 1,950 1,215 $301 $452 $3,932 $2,977

(1) Net of reinsurance recoveries

(2) Net of reinsurance recoverable

(3) Data for 2004 includes international exposures acquired in merger

The policyholders with settlement agreements category includes structured agreements, coverage in place

arrangements and, with respect to TPC, Wellington accounts and the settlement of the Statutory and Hawaii

Actions and the Common Law Claims (for a fuller description of these matters, see “Item 3—Legal

Proceedings”) (collectively the “Direct Action Settlement”). Reserves are based on the expected payout for each

policyholder under the applicable agreement. Structured agreements are arrangements under which policyholders

and/or plaintiffs agree to fixed financial amounts to be paid at scheduled times. Structured agreements include

the Company’s obligations related to PPG Industries, Inc. (PPG). In May 2002 the Company agreed along with

approximately three dozen other insurers and PPG on key terms to settle asbestos related coverage litigation

under insurance policies issued to PPG. This settlement is to be incorporated into the Plan of Reorganization (the

Plan) proposed as part of the Pittsburgh Corning (PC) bankruptcy proceeding. There remain a number of

contingencies to consummation of the settlement including the final execution of documents, court approval of

the PC Plan over pending objections, approval of the settlement and possible appeals. Pursuant to the proposed

PC Plan, PC along with enumerated affiliated companies (including PPG and Corning) are to receive the

protections afforded by Section 524(g) of the Bankruptcy Code from certain asbestos related bodily injury

claims. A recent ruling by the Third Circuit Court of Appeals in the In Re Combustion Engineering, Inc. (CE)

matter may impact the scope of relief that is potentially available to the debtor and other Plan proponents. As a

result, the PC bankruptcy court has sought additional briefing on the impact of the CE decision on the proposed

73