Travelers 2004 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company also invests much smaller amounts in equity securities, venture capital and real estate. These

investment classes have the potential for higher returns but also involve varying degrees of risk, including less

stable rates of return and less liquidity.

The primary goal of the Company’s asset liability management process is to satisfy the insurance liabilities

and manage the interest rate risk embedded in those insurance liabilities. Generally, the expected principal and

interest payments produced by the Company’s fixed income portfolio adequately fund the estimated runoff of the

Company’s insurance reserves. Although this is not an exact cash flow match in each period, the substantial

degree by which the market value of the fixed income portfolio exceeds the present value of the net insurance

liabilities provides assurance of the Company’s ability to fund the payment of claims through the sale of

securities or a restructuring of the portfolio, if necessary, without jeopardizing its asset-liability management

objectives. The Company does not believe that the impact of selling securities before anticipated or the use of

credit facilities to pay for policyholder liabilities, if necessary, would have a material impact on future liquidity

or results of operations.

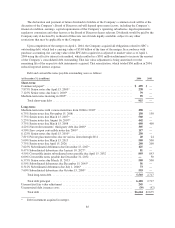

At December 31, 2004, total cash and short-term invested assets of $159 million were held at the holding

company level. These liquid assets were primarily funded by dividends received from the Company’s operating

subsidiaries. These liquid assets, combined with other sources of funds available, primarily additional dividends

from the Company’s operating subsidiaries, are considered sufficient to meet the liquidity requirements of the

Company. These liquidity requirements include primarily, shareholder dividends and debt service.

Net cash flows used in financing activities totaled $546 million, $1.10 billion and $800 million in 2004,

2003 and 2002, respectively. The 2004 outflows were primarily attributable to dividends paid to shareholders of

$642 million. Net maturities and retirements of debt, including the repurchase of CIRI’s outstanding notes,

totaled $75 million in 2004. In addition, the Company repurchased the minority interest in CIRI during the

second quarter for a total cost of $76 million.

Cash flows used in financing activities in 2003 were primarily attributable to the redemption of $900 million

aggregate principal amount of junior subordinated debt securities held by subsidiary trusts, the repayment of

$700 million of notes payable to a former affiliate and the repayment of $550 million of short-term debt. Funds

used in these repayments were primarily provided by the Company’s issuance of $1.40 billion of senior notes in

March 2003 and by cash flows provided by operating activities. These refinancing activities were initiated with

the objective of lowering the average interest rate on the Company’s total outstanding debt. Also reflected in

2003 was the issuance of $550 million of short-term Floating Rate Notes which were used to repay the $550

million Promissory Note due in January 2004. Net cash flows used in financing activities in 2003 also included

dividends paid to shareholders of $282 million. The 2002 cash flows used in financing activities reflects the

repayment of $6.35 billion of notes payable to Citigroup. These payments were partially offset by the receipt of

$4.09 billion from the first quarter 2002 initial public offering and the issuance of $917 million of convertible

notes payable.

The Company paid $636 million of common dividends in 2004, comprised of regular quarterly dividends

totaling $522 million and $114 million that had been declared by SPC prior to the merger. That amount consisted

of SPC’s regular quarterly dividend at a rate of $0.29 per share ($66 million), and a special $0.21 per share ($48

million) dividend related to the merger. The special dividend declared by SPC prior to the closing of the merger

was designed to result in the holders of SPC’s common stock prior to the merger receiving aggregate dividends

with record dates in 2004 of $1.16 per share, which was SPC’s indicated annual dividend rate prior to the merger.

On January 26, 2005, the Company’s Board of Directors declared a quarterly dividend of $0.22 per share,

payable March 31, 2005 to shareholders of record on March 10, 2005.

In 2004 and 2003, the Company acquired 0.4 million and 0.8 million shares (as adjusted for the merger),

respectively, of common stock from employees as treasury stock primarily to cover payroll withholding taxes in

connection with the vesting of restricted stock awards and exercises of stock options. In 2003, TPC repurchased

approximately 1.1 million shares (as adjusted for the merger) of common stock at a total cost of $40 million,

representing the acquisition of shares under a repurchase program that had been approved by TPC’s board of

directors. TPC’s repurchase program was terminated upon completion of the merger.

84