Travelers 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(c) The Gulf Insurance Group consists of Gulf Insurance Company and its subsidiaries, Gulf Underwriters

Insurance Company, Select Insurance Company and Atlantic Insurance Company. Gulf Insurance Company

reinsures 100% of the business of these subsidiaries. Gulf Insurance Company’s direct and assumed

insurance liabilities are guaranteed by The Travelers Indemnity Company.

(d) The Northland Pool consists of Northland Insurance Company, Northfield Insurance Company, Northland

Casualty Company, Mendota Insurance Company, Mendakota Insurance Company, American Equity

Insurance Company and American Equity Specialty Insurance Company.

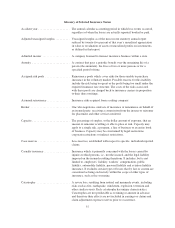

INVESTMENTS

Insurance company investments must comply with applicable laws and regulations which prescribe the kind,

quality and concentration of investments. In general, these laws and regulations permit investments in federal,

state and municipal obligations, corporate bonds, preferred and common equity securities, mortgage loans, real

estate and certain other investments, subject to specified limits and certain other qualifications.

At December 31, 2004, the carrying value of the Company’s investment portfolio was $64.71 billion, of

which 92% was invested in fixed maturity investments and short-term investments (of which 55% was invested

in federal, state or municipal government obligations), 1% in mortgage loans and real estate, 1% in common

stocks and other equity securities and 6% in other investments. The average duration of the fixed maturity

portfolio, including short-term investments, was 4.1 years at December 31, 2004. Non-investment grade

securities totaled approximately $1.78 billion, representing approximately 3% of the Company’s fixed maturity

investment portfolio as of December 31, 2004.

The following table sets forth information regarding the Company’s investments. It reflects the average

amount of investments, net investment income earned and the yield thereon. See note 6 of notes to the

Company’s consolidated financial statements for information regarding the Company’s investment portfolio.

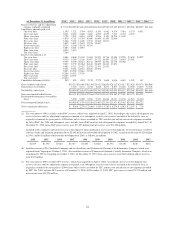

(for the year ended December 31, in millions) 2004 2003 2002

Average investments (a) .............................................. $55,334 $35,306 $32,505

Net investment income ............................................... $ 2,663 $ 1,869 $ 1,881

Average pretax yield (b) .............................................. 4.8% 5.3% 6.0%

Average pretax equivalent yield (b) ..................................... 5.6% 6.2% 6.8%

Average aftertax yield (b) ............................................ 3.7% 4.0% 4.4%

(a) Reduced by payables for securities lending and repurchase agreements, and adjusted for the impact of

unrealized investment gains and losses, receivables for investment sales and payables on investment

purchases.

(b) Excluding net realized and unrealized investment gains and losses.

DERIVATIVES

See note 16 of notes to the Company’s consolidated financial statements for a discussion of the policies and

transactions related to the Company’s derivative financial instruments.

COMPETITION

The property and casualty insurance industry is highly competitive in the areas of price, service, product

offerings, agent relationships and method of distribution, i.e., use of independent agents, exclusive agents and/or

salaried employees. According to A.M. Best, there are approximately 950 property casualty organizations in the

United States, comprising approximately 2,400 property casualty companies. Of those organizations, the top 150

accounted for approximately 92% of the consolidated industry’s total net written premiums in 2003. Several

property and casualty insurers writing commercial lines of business, including the Company, offer products for

alternative forms of risk protection in addition to traditional insurance products. These products, including large

deductible programs and various forms of self-insurance that utilize captive insurance companies and risk

retention groups, have been instituted in reaction to the escalating cost of insurance caused in part by increased

costs from workers’ compensation cases and jury awards in third-party liability cases.

27