Travelers 2004 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

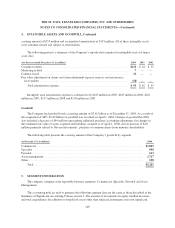

6. INVESTMENTS

Fixed Maturities

The Company’s investment portfolio includes the fixed maturities, equity securities, and other investments

acquired in the merger at their fair values as of the merger date. The fair value at acquisition became the new cost

basis for these investments.

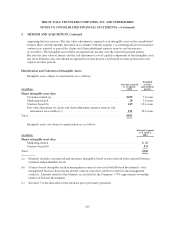

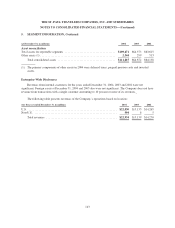

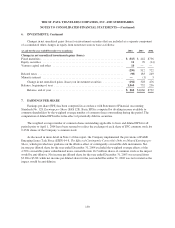

The amortized cost and fair value of investments in fixed maturities classified as available for sale were as

follows:

(at December 31, 2004, in millions)

Amortized

Cost

Gross Unrealized Fair

ValueGains Losses

Mortgage-backed securities, collateralized mortgage obligations and

pass-through securities ....................................... $ 8,543 $ 169 $ 34 $ 8,678

U.S. Treasury securities and obligations of U.S. Government and

government agencies and authorities ............................ 3,015 40 22 3,033

Obligations of states, municipalities and political subdivisions ......... 26,034 857 50 26,841

Debt securities issued by foreign governments ...................... 1,846 19 4 1,861

All other corporate bonds ...................................... 13,383 361 99 13,645

Redeemable preferred stock ..................................... 183 16 1 198

Total ................................................... $53,004 $1,462 $210 $54,256

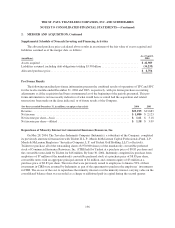

(at December 31, 2003, in millions)

Mortgage-backed securities, collateralized mortgage obligations and

pass-through securities ....................................... $ 7,498 $ 248 $ 8 $ 7,738

U.S. Treasury securities and obligations of U.S. Government and

government agencies and authorities ............................ 1,343 41 — 1,384

Obligations of states, municipalities and political subdivisions ......... 14,616 813 2 15,427

Debt securities issued by foreign governments ...................... 243 16 3 256

All other corporate bonds ...................................... 7,537 475 27 7,985

Redeemable preferred stock ..................................... 242 16 2 256

Total ................................................... $31,479 $1,609 $ 42 $33,046

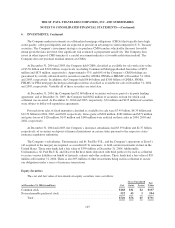

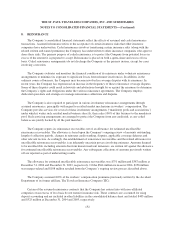

The amortized cost and fair value of fixed maturities by contractual maturity follow. Actual maturities will

differ from contractual maturities because borrowers may have the right to call or prepay obligations with or

without call or prepayment penalties.

(at December 31, 2004, in millions)

Amortized

Cost

Fair

Value

Due in one year or less ....................................................... $ 2,495 $ 2,499

Due after 1 year through 5 years ............................................... 10,607 10,772

Due after 5 years through 10 years ............................................. 14,345 14,730

Due after 10 years .......................................................... 17,014 17,577

44,461 45,578

Mortgage-backed securities ................................................... 8,543 8,678

Total ................................................................. $53,004 $54,256

144