Travelers 2004 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.loss and loss expense experience as a result of the exhaustion or unavailability due to insolvency of other

insurance potentially available to policyholders along with the insolvency or bankruptcy of other defendants. The

Company is currently involved in coverage litigation concerning a number of policyholders who have filed for

bankruptcy, including, among others, ACandS, Inc., who in some instances have asserted that all or a portion of

their asbestos-related claims are not subject to aggregate limits on coverage as described generally in the next

paragraph. (Also see “Part I—Item 3, Legal Proceedings”). These trends are expected to continue through 2005.

As a result of the factors described above, there is a high degree of uncertainty with respect to future exposure

from asbestos claims.

In some instances, policyholders continue to assert that their claims for asbestos-related insurance are not

subject to aggregate limits on coverage and that each individual bodily injury claim should be treated as a

separate occurrence under the policy. It is difficult to predict whether these policyholders will be successful on

both issues or whether the Company will be successful in asserting additional defenses. To the extent both issues

are resolved in policyholders’ favor and other additional Company defenses are not successful, the Company’s

coverage obligations under the policies at issue would be materially increased and bounded only by the

applicable per-occurrence limits and the number of asbestos bodily injury claims against the policyholders.

Accordingly, it is difficult to predict the ultimate cost of the claims for coverage not subject to aggregate limits.

Many coverage disputes with policyholders are only resolved through settlement agreements. Because many

policyholders make exaggerated demands, it is difficult to predict the outcome of settlement negotiations.

Settlements involving bankrupt policyholders may include extensive releases which are favorable to the

Company but which could result in settlements for larger amounts than originally anticipated. As in the past, the

Company will continue to pursue settlement opportunities.

In addition, proceedings have been launched directly against insurers, including the Company, challenging

insurers’ conduct in respect of asbestos claims, and, as discussed below, claims by individuals seeking damages

arising from alleged asbestos-related bodily injuries. The Company anticipates the filing of other direct actions

against insurers, including the Company, in the future. It is difficult to predict the outcome of these proceedings,

including whether the plaintiffs will be able to sustain these actions against insurers based on novel legal theories

of liability. The Company believes it has meritorious defenses to these claims and has received favorable rulings

in certain jurisdictions. Additionally, TPC has entered into settlement agreements, which have been approved by

the court in connection with the proceedings initiated by TPC in the Johns Manville bankruptcy court. If the

rulings of the bankruptcy court are affirmed through the appellate process, then TPC will have resolved

substantially all of the pending claims against it of this nature. (Also, see “Item 3—Legal Proceedings”).

Because each policyholder presents different liability and coverage issues, the Company generally evaluates

the exposure presented by each policyholder on a policyholder-by-policyholder basis. In the course of this

evaluation, the Company considers: available insurance coverage, including the role of any umbrella or excess

insurance the Company has issued to the policyholder; limits and deductibles; an analysis of each policyholder’s

potential liability; the jurisdictions involved; past and anticipated future claim activity and loss development on

pending claims; past settlement values of similar claims; allocated claim adjustment expense; potential role of

other insurance; the role, if any, of non-asbestos claims or potential non-asbestos claims in any resolution

process; and applicable coverage defenses or determinations, if any, including the determination as to whether or

not an asbestos claim is a products/completed operation claim subject to an aggregate limit and the available

coverage, if any, for that claim. When the gross ultimate exposure for indemnity and related claim adjustment

expense is determined for a policyholder, the Company calculates, by each policy year, a ceded reinsurance

projection based on any applicable facultative and treaty reinsurance, past ceded experience and reinsurance

collections. Conventional actuarial methods are not utilized to establish asbestos reserves. The Company’s

evaluations have not resulted in any data from which a meaningful average asbestos defense or indemnity

payment may be determined.

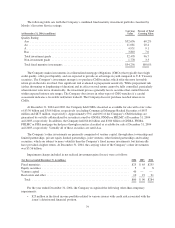

The Company also compares its historical gross and net loss and expense paid experience, year-by-year, to

assess any emerging trends, fluctuations, or characteristics suggested by the aggregate paid activity. Net asbestos

72