Travelers 2004 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

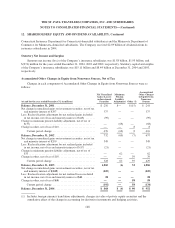

14. PENSION PLANS, RETIREMENT BENEFITS AND SAVINGS PLANS, Continued

The pretax minimum liability included in other comprehensive income was $10 million at both

December 31, 2004 and 2003.

The Company does not have a best estimate of contributions expected to be paid to the qualified pension

plan during the next fiscal year at this time.

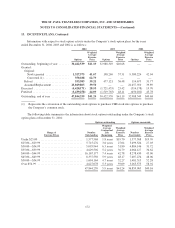

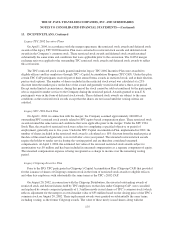

Assumptions and Health Care Cost Trend Rate Sensitivity

(at and for the year ended December 31,) 2004 2003

Assumptions used to determine benefit obligations

Discount rate .......................................................... 6.00% 6.25%

Future compensation increase rate .......................................... 4.00% 4.00%

Assumptions used to determine net periodic benefit cost

Discount rate .......................................................... 6.00% to 6.25% 6.75%

Expected long-term rate of return on assets ................................... 8.00% 8.00%

Assumed health care cost trend rates

Following year ......................................................... 10.0% 10.0%

Rate to which the cost trend rate is assumed to decline (ultimate trend rate) ......... 5.0% 5.0%

Year that the rate reaches the ultimate trend rate ............................... 2010 2009

In choosing the expected long-term rate of return, the Company’s Pension Plan Investment Committee

considered the historical returns of equity and fixed income markets in conjunction with today’s economic and

financial market conditions.

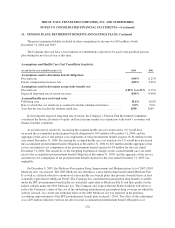

As an indicator of sensitivity, increasing the assumed health care cost trend rate by 1% would have

increased the accumulated postretirement benefit obligation by $39 million at December 31, 2004, and the

aggregate of the service and interest cost components of net postretirement benefit expense by $4 million for the

year ended December 31, 2004. Decreasing the assumed health care cost trend rate by 1% would have decreased

the accumulated postretirement benefit obligation at December 31, 2004 by $32 million and the aggregate of the

service and interest cost components of net postretirement benefit expense by $3 million for the year ended

December 31, 2004. The sensitivity of the foregoing hypothetical changes in the assumed health care cost trend

rates to the accumulated postretirement benefit obligation at December 31, 2003, and the aggregate of the service

and interest cost components of net postretirement benefit expense for the year ended December 31, 2003 was

negligible.

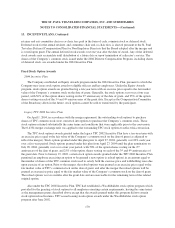

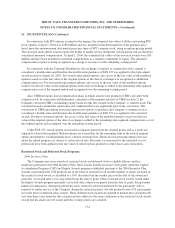

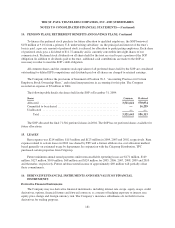

On December 8, 2003, the Medicare Prescription Drug, Improvement and Modernization Act of 2003 (2003

Medicare Act) was enacted. The 2003 Medicare Act introduces a prescription drug benefit under Medicare Part

D as well as a federal subsidy to sponsors of retiree health care benefit plans that provide a benefit that is at least

actuarially equivalent to Medicare Part D. The Company has concluded that prescription drug benefits available

under the SPC postretirement benefit plan are actuarially equivalent to Medicare Part D and thus qualify for the

federal subsidy under the 2003 Medicare Act. The Company also expects that the Federal subsidy will offset or

reduce the Company’s share of the cost of the underlying postretirement prescription drug coverage on which the

subsidy is based. As a result, the estimated effect of the 2003 Medicare Act was reflected in the purchase

accounting remeasurement of the SPC postretirement benefit plan on April 1, 2004. The effect of this adjustment

was a $29 million reduction (with no tax effect) in the accumulated postretirement benefit obligation as of

178