Travelers 2004 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

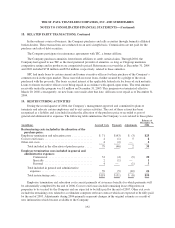

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

16. DERIVATIVE FINANCIAL INSTRUMENTS AND FAIR VALUE OF FINANCIAL

INSTRUMENTS, Continued

At December 31, 2004 and 2003, investments in fixed maturities had a fair value, which equaled carrying

value, of $54.26 billion and $33.05 billion, respectively. The fair value of investments in fixed maturities for

which a quoted market price or dealer quote are not available was $574 million and $685 million at

December 31, 2004 and 2003, respectively. See note 1.

The carrying values of cash, short-term securities, mortgage loans, investment income accrued, and

payables for securities lending and repurchase agreements approximated their fair values. See notes 1 and 6.

The carrying values of $1.23 billion and $284 million of financial instruments classified as other assets

approximated their fair values at December 31, 2004 and 2003, respectively. The carrying values of $4.94 billion

and $2.69 billion of financial instruments classified as other liabilities at December 31, 2004 and 2003,

respectively, also approximated their fair values. Fair value is determined using various methods including

discounted cash flows, as appropriate for the various financial instruments.

The carrying value and fair value of the Company’s debt at December 31, 2004 was $6.62 billion and $6.78

billion, respectively. The respective totals at December 31, 2003 were $2.68 billion and $2.77 billion.

The fair value of commercial paper included in debt outstanding at December 31, 2004 approximated its

book value of $499 million because of its short-term nature. For other debt, the fair value estimate was based

upon the bid price at December 31, 2004 and 2003.

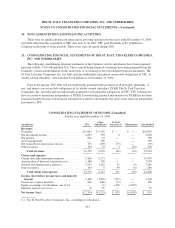

17. CONTINGENCIES, COMMITMENTS AND GUARANTEES

Contingencies

The following section describes the major pending legal proceedings, other than ordinary routine litigation

incidental to the business, to which the Company or its subsidiaries are a party or to which any of the Company’s

property is subject.

Asbestos and Environmental-Related Proceedings

In the ordinary course of its insurance business, the Company receives claims for insurance arising under

policies issued by the Company asserting alleged injuries and damages from asbestos and other hazardous waste

and toxic substances which are the subject of related coverage litigation, including, among others, the litigation

described below. The Company continues to be subject to aggressive asbestos-related litigation. The conditions

surrounding the final resolution of these claims and the related litigation continue to change.

TPC is involved in three significant proceedings relating to ACandS, Inc. (ACandS), formerly a national

distributor and installer of products containing asbestos, including ACandS’ bankruptcy proceedings. The

proceedings involve disputes as to whether and to what extent any of ACandS’ potential liabilities for bodily

injury asbestos claims are covered by insurance policies issued by TPC. These proceedings have resulted in

decisions favorable to TPC, although those decisions are subject to appellate review. The status of the various

proceedings is described below.

ACandS filed for bankruptcy in September 2002 (In re: ACandS, Inc., pending in the U.S. Bankruptcy Court

for the District of Delaware). In its proposed plan of reorganization, ACandS sought to establish a trust to pay

asbestos bodily injury claims against it and sought to assign to the trust its rights under the insurance policies

184