Travelers 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

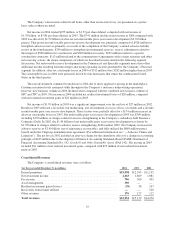

additional $115 million of net written premium in 2002 related to the termination of certain reinsurance

contracts. Net written premiums for the Northland subsidiaries were $547 million in 2003 compared to $825

million in 2002. The Commercial business of those subsidiaries is included with Commercial Accounts.

Commercial Accounts net written premiums increased $100 million, or 3%, in 2003. Net written premiums

associated with the Northland subsidiaries declined to $547 million in 2003 from $825 million in 2002 due to the

factors described above. Excluding the Northland subsidiaries’ net written premiums in both 2003 and 2002,

Commercial Accounts premium volume in 2003 grew 16% over 2002. The increase was primarily due to renewal

price increases, new business growth in targeted markets and strong retention across all major product lines.

Select Accounts net written premiums in 2003 increased $178 million, or 10%, over 2002. The increase

primarily reflected renewal price increases, new business and strong retention. New business growth was

especially strong in property, general liability and commercial multi-peril lines of business. Select Accounts

retention levels in 2003 were strongest for small commercial business handled through the Company’s Service

Centers, while premium growth was centered in the commercial multi-peril and property product lines.

National Accounts net written premiums in 2003 increased $190 million, or 30%, over 2002, primarily due

to the continued benefit from rate increases, higher new business levels that, in part, resulted from the

Company’s third quarter 2003 renewal rights transaction with Royal & SunAlliance and higher business volume

in residual market pools.

The Commercial Other sector of the Commercial segment in 2003 and 2002 consisted primarily of results

from the Company’s Gulf subsidiary, which marketed products to national, mid-sized and small customers and

distributed them through both wholesale brokers and retail agents and brokers throughout the United States with

particular emphasis on management and professional liability coverages and excess and surplus lines of

insurance. Gulf net written premiums increased $83 million, or 14%, in 2003 as a result of significant rate

increases across all classes of management liability products.

Specialty

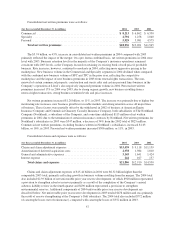

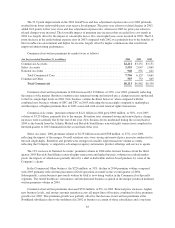

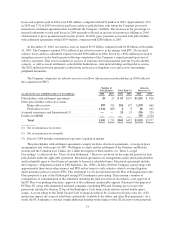

The Specialty segment’s results for the twelve months ended December 31, 2004 reflect the results of TPC’s

Bond and Construction operations for the three months ended March 31, 2004 and the post-merger combined

results of SPC’s specialty operations and TPC’s Bond and Construction operations for the nine months ended

December 31, 2004. Results for 2003 and 2002 represent TPC’s Bond and Construction operations only.

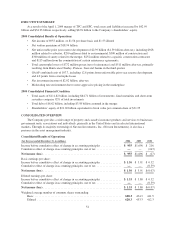

(for the year ended December 31, in millions) 2004 2003 2002

Revenues:

Earned premiums .................................................. $4,791 $1,171 $ 970

Net investment income .............................................. 507 183 188

Fee income ....................................................... 26 15 9

Other revenues .................................................... 22 85

Total revenues .................................................... $5,346 $1,377 $1,172

Total claims and expenses .............................................. $6,517 $1,048 $ 915

Operating income (loss) ................................................ $ (724) $ 234 $ 184

Loss and loss adjustment expense ratio ..................................... 102.8% 51.3% 53.5%

Underwriting expense ratio .............................................. 32.6 36.0 39.1

GAAP combined ratio ............................................. 135.4% 87.3% 92.6%

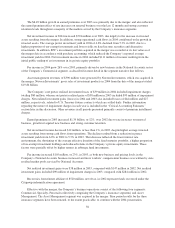

The operating loss of $724 million in 2004 was driven by after-tax unfavorable prior year reserve

development of $1.03 billion ($1.59 billion, pretax) including $500 million and $300 million (pretax) of net

unfavorable prior year loss development related to the construction and surety reserves, respectively, acquired in

64