Travelers 2004 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

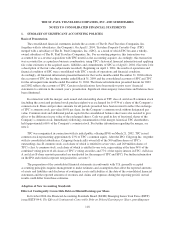

privately-held, early-stage venture investments, events giving rise to impairment can occur in a brief period of

time (e.g., the entity has been unsuccessful in securing additional financing, other investors decide to withdraw

their support, complications arise in the product development process, etc.), and decisions are made at that point

in time, based on the specific facts and circumstances, with respect to a recognition of “other-than-temporary”

impairment or sale of the investment.

Non-Publicly Traded Investments

The Company’s investment portfolio includes non-publicly traded investments, such as venture capital

investments, private equity limited partnerships, joint ventures, other limited partnerships, and certain fixed

income securities. Venture capital investments owned directly are consolidated in the Company’s financial

statements. The Company uses the equity method of accounting for joint ventures, limited partnerships and

certain private equity securities. Certain other private equity investments, including venture capital investments,

are not subject to the provisions of Statement of Financial Accounting Standards (FAS) No. 115, Accounting for

Certain Investments in Debt and Equity Securities, but are reported at estimated fair value in accordance with

FAS 60, Accounting and Reporting by Insurance Enterprises. The fair value of the venture capital investments is

based on an estimate determined by an internal valuation committee for securities for which there is no public

market. The internal valuation committee reviews such factors as recent filings, operating results, balance sheet

stability, growth, and other business and market sector fundamental statistics in estimating fair values of specific

investments.

The following is a summary of the approximate carrying value of the Company’s non-publicly traded

securities at December 31, 2004:

(in millions) Carrying Value

Investment partnerships, including hedge funds ........................................ $1,883

Fixed income securities ........................................................... 328

Equity investments ............................................................... 355

Real estate partnerships and joint ventures ............................................ 155

Venture capital .................................................................. 441

Total ..................................................................... $3,162

OTHER MATTERS

On July 23, 2004, the Company announced that it was seeking guidance from the staff of the Division of

Corporation Finance of the Securities Exchange Commission with respect to the appropriate purchase accounting

treatment for certain second quarter 2004 adjustments totaling $1.63 billion ($1.07 billion after-tax). The

Company recorded these adjustments as charges in its income statement in the second quarter of 2004. Through

an informal comment process, the staff of the Division of Corporation Finance has subsequently asked for further

information relating to these adjustments, and the dialogue is ongoing. Specifically, the staff has asked for

information concerning the Company’s adjustments to certain of SPC’s insurance reserves and reserves for

reinsurance recoverables and premiums due from policyholders, and how those adjustments may relate to SPC’s

reserves for periods prior to the merger. After reviewing the staff’s questions and comments and discussions with

the Company’s independent auditors, the Company continues to believe that its accounting treatment for these

adjustments is appropriate. If, however, the staff disagrees, some or all of the adjustments being discussed may

not be recorded as charges in the Company’s income statement, thereby increasing net income for the second

quarter and full year 2004 and increasing shareholders’ equity at December 31, 2004, in each case by the

approximate after-tax amount of the change. The effect on tangible shareholders’ equity (adjusted for the effects

of deferred taxes associated with goodwill and intangible assets) at December 31, 2004 would not be material.

Increases to goodwill and deferred tax liabilities would be reflected on the Company’s balance sheet as of

April 1, 2004, either due to purchase accounting or adjustment of SPC’s reserves prior to the merger.

108