Travelers 2004 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

9. INSURANCE CLAIMS RESERVES, Continued

Prior Year Development

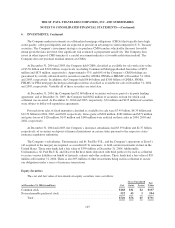

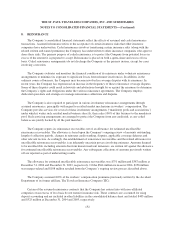

In 2004, estimated claims and claim adjustment expenses for claims arising in prior years totaled a net $2.40

billion, including $2.39 billion of net unfavorable prior year reserve development impacting the Company’s

results of operations, excluding $75 million of accretion of discount. Pretax net unfavorable prior year reserve

development included $928 million to strengthen asbestos reserves primarily as a result of the completion of the

Company’s annual asbestos liability review in the fourth quarter, $290 million to strengthen environmental

reserves, reserve adjustments related to the merger of $500 million for construction and $300 million for surety,

$252 million related to a specific construction contractor, $113 million related to the commutation of agreements

with a major reinsurer, and other net reserving actions

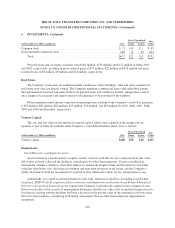

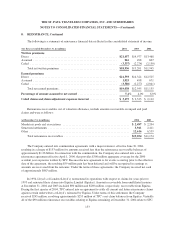

The asbestos provision primarily resulted from an increase in litigation costs and activity surrounding

peripheral defendants. With regard to the environmental provision, new claims for hazardous waste and pollution

continue to decline, though the pace of the decrease has slowed. The average severity of claims has increased,

however, leading the Company to conclude that reserves for environmental losses needed to be increased. The

majority of the asbestos and environmental provision is included in the Commercial segment. Also included in

net unfavorable prior year reserve development of $1.18 billion in the Commercial segment was $38 million

related to the commutation of agreements with a major reinsurer along with a strengthening of Gulf reserves,

which was more than offset by favorable prior year reserve development in core Commercial operations due to

reductions in the frequency of non-catastrophe related losses.

The Specialty segment recorded prior year reserve development of $1.59 billion and included $500 million

and $300 million of net unfavorable prior year reserve development related to the construction and surety

reserves, respectively, acquired in the merger, as well as a $252 million charge related to a specific construction

contractor and $75 million related to the commutation of agreements with a major reinsurer. Results in 2004 also

reflected $150 million of unfavorable prior year reserve development recorded in TPC’s Construction operation

prior to the merger, other reserve increases, and a charge to increase the allowance for estimated amounts due

from a co-surety on a specific construction contractor claim.

In the Personal segment, net favorable prior year reserve development was $378 million, driven by a decline

in the frequency of non-catastrophe homeowners’ losses, as well as a reduction in the frequency and severity of

losses in the automobile line of business.

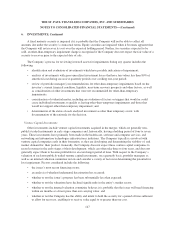

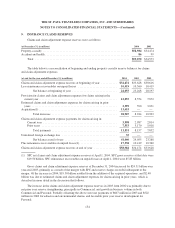

In 2003, net unfavorable prior year reserve development included in estimated claims and claim adjustment

expenses totaled $390 million. That amount included $549 million of net unfavorable development impacting the

Company’s results of operations that primarily resulted from $521 million of reserve strengthening at Gulf

Insurance Company, a subsidiary that wrote specialty insurance prior to being placed in runoff in 2004. The net

2003 total also included unfavorable development related to American Equity, an operation that was placed in

run-off in the second quarter of 2002, and environmental claims. Those provisions were partially offset by net

favorable development in other Commercial businesses, principally property coverages, in which the Company

experienced lower non-catastrophe-related claim frequency. In 2003, estimated claims and claim adjustment

expenses for claims arising in prior years included $42 million of net favorable loss development on Commercial

loss sensitive policies in various lines; however, since the business to which it relates was subject to premium

adjustments, there was no impact on results of operations.

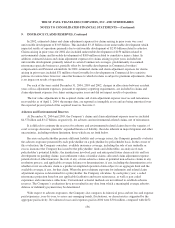

In addition, Personal recorded $162 million in net favorable prior year reserve development in 2003

principally due to continued reduced levels of non-catastrophe claim frequency in both homeowners and non-

bodily injury automobile businesses, and a $50 million reduction in reserves held related to the terrorist attack on

September 11, 2001.

155