Travelers 2004 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.downgraded the debt ratings of Travelers Property Casualty Corp. and Travelers Insurance Group

Holdings, Inc. to a- from a. Discover Reinsurance Company was assigned an outlook of negative, while

the St. Paul Insurance Group and Travelers PC Pool were assigned outlooks of stable.

• Moody’s affirmed the insurance financial strength ratings of the Travelers Property Casualty Pool

(Aa3), St. Paul Insurance Group (A1) and Gulf Insurance Group (A2). Additionally, Moody’s affirmed

the long-term debt ratings of The St. Paul Travelers Companies, Inc., Travelers Property Casualty Corp.

and Travelers Insurance Group Holdings, Inc. (A3). The outlook for the legacy St. Paul Insurance Group

was assigned an outlook of negative.

• S&P affirmed the counterparty credit and financial strength ratings on members of the St. Paul

Insurance Group, Travelers Property Casualty Pool, Travelers Casualty and Surety Company of

America, Travelers Casualty and Surety Company of Europe, LTD and Gulf Insurance Group (A+).

S&P also affirmed the counterparty credit and senior debt ratings of The St. Paul Travelers Companies,

Inc. (BBB+). A stable outlook was assigned to all the above ratings.

• Fitch downgraded the insurer financial strength rating of the members of the Travelers Property

Casualty Group to AA- from AA. Fitch also assigned the members of The St. Paul Insurance Group the

insurer financial strength rating of AAⳮ. The senior and long-term issuer debt ratings of The St. Paul

Travelers Companies, Inc., Travelers Property Casualty Corp. and Travelers Insurance Group Holdings,

Inc. were affirmed at Aⳮ. All ratings were assigned the outlook of stable.

On September 15, 2004, S&P downgraded its counterparty and financial strength ratings of Afianzadora

Insurgentes, S.A., a majority-owned subsidiary of United States Fidelity and Guaranty Company operating in

Mexico, to BBBⳮfrom BBB+ in the global scale and to mxAA from mxAAA in the national scale. The short-

term financial strength ratings were affirmed at mxA-1+ in the national scale. The ratings were removed from

CreditWatch with an outlook of negative. At the same time, counterparty and financial strength ratings were

withdrawn at the Company’s request.

On January 6, 2005, A.M. Best affirmed the financial strength rating of A of St. Paul Guarantee Insurance

Company and withdrew the financial strength rating of A+ of Travelers Casualty and Surety Company of Canada

(assigned an NR-5, not formerly followed rating). Both ratings were removed from under review with developing

implications. St. Paul Guarantee Insurance Company was assigned a rating outlook of stable. These actions

followed the January 1, 2005 completion of the amalgamation of St. Paul Guarantee Insurance Company and

Travelers Casualty and Surety Company of Canada.

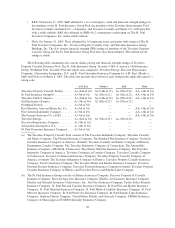

In connection with the Company’s January 31, 2005 announcement of fourth quarter 2004 earnings,

A.M. Best, Moody’s, S&P and Fitch announced the following rating actions with respect to the company.

• A.M. Best: On January 31, 2005, A.M. Best placed the financial strength rating of A+ of Travelers

Property Casualty Pool and the debt ratings of a- on senior debt, bbb+ on subordinated debt, bbb on trust

preferred securities, bbb on preferred stock and AMB-1 on commercial paper of The St. Paul Travelers

Companies, Inc. and its subsidiaries under review with negative implications, pending the close of a

potential divestiture of the Company’s investment in Nuveen Investments. Concurrently, A.M. Best

affirmed the financial strength rating of A of The St. Paul Insurance Group. The rating outlook is stable.

• Moody’s: On February 1, 2005, Moody’s announced that it affirmed the long-term debt ratings (senior

unsecured debt at A3) of The St. Paul Travelers Companies, Inc. and also affirmed the Aa3 insurance

financial strength (IFSR) of the members of the legacy Travelers intercompany pool. The outlook for

these ratings was changed to negative from stable. Moody’s also placed the A1 IFSR of the legacy St.

Paul intercompany pool and the A2 IFSR of United States Fidelity and Guaranty Company on review

for possible upgrade. The outlook on the A2 IFSR of the Gulf intercompany pool subsidiaries was

changed to positive from stable. The outlook of the A1 IFSR of Travelers Casualty and Surety Company

of Europe, Limited was changed to positive from developing.

25