Travelers 2004 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

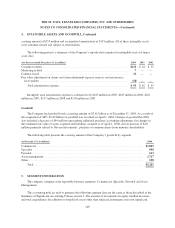

3. TPC CORPORATE REORGANIZATION, Continued

public and to divest the remaining shares it holds within five years following the Citigroup Distribution. After the

merger, this undertaking also applies to shares of the Company’s common stock.

On August 20, 2002, in connection with the Citigroup Distribution, stock-based awards held by TPC

employees on that date under Citigroup’s various incentive plans were cancelled and replaced by awards under

TPC’s own incentive programs (see note 13 to the Company’s consolidated financial statements for a further

discussion), which awards were granted on substantially the same terms, including vesting, as the former

Citigroup awards.

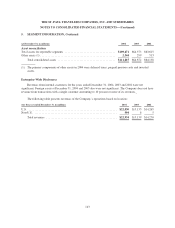

Other TPC Corporate Reorganization, Offerings and Citigroup Distribution Transactions

The following transactions were completed in conjunction with the 2002 corporate reorganization, offerings

and Citigroup Distribution:

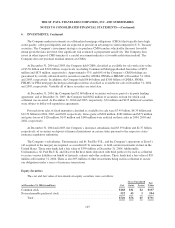

In February 2002, TPC paid a dividend of $1.00 billion to Citigroup in the form of a non-interest bearing

note payable on December 31, 2002. TPC repaid this note on December 31, 2002. Also in February 2002, TPC

paid an additional dividend of $3.70 billion to Citigroup in the form of a note payable in two installments. This

note was substantially prepaid following the offerings. The balance of $150 million was due on May 9, 2004. The

remaining portion of this note was prepaid on May 8, 2002. In March 2002, TPC paid a dividend of $395 million

to Citigroup in the form of a note. This note was prepaid following the offerings.

At December 31, 2001, TPC had a note payable to Citigroup in the amount of $1.20 billion, in conjunction

with its purchase of TIGHI’s outstanding shares in April 2000. On February 7, 2002, this note agreement was

replaced by a new note agreement. Under the terms of the new note agreement, interest accrued on the aggregate

principal amount outstanding at the commercial paper rate (the then current short-term rate) plus 10 basis points

per annum. Interest was compounded monthly. This note was prepaid following the offerings.

During March 2002, TPC entered into an agreement with Citigroup (the Citigroup indemnification

agreement) which provided that in any year in which TPC recorded additional asbestos-related income statement

charges in excess of $150 million, net of any reinsurance, Citigroup would pay to TPC the amount of any such

excess up to a cumulative aggregate of $800 million, reduced by the tax effect of the highest applicable federal

income tax rate. During 2002, TPC recorded $2.95 billion of asbestos incurred losses, net of reinsurance, and

accordingly fully utilized in 2002 the total benefit available under the agreement. For the year ended December

31, 2002, revenues included $520 million from Citigroup under this agreement. Included in federal income taxes

in the consolidated statement of income for 2002 was a tax benefit of $280 million related to the asbestos charge

covered by the agreement. For additional information see “—Asbestos Claims and Litigation.”

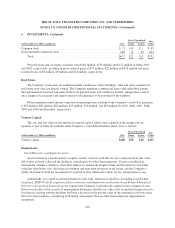

On February 28, 2002, TPC sold CitiInsurance to other Citigroup affiliated companies for $403 million, its

net book value. TPC applied $138 million of the proceeds from this sale to repay intercompany indebtedness to

Citigroup. In addition, TPC purchased from Citigroup affiliated companies the premises located at One Tower

Square, Hartford, Connecticut and other properties for $68 million. Additionally, certain liabilities relating to

employee benefit plans and lease obligations were assigned and assumed by Citigroup affiliated companies. In

connection with these assignments, TPC transferred $172 million and $88 million, respectively, to Citigroup

affiliated companies.

Prior to the 2002 Citigroup Distribution, TPC provided and purchased services to and from Citigroup

affiliated companies, including facilities management, banking and financial functions, benefit coverages, data

138