Travelers 2004 Annual Report Download - page 54

Download and view the complete annual report

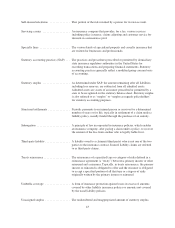

Please find page 54 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Residual market (involuntary

business) ....................... Insurance market which provides coverage for risks for those unable

to purchase insurance in the voluntary market. Possible reasons for

this inability include the risk being too great or the profit potential too

small under the required insurance rate structure. Residual markets

are frequently created by state legislation either because of lack of

available coverage such as: property coverage in a windstorm prone

area or protection of the accident victim as in the case of workers’

compensation. The costs of the residual market are usually charged

back to the direct insurance carriers in proportion to the carriers’

voluntary market shares for the type of coverage involved.

Retention ......................... Theamount of exposure a policyholder company retains on any one

risk or group of risks. The term may apply to an insurance policy,

where the policyholder is an individual, family or business, or a

reinsurance policy, where the policyholder is an insurance company.

Retention ratio ..................... Current period renewal accounts or policies as a percentage of total

accounts or policies available for renewal.

Retrospective premiums ............. Premiums related to retrospectively rated policies.

Retrospective rating ................. Aplan or method which permits adjustment of the final premium or

commission on the basis of actual loss experience, subject to certain

minimum and maximum limits.

Return on equity ................... Theratio of net income to average equity.

Risk-based capital (RBC) ............ Ameasure adopted by the NAIC and enacted by states for

determining the minimum statutory capital and surplus requirements

of insurers. Insurers having total adjusted capital less than that

required by the RBC calculation will be subject to varying degrees of

regulatory action depending on the level of capital inadequacy.

Risk retention group ................ Analternative form of insurance in which members of a similar

profession or business band together to self insure their risks.

Run-off business ................... Anoperation which has been determined to be nonstrategic; includes

non-renewals of inforce policies and a cessation of writing new

business, where allowed by law.

Salvage .......................... Theamount of money an insurer recovers through the sale of property

transferred to the insurer as a result of a loss payment.

Second-injury fund ................. Theemployer of an injured, impaired worker is responsible only for

the workers’ compensation benefit for the most recent injury; the

second-injury fund would cover the cost of any additional benefits for

aggravation of a prior condition. The cost is shared by the insurance

industry and self-insureds, funded through assessments to insurance

companies and self-insureds based on either premiums or losses.

42