Travelers 2004 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

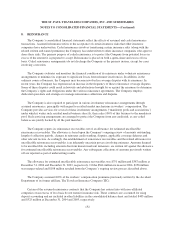

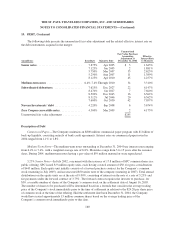

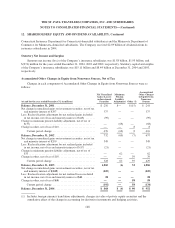

10. DEBT, Continued

Nuveen Investments’ Debt—In September 2003, Nuveen Investments issued $300 million of 4.22% notes in

a private placement. The notes mature in 2008. A portion of the proceeds was used to refinance existing debt and

repay a $105 million loan from SPC. The remainder was used for Nuveen Investments’ general corporate

purposes. The carrying value of Nuveen Investments’ debt in the foregoing table included the unamortized gains

from the cancellation of prior interest rate swap transactions in connection with the private placement, as well as

unamortized private placement debt issue costs.

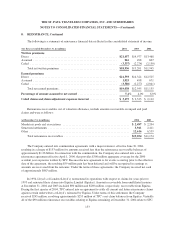

Zero Coupon Convertible Notes—The zero coupon convertible notes mature in 2009, but are redeemable at

the option of the holder for an amount equal to the original issue price plus accreted original issue discount.

3.75%, 5.00%, 6.375% Senior Notes—On March 11, 2003, the Company issued $1.40 billion of senior

notes comprising $400 million of 3.75% senior notes due March 15, 2008, $500 million of 5.00% senior notes

due March 15, 2013 and $500 million of 6.375% senior notes due March 15, 2033. The notes pay interest semi-

annually on March 15 and September 15 of each year, beginning September 15, 2003, are senior unsecured

obligations and rank equally with all of the Company’s other senior unsecured indebtedness. The Company may

redeem some or all of the notes prior to maturity by paying a “make-whole” premium based on U.S. Treasury

rates. The net proceeds from the sale of these notes were contributed to TIGHI, so that TIGHI could prepay and

refinance $500 million of 3.60% indebtedness to Citigroup and to redeem $900 million aggregate principal

amount of TIGHI’s 8.00% to 8.08% junior subordinated debt securities held by subsidiary trusts. These trusts, in

turn, used these funds to redeem $900 million of preferred capital securities on April 9, 2003.

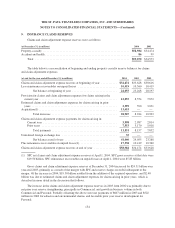

These senior notes were sold to qualified institutional buyers as defined under Rule 144A under the

Securities Act of 1933 (the Securities Act) and outside the United States in reliance on Regulation S under the

Securities Act. Accordingly, the notes (the restricted notes) were not registered under the Securities Act or any

state securities laws and could not be transferred or resold except pursuant to certain exemptions. As part of this

offering, the Company agreed to file a registration statement under the Securities Act to permit the exchange of

the notes for registered notes (the Exchange Notes) having terms identical to those of the senior notes described

above (Exchange Offer). On April 14, 2003, the Company initiated the Exchange Offer pursuant to a Form S-4

that was filed with the Securities and Exchange Commission. Accordingly, each series of Exchange Notes has

been registered under the Securities Act, and the transfer restrictions and registration rights relating to the

restricted notes do not apply to the Exchange Notes. As of May 13, 2003 (the Expiration Date of the Exchange

Offer), 99.8%, 99.4% and 100% of the company’s 5, 10, and 30-year restricted notes, respectively, were

exchanged for Exchange Notes.

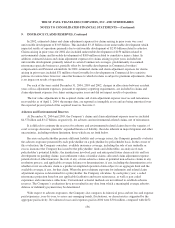

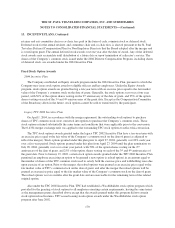

4.50% Convertible Junior Subordinated Notes—In March 2002, the Company issued $893 million

aggregate principal amount of 4.5% convertible junior subordinated notes, which will mature on April 15, 2032,

unless earlier redeemed, repurchased or converted. Interest is payable quarterly in arrears. The Company has the

option to defer interest payments on the notes for a period not exceeding 20 consecutive interest periods nor

beyond the maturity of the notes. During a deferral period, the amount of interest due to holders of the notes will

continue to accumulate, and such deferred interest payments will themselves accrue interest. Deferral of any

interest can create certain restrictions for the Company. Unless previously redeemed or repurchased, the notes are

convertible into shares of common stock at the option of the holders at any time after March 27, 2003 and prior

to April 15, 2032 if at any time (1) the average of the daily closing prices of common stock for the 20

consecutive trading days immediately prior to the conversion date is at least 20% above the then applicable

conversion price on the conversion date, (2) the notes have been called for redemption, (3) specified corporate

transactions have occurred, or (4) specified credit rating events with respect to the notes have occurred. The notes

161