Travelers 2004 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

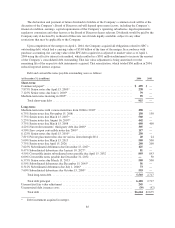

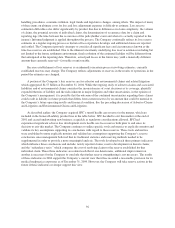

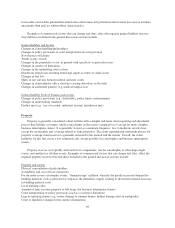

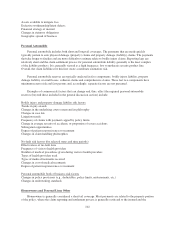

Claims and claim adjustment expense reserves by product line were as follows:

2004 2003

(at December 31, in millions) Case IBNR Total Case IBNR Total

General liability ........................... $ 8,445 $12,232 $20,677 $ 3,378 $ 7,664 $11,042

Property ................................. 1,534 1,359 2,893 685 735 1,420

Commercial multi-peril ..................... 1,979 2,216 4,195 1,325 2,059 3,384

Commercial automobile .................... 2,817 1,966 4,783 1,587 1,131 2,718

Workers’ compensation ..................... 8,313 6,658 14,971 6,207 5,081 11,288

Fidelity and surety ......................... 1,216 845 2,061 264 317 581

Personal automobile ....................... 1,484 1,219 2,703 1,286 1,097 2,383

Homeowners and personal—other ............ 470 523 993 379 537 916

International and other ..................... 2,934 2,774 5,708 354 388 742

Property-casualty ........................ 29,192 29,792 58,984 15,465 19,009 34,474

Accident and health ........................ 76 10 86 88 11 99

Claims and claim adjustment expense

reserves ............................. $29,268 $29,802 $59,070 $15,553 $19,020 $34,573

Property-casualty claims and claim adjustment expense reserves at December 31, 2004 increased by $24.51

billion over year-end 2003, primarily as a result of the merger with SPC and reserve charges recorded subsequent

to the merger. Of the increase in 2004, $19.50 billion resulted from the addition of the acquired reserves, and

$2.39 billion, net of reinsurance, was due to net unfavorable prior year reserve development primarily comprised

of $928 million to strengthen asbestos reserves primarily as a result of the completion of the Company’s annual

asbestos liability review in the fourth quarter, $290 million to strengthen environmental reserves, $800 million of

reserve adjustments related to the merger for surety and construction loss reserves, $252 million related to a

specific construction contractor, $113 million related to the commutation of agreements with a major reinsurer

and other net reserving actions. For discussion of the components of net unfavorable prior year reserve

development, see note 9 to the consolidated financial statements.

Asbestos and environmental reserves are included in the General liability, Commercial multi-peril lines and

International and other lines in the summary table. Asbestos and environmental reserves are discussed separately,

see “Asbestos Claims and Litigation”, “Environmental Claims and Litigation” and “Uncertainty Regarding

Adequacy of Asbestos and Environmental Reserves”.

General Discussion

Claim and claim adjustment expense reserves (loss reserves) represent management’s estimate of ultimate

unpaid costs of losses and loss adjustment expenses for claims that have been reported and claims that have been

incurred but not yet reported. The process for estimating these liabilities begins with the collection and analysis

of claim data. Data on individual reported claims, both current and historical, including paid amounts and

individual claim adjuster estimates, are grouped by common characteristics (“components”) and evaluated by

actuaries in their analyses of ultimate claim liabilities by product line. Such data is occasionally supplemented

with external data as available and when appropriate. The process of analyzing reserves for a component is

undertaken on a regular basis, generally quarterly, in light of continually updated information.

Multiple estimation methods are available for the analysis of ultimate claim liabilities. Each estimation

method has its own set of assumption variables and its own advantages and disadvantages, with no single

estimation method being better than the others in all situations and no one set of assumption variables being

meaningful for all product line components. The relative strengths and weaknesses of the particular estimation

methods when applied to a particular group of claims can also change over time. Therefore, the actual choice of

estimation method(s) can change with each evaluation. The estimation method(s) chosen are those that are

believed to produce the most reliable indication at that particular evaluation date for the claim liabilities being

evaluated.

93