Travelers 2004 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

14. PENSION PLANS, RETIREMENT BENEFITS AND SAVINGS PLANS, Continued

April 1, 2004 and a reduction of $2 million in net periodic postretirement benefit cost for the year ended

December 31, 2004. See note 1.

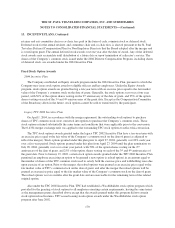

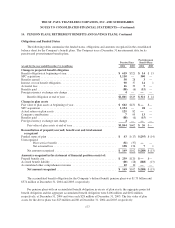

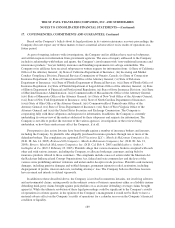

Components of Net Periodic Benefit Cost

The following table summarizes the components of net benefit expense recognized in the consolidated

statement of income for the benefit plans for the years ended December 31, 2004 and 2003 and for the period

August 20, 2002 through December 31, 2002.

Pension Plans

Postretirement Benefit

Plans

(in millions) 2004 2003 2002 2004 2003 2002

Service cost ............................................. $50 $28 $10 $3$— $—

Interest cost on benefit obligation ............................ 90 37 13 14 1—

Expected return on plan assets .............................. (119) (39) (15) (1) ——

Amortization of unrecognized:

Prior service cost ..................................... (5) (6) (2) ———

Net actuarial loss ..................................... 951———

Net benefit expense ............................... $25 $25 $ 7 $16 $1$—

The Company’s share of expenses related to these plans for the period January 1, 2002 to August 20, 2002

was not significant.

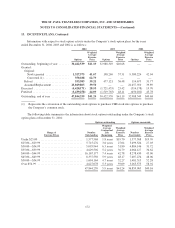

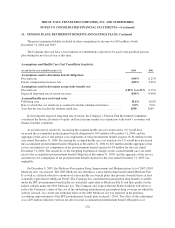

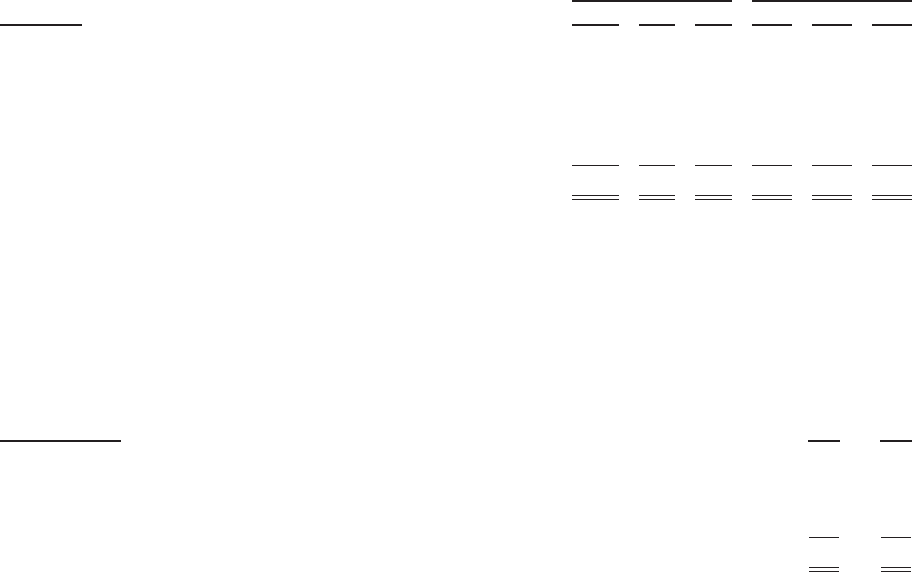

Plan Assets

The percentage of the fair value of pension plan assets held by asset category is as follows:

(at December 31,) 2004 2003

Equity securities ................................................................. 66% 60%

Debt securities .................................................................. 30% 40%

Cash .......................................................................... 2% —

Other .......................................................................... 2% —

Total ...................................................................... 100% 100%

Pension plan assets are invested for the exclusive benefit of the plan participants and beneficiaries and are

intended, over time, to satisfy the benefit obligations under the plan. Risk tolerance is established through

consideration of plan liabilities, plan funded status, and corporate financial condition. The asset mix guidelines

have been established and are reviewed quarterly. These guidelines are intended to serve as tools to facilitate the

investment of plan assets to maximize long-term total return and the ongoing oversight of the plan’s investment

performance. The investment portfolio contains a diversified mix of equity and fixed-income investments. Equity

investments are diversified across U.S. and non-U.S. stocks. Other assets such as partnerships and real estate are

used to enhance long-term returns while improving portfolio diversification. Investment risk is measured and

monitored on an ongoing basis through daily and monthly investment portfolio review, annual liability

measurements, and periodic asset/liability studies.

179