Travelers 2004 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued

Automobile policies provide coverage for liability to others for both bodily injury and property damage, and

for physical damage to an insured’s own vehicle from collision and various other perils. In addition, many states

require policies to provide first-party personal injury protection, frequently referred to as no-fault coverage.

Homeowners policies are available for dwellings, condominiums, mobile homes and rental property

contents. Protection against losses to dwellings and contents from a wide variety of perils is included in these

policies, as well as coverage for liability arising from ownership or occupancy.

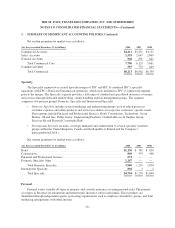

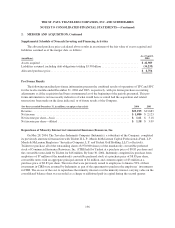

Net written premiums by product line were as follows:

(for the year ended December 31, in millions) 2004 2003 2002

Automobile ........................................................... $3,433 $3,054 $2,843

Homeowners and other .................................................. 2,496 2,027 1,732

Total Personal ..................................................... $5,929 $5,081 $4,575

Asset Management

The Asset Management segment is comprised of the Company’s majority interest in Nuveen Investments,

Inc., whose core businesses are asset management and related research, as well as the development, marketing

and distribution of investment products and services for the affluent, high-net-worth and institutional market

segments. Nuveen Investments distributes its investment products and services, including individually managed

accounts, closed-end exchange-traded funds and mutual funds, to the affluent and high-net-worth market

segments through unaffiliated intermediary firms including broker/dealers, commercial banks, affiliates of

insurance providers, financial planners, accountants, consultants and investment advisors. Nuveen Investments

also provides managed account services to several institutional market segments and channels. Nuveen

Investments markets its capabilities under four distinct brands: Rittenhouse (“blue-chip” growth-style equities);

NWQ (value-style equities); Nuveen (fixed-income investments); and Symphony (an institutional manager of

market-neutral alternative investment portfolios). Nuveen Investments is listed on the New York Stock

Exchange, trading under the symbol “JNC.” The Company’s interest in Nuveen Investments was approximately

79% at December 31, 2004.

Catastrophe Exposure

The Company has geographic exposure to catastrophe losses in certain areas of the country. Catastrophes

can be caused by various natural and man-made events including hurricanes, windstorms, earthquakes, hail,

severe winter weather, explosions and fires. The incidence and severity of catastrophes are inherently

unpredictable. The extent of losses from a catastrophe is a function of both the total amount of insured exposure

in the area affected by the event and the severity of the event. Most catastrophes are restricted to small

geographic areas; however, hurricanes and earthquakes may produce significant damage in larger areas,

especially those that are heavily populated. The Company generally seeks to reduce its exposure to catastrophes

through individual risk selection and the purchase of catastrophe reinsurance.

On November 26, 2002, the Terrorism Risk Insurance Act of 2002 (the Terrorism Act) was enacted into

Federal law and established the Terrorism Insurance Program (the Program), a temporary Federal program in the

Department of the Treasury, that provides for a system of shared public and private compensation for insured

losses resulting from acts of terrorism or war committed by or on behalf of a foreign interest. In order for a loss

to be covered under the Program (subject losses), the loss must be the result of an event that is certified as an act

132