Travelers 2004 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

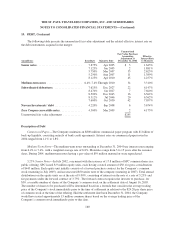

13. INCENTIVE PLANS

After the merger, the Company’s Board of Directors adopted The St. Paul Travelers Companies, Inc. 2004

Stock Incentive Plan (the 2004 Incentive Plan), which also was approved by the Company’s shareholders on July

28, 2004. The purposes of the 2004 Incentive Plan are to reward the efforts of the Company’s non-employee

directors, executive officers and other employees and to attract new personnel by providing incentives in the

form of stock-based awards. The 2004 Incentive Plan permits grants of nonqualified stock options, incentive

stock options, stock appreciation rights, restricted stock, deferred stock, stock units, performance awards and

other stock-based or stock-denominated awards with respect to the Company’s common stock. The maximum

number of shares of the Company’s common stock that may be issued pursuant to awards granted under the 2004

Incentive Plan is 35 million shares, subject to additional shares that may be available for awards as described

below.

In connection with the adoption of the 2004 Incentive Plan, the legacy Travelers Property Casualty Corp.

2002 Stock Incentive Plan (legacy TPC 2002 Incentive Plan) and the legacy St. Paul Global Stock Option Plan

(legacy Global Stock Option Plan), which ceased granting awards after 2001, were terminated. The legacy St.

Paul Amended and Restated 1994 Stock Incentive Plan (legacy SPC 1994 Stock Plan) had expired on May 4,

2004 by its own terms, and other legacy SPC stock plans had either terminated or had no shares available for

future grant. The legacy TPC 2002 Incentive Plan was the only plan pursuant to which TPC could make stock-

based awards prior to the merger. Outstanding grants were not affected by the plans’ termination including the

grant of reload options related to prior option grants under the legacy TPC 2002 Incentive Plan and the legacy

SPC 1994 Stock Plan.

The 2004 Incentive Plan is the only plan pursuant to which future stock-based awards may be granted. In

addition to the 35 million shares initially authorized for issuance under the 2004 Incentive Plan, the following

will not be counted towards the 35 million shares available and will be available for future grants under the 2004

Incentive Plan: (i) shares of common stock subject to an award that expires unexercised, that is forfeited,

terminated or canceled, that is settled in cash or other forms of property, or otherwise does not result in the

issuance of shares of common stock, in whole or in part; (ii) shares that are used to pay the exercise price of

stock options and shares used to pay withholding taxes on awards generally; and (iii) shares purchased by the

Company on the open market using cash option exercise proceeds; provided, however, that the increase in the

number of shares of common stock available for grant pursuant to such market purchases shall not be greater

than the number that could be repurchased at fair market value on the date of exercise of the stock option giving

rise to such option proceeds.

Except for shares delivered to or retained in the SPC 1994 Stock Plan and the TPC 2002 Incentive Plan in

connection with the payment of the exercise price of and, as to TPC option grants, the withholding of taxes

applicable to the exercise of, outstanding options under those plans that have reload features, the provisions of

the preceding paragraph that result in shares becoming available for future grants under the 2004 Incentive Plan

also apply to any awards granted under the SPC1994 Stock Plan and the TPC 2002 Incentive Plan that were

outstanding on the effective date of the 2004 Stock Plan. In addition, the number of shares of common stock

available for grant under the 2004 Stock Plan will not be reduced by shares subject to awards granted under the

2004 Incentive Plan upon the assumption of or in substitution for awards in connection with business

combinations (as defined in the 2004 Incentive Plan).

After the merger, the Company’s Board of Directors also adopted a compensation program for non-

employee directors (the 2004 Director Compensation Program). Under the 2004 Director Compensation

Program, non-employee directors’ compensation consists of an annual retainer, a deferred stock award and a

stock option award. Each non-employee director may choose to receive all or a portion of his or her annual

169