Travelers 2004 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Pursuant to covenants in the 5-Year Line of Credit and STA 364-Day Line of Credit, supporting the

Company’s commercial paper program, the Company must maintain an excess of consolidated net worth over

goodwill and other intangible assets of not less than $10 billion at all times. The Company must also maintain a

ratio of total consolidated debt to the sum of total consolidated debt plus consolidated net worth of not greater

than 0.40 to 1.00. Pursuant to the covenants in the 45-Month Line of Credit, TPC and its subsidiaries must

maintain, as of the last day of any fiscal quarter, combined statutory capital and surplus in excess of $5.50 billion

and a leverage ratio of total consolidated debt to total consolidated capital of less than 0.45 to 1.00. There were

no ratings based triggers for the Company Line of Credit. At December 31, 2004, the Company was in

compliance with these covenants and all other covenants related to its respective debt instruments outstanding.

An event of default will occur if there is a change in control (as defined in the 45-Month Line of Credit and

5-Year Line of Credit agreements). The merger of TPC and SPC did constitute a change in control for both TPC

and SPC; however, both entities obtained a waiver from their respective banks of that event of default. There

were no amounts outstanding under the Company Line of Credit at December 31, 2004.

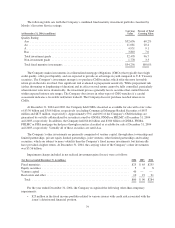

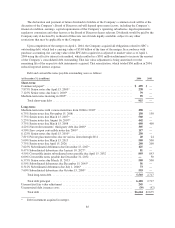

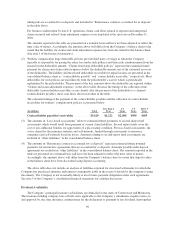

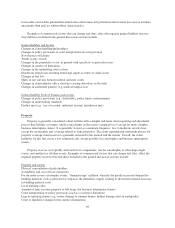

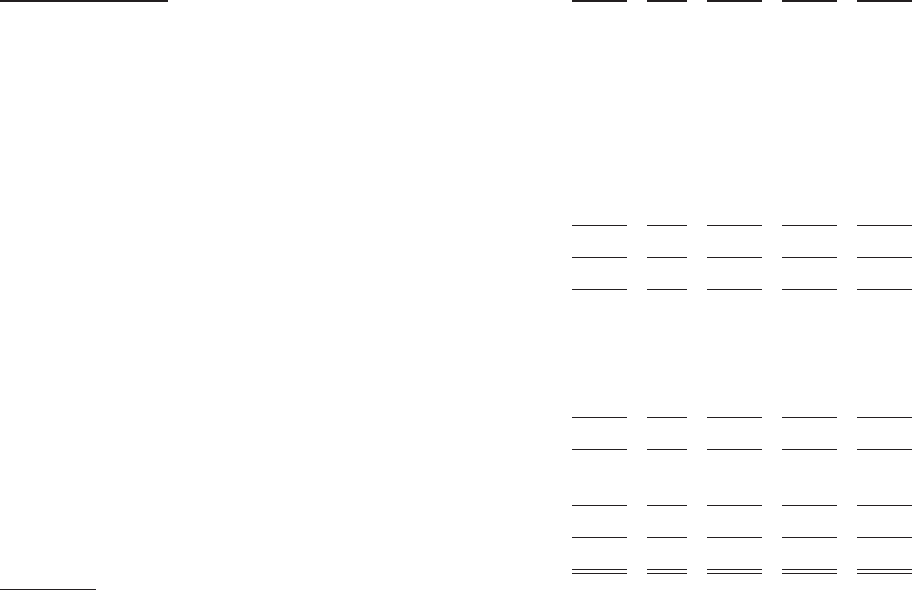

Contractual Obligations

The following table excludes short-term obligations. The table also excludes estimated cash flows of claim

and claim related payments, which are presented in the table that follows. The contractual obligations, which

include only liabilities at December 31, 2004 with a cash payment requirement for settlement, were as follows:

Payments Due by Period

(in millions) Total

Less

than

1

Year

1-3

Years

3-5

Years

After 5

Years

Debt(1)

Medium term notes ................................... $ 397 $ 99 $ 128 $ 149 $ 21

Convertible notes ..................................... 893 ———893

Senior notes ......................................... 2,817 317 650 400 1,450

Capital trusts ........................................ 928 ———928

Nuveen Investments’ third-party debt ..................... 305 — — 305 —

Zero coupon convertible notes .......................... 117 — — 117 —

Equity units ......................................... 442 — 442 — —

Private placement notes ................................ 20 4754

Total debt .......................................... 5,919 420 1,227 976 3,296

Operating leases(2) ...................................... 739 171 276 168 124

Purchase obligations

Information systems administration and maintenance

commitments(3) ................................... 89 31 38 20 —

Reinsurance brokerage commitment(4) ................... 160 20 40 40 60

Other purchase commitments(5) ......................... 8 6 2 — —

Total purchase obligations ............................ 257 57 80 60 60

Long-term liabilities

Unfunded investment commitments(6) .................... 772 133 354 206 79

Total long-term liabilities ............................. 772 133 354 206 79

Total Contractual Obligations ............................. $7,687 $781 $1,937 $1,410 $3,559

(1) See note 10 of the notes to the Company’s consolidated financial statements for a further discussion.

(2) Represents agreements entered into in the ordinary course of business to lease office space, equipment and

furniture.

88