Travelers 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The $6.49 billion growth in earned premiums over 2003 was primarily due to the merger, and also reflected

the earned premium effect of rate increases on renewal business over the last 12 months and strong customer

retention levels throughout a majority of the markets served by the Company’s insurance segments.

Net investment income in 2004 increased $794 million over 2003, due largely to the increase in invested

assets resulting from the merger. In addition, strong operational cash flows in 2004 contributed to the growth in

invested assets. The average pretax investment yield in 2004 of 4.8% declined from 5.3% in 2003, due to a

higher proportion of tax-exempt investments and lower yields on fixed income securities and alternative

investments. In addition, SPC’s investment portfolio acquired in the merger was recorded at its fair value as of

the merger date in accordance with purchase accounting, which reduced the Company’s reported average

investment yield in 2004. Net investment income in 2004 included $111 million of income resulting from the

initial public trading of an investment in its private equity portfolio.

Fee income in 2004 grew 26% over 2003, primarily driven by new business in the National Accounts sector

of the Company’s Commercial segment, as described in more detail in the segment narrative that follows.

Asset management revenues of $390 million were generated by Nuveen Investments, which was acquired in

the merger. Nuveen Investments’ gross sales of investment products in 2004 from the date of the merger totaled

$19.86 billion.

The Company’s net pretax realized investment losses of $39 million in 2004 included impairment charges

totaling $80 million, whereas net pretax realized gains of $38 million in 2003 included $90 million of impairment

charges. Net realized investment gains (losses) in 2004 and 2003 also included losses of $44 million and $27

million, respectively, related to U.S. Treasury futures contracts which are settled daily. Further information

regarding the nature of impairment charges in each year is included in the “Critical Accounting Estimates”

section later in this discussion. Other revenues in all periods presented primarily consist of premium installment

charges.

Earned premiums in 2003 increased $1.39 billion, or 12%, over 2002 due to rate increases on renewal

business, growth in targeted new business and strong customer retention.

Net investment income decreased $12 million, or less than 1%, in 2003, despite higher average invested

assets resulting from strong cash flows from operations. The decline resulted from a reduction in pretax

investment yields from 6.0% in 2002 to 5.3% in 2003. That decrease reflected the lower interest rate

environment, the shortening of the average effective duration of the fixed maturity portfolio, a higher proportion

of tax-exempt investment holdings and reduced returns in the Company’s private equity investments. These

factors were partially offset by higher returns in arbitrage fund investments.

Fee income increased $105 million, or 23%, in 2003, as both new business and pricing levels in the

Company’s National Accounts business increased and more workers’ compensation business was written by state

residual market pools serviced by National Accounts.

Net realized investment gains were $38 million in 2003, compared with $147 million in 2002. Net realized

investment gains included $90 million of impairment charges in 2003, compared with $284 million in 2002.

Recoveries from former affiliate of $520 million, net of tax, in 2002 represent funds recovered under the

Citigroup indemnification agreement.

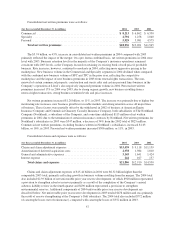

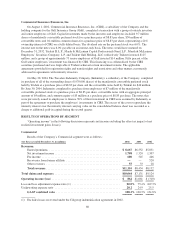

Effective with the merger, the Company’s business operations consist of the following four segments:

Commercial, Specialty, Personal (collectively comprising the Company’s insurance segments) and Asset

Management. The Asset Management segment was acquired in the merger. Prior period results for the three

insurance segments have been restated, to the extent practicable, to conform with the 2004 presentation.

56