Travelers 2004 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

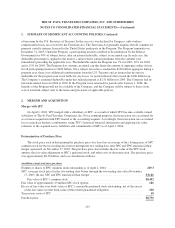

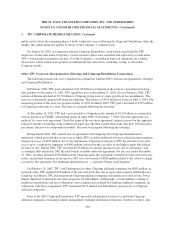

3. TPC CORPORATE REORGANIZATION, Continued

processing services and short-term investment pool management services. Charges for these shared services were

allocated at cost. In connection with the Citigroup Distribution, TPC and Citigroup and its affiliates entered into

a transition services agreement for the provision of certain of these services, tradename and trademark and

similar agreements related to the use of trademarks, logos and tradenames in an amendment to the March 26,

2002 Intercompany Agreement with Citigroup. During the first quarter of 2002, Citigroup provided investment

advisory services on an allocated cost basis, consistent with prior years. On August 6, 2002, TPC entered into an

investment management agreement, which was applied retroactive to April 1, 2002, with an affiliate of Citigroup

whereby the affiliate of Citigroup provided investment advisory and administrative services to TPC, with respect

to its entire investment portfolio for a period of two years and at fees mutually agreed upon, including a

component based on investment performance. This agreement was modified and extended through the first

quarter of 2005. Charges incurred related to this agreement were $58 million for the year ended December 31,

2004, $60 million for the year ended December 31, 2003 and $47 million for the period from April 1, 2002

through December 31, 2002.

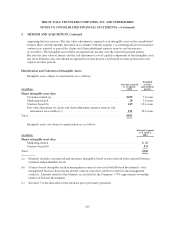

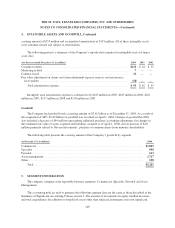

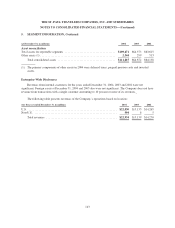

4. INTANGIBLE ASSETS AND GOODWILL

Intangible Assets

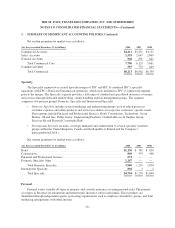

The following presents a summary of the Company’s intangible assets by major asset class as of

December 31, 2004:

(in millions)

Gross

Carrying

Amount

Accumulated

Amortization Net

Intangibles subject to amortization

Customer-related .................................................. $1,032 $252 $ 780

Marketing-related ................................................. 20 7 13

Contract-based .................................................... 145 12 133

Fair value adjustment on claims and claim adjustment expense reserves and

reinsurance recoverables .......................................... 191 (58)(1) 249

Total intangible assets subject to amortization ....................... 1,388 213 1,175

Intangible assets not subject to amortization

Marketing-related ................................................. 15 — 15

Contract-based .................................................... 511 — 511

Total intangible assets not subject to amortization .................... 526 — 526

Total intangible assets .......................................... $1,914 $213 $1,701

(1) The time value of money and the risk margin (cost of capital) components of the intangible asset runoff at

different rates, and as such, the amount recognized in income may be a net benefit in some periods and a net

expense in other periods. See note 2 for further information on the fair value adjustment on claims and claim

adjustment expense reserves and reinsurance recoverables.

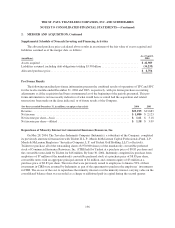

The December 31, 2004 ending balance of $1.70 billion includes $1.33 billion of intangible assets acquired

in the merger (see note 2). Contract-based intangibles include management contracts associated with Nuveen

Investments’ asset management business based on the present value of expected cash flows related to the

management contracts. At December 31, 2003, the Company had $422 million of intangible assets, with a gross

139