Travelers 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Risk-Based Capital (RBC) Requirements

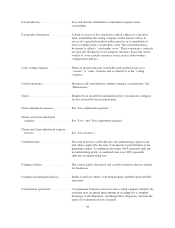

In order to enhance the regulation of insurer solvency, the NAIC has adopted a formula and model law to

implement RBC requirements for most property and casualty insurance companies, which is designed to

determine minimum capital requirements and to raise the level of protection that statutory surplus provides for

policyholder obligations. The RBC formula for property and casualty insurance companies measures three major

areas of risk facing property and casualty insurers:

• underwriting, which encompasses the risk of adverse loss developments and inadequate pricing;

• declines in asset values arising from market and/or credit risk; and

• off-balance sheet risk arising from adverse experience from non-controlled assets, guarantees for

affiliates or other contingent liabilities and reserve and premium growth.

Under laws adopted by individual states, insurers having total adjusted capital less than that required by the

RBC calculation will be subject to varying degrees of regulatory action, depending on the level of capital

inadequacy.

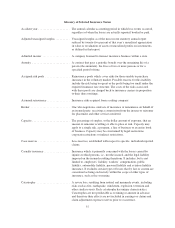

The RBC law provides for four levels of regulatory action. The extent of regulatory intervention and action

increases as the level of surplus to RBC falls. The first level, the company action level as defined by the NAIC,

requires an insurer to submit a plan of corrective actions to the regulator if surplus falls below 200% of the RBC

amount. The regulatory action level, as defined by the NAIC, requires an insurer to submit a plan containing

corrective actions and requires the relevant insurance commissioner to perform an examination or other analysis

and issue a corrective order if surplus falls below 150% of the RBC amount. The authorized control level, as

defined by the NAIC, authorizes the relevant insurance commissioner to take whatever regulatory actions

considered necessary to protect the best interest of the policyholders and creditors of the insurer which may

include the actions necessary to cause the insurer to be placed under regulatory control, i.e., rehabilitation or

liquidation, if surplus falls below 100% of the RBC amount. The fourth action level is the mandatory control

level as defined by the NAIC, which requires the relevant insurance commissioner to place the insurer under

regulatory control if surplus falls below 70% of the RBC amount.

The formulas have not been designed to differentiate among adequately capitalized companies that operate

with higher levels of capital. Therefore, it is inappropriate and ineffective to use the formulas to rate or to rank

these companies. At December 31, 2004, all of the Company’s property and casualty insurance subsidiaries had

total adjusted capital in excess of amounts requiring company or regulatory action at any prescribed RBC action

level.

Asset Management Regulation

One of Nuveen Investments’ subsidiaries is registered as a broker/dealer under the Securities Exchange Act

of 1934 and is subject to regulation by the SEC, NASD Regulation, Inc. and other federal and state agencies and

self-regulatory organizations. The securities industry is one of the most highly regulated in the United States, and

failure to comply with related laws and regulations can result in the revocation of broker/dealer licenses, the

imposition of censures or fines, and the suspension or expulsion of a firm and/or its employees from the

securities business.

Each of Nuveen Investments’ investment adviser subsidiaries is registered with the SEC under the

Investment Advisers Act. Virtually all aspects of Nuveen Investments’ investment management business are

subject to various federal and state laws and regulations. These laws and regulations are primarily intended to

benefit the investment product holder and generally grant supervisory agencies and bodies broad administrative

powers, including the power to limit or restrict Nuveen Investments from carrying on its investment management

business in the event that it fails to comply with such laws and regulations. In such event, the possible sanctions

35