Travelers 2004 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

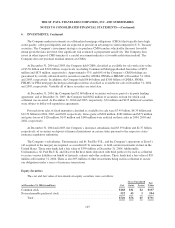

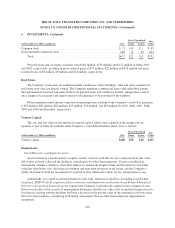

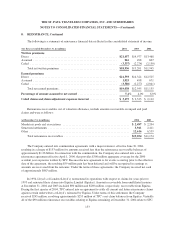

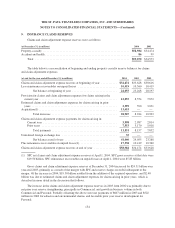

6. INVESTMENTS, Continued

A fixed maturity security is impaired if it is probable that the Company will not be able to collect all

amounts due under the security’s contractual terms. Equity securities are impaired when it becomes apparent that

the Company will not recover its cost over the expected holding period. Further, for securities expected to be

sold, an other-than-temporary impairment charge is recognized if the Company does not expect the fair value of a

security to recover prior to the expected date of sale.

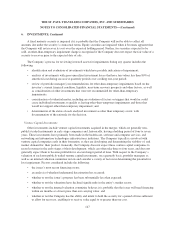

The Company’s process for reviewing invested assets for impairments during any quarter includes the

following:

• identification and evaluation of investments which have possible indications of impairment;

• analysis of investments with gross unrealized investment losses that have fair values less than 80% of

amortized cost during successive quarterly periods over a rolling one-year period;

• review of portfolio manager(s) recommendations for other-than-temporary impairments based on the

investee’s current financial condition, liquidity, near-term recovery prospects and other factors, as well

as consideration of other investments that were not recommended for other-than-temporary

impairments;

• consideration of evidential matter, including an evaluation of factors or triggers that would or could

cause individual investments to qualify as having other-than-temporary impairments and those that

would not support other-than-temporary impairment; and

• determination of the status of each analyzed investment as other than temporary or not, with

documentation of the rationale for the decision.

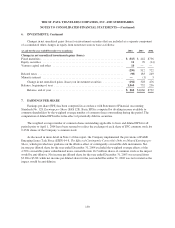

Venture Capital Investments

Other investments include venture capital investments acquired in the merger, which are generally non-

publicly traded instruments in early-stage companies and, historically, having a holding period of four to seven

years. These investments have primarily been made in the health care, software and computer services, and

networking and information technologies infrastructures industries. The Company typically is involved with

venture capital companies early in their formation, as they are developing and determining the viability of, and

market demand for, their product. Generally, the Company does not expect these venture capital companies to

record revenues in the early stages of their development, which can often take three to four years, and does not

generally expect them to become profitable for an even longer period of time. With respect to the Company’s

valuation of such non-publicly traded venture capital investments, on a quarterly basis, portfolio managers as

well as an internal valuation committee review and consider a variety of factors in determining the potential for

loss impairment. Factors considered include the following:

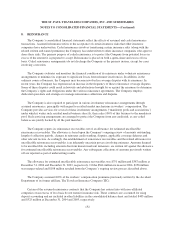

• the issuer’s most recent financing events;

• an analysis of whether fundamental deterioration has occurred;

• whether or not the issuer’s progress has been substantially less than expected;

• whether or not the valuations have declined significantly in the entity’s market sector;

• whether or not the internal valuation committee believes it is probable that the issuer will need financing

within six months at a lower price than our carrying value; and

• whether or not the Company has the ability and intent to hold the security for a period of time sufficient

to allow for recovery, enabling it to receive value equal to or greater than our cost.

147