Travelers 2004 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LIQUIDITY AND CAPITAL RESOURCES

Liquidity is a measure of a company’s ability to generate sufficient cash flows to meet the short- and long-

term cash requirements of its business operations. The liquidity requirements of the Company’s business have

been met primarily by funds generated from operations, asset maturities and income received on investments.

Cash provided from these sources is used primarily for claims and claim adjustment expense payments and

operating expenses. Catastrophe claims, the timing and amount of which are inherently unpredictable, may create

increased liquidity requirements. The timing and amount of reinsurance recoveries may be affected by reinsurer

solvency and increasingly by reinsurance coverage disputes. Additionally, recent increases in asbestos-related

claim payments, as well as potential judgments and settlements arising out of litigation, may also result in

increased liquidity requirements. In the opinion of the Company’s management, the Company’s future liquidity

needs will be met from all of the above sources.

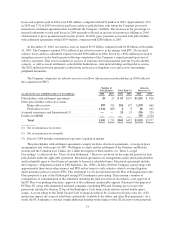

Net cash flows provided by operating activities totaled $5.24 billion, $3.83 billion and $2.93 billion in 2004,

2003 and 2002, respectively. Cash flows in 2004 included $867 million in cash proceeds received pursuant to the

commutation of specific reinsurance agreements in the second quarter described previously. Cash flows in 2004

also benefited from premium rate and volume increases. The previously discussed adjustments recorded in the

second quarter did not materially impact year-to-date 2004 cash flows. The Company utilized $550 million of net

operating loss carryforwards (NOL) during 2004, thereby reducing current regular tax payments by $193 million.

At December 31, 2004, the Company had significant NOLs available to offset future taxable income. See note 11

to the consolidated financial statements for further information regarding NOLs.

Net cash flows provided by operating activities in 2003 benefited from premium rate increases and the

receipt of $361 million from Citigroup related to recoveries under the asbestos indemnification agreement in the

first quarter of 2003 and $531 million of federal income taxes refunded from the Company’s net operating loss

carryback.

Net cash flows provided by operating activities for all three years were negatively impacted by payments for

asbestos and environmental liabilities and, in 2004, for reinsurance, health care and certain international runoff

operations. Included in the Company’s structured agreement component of asbestos loss reserves at December

31, 2004 was $395 million (net of reinsurance) for the Company’s single payment contribution to the proposed

settlement related to PPG, and $502 million for the Company’s settlement of the Statutory and Hawaii Actions

and the Common Law Claims. Although each of these settlements is subject to certain contingencies or final

orders and relief as previously discussed, it is possible that these settlement amounts will be paid in 2005.

Net cash flows used in investing activities totaled $4.79 billion, $2.48 billion and $2.27 billion in 2004,

2003 and 2002, respectively. The increase in 2004 corresponds to the increase in operational cash flows, which

were invested predominantly in fixed maturity securities. In 2003, cash used in investing activities was partly

offset by sales of securities to fund net payment activity related to debt and junior subordinated debt securities

held by subsidiary trusts of $772 million. The 2002 net cash flows used in investing activities principally

reflected investing of net cash from operating activities and the receipt of $4.09 billion from the first quarter

2002 initial public offering and the concurrent issuance of $867 million of convertible notes payable, partially

offset by the repayment of $6.35 billion of notes payable to a former affiliate.

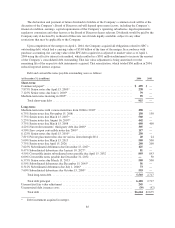

The majority of funds available for investment are deployed in a widely diversified portfolio of high quality

intermediate-term taxable U.S. government, corporate and mortgage backed bonds and tax-exempt U.S.

municipal bonds. The Company closely monitors the duration of its fixed maturity investments, and investment

purchases and sales are executed with the objective of having adequate funds available to satisfy the Company’s

insurance and debt obligations. The Company’s management of the duration of the fixed income investment

portfolio generally produces a duration that exceeds the duration of the Company’s net insurance liabilities. As

the Company’s investment strategy focuses on asset and liability durations, and not specific cash flows, asset

sales may be required to satisfy obligations and/or rebalance asset portfolios. The average duration of fixed

maturities and short-term securities was 4.1 years as of December 31, 2004, unchanged from December 31, 2003.

83